What is AEPS?

AEPS stands for Aadhaar enabled payment system. This is the new type of payment system in which a bank customer can use basic banking activities using Aadhaar card. In AEPS service a bank customer whose bank account linked with Aadhaar card can use all basic banking transactions.

The main reason behind the AEPS, is to bring all the unbanked sections of society into the banking framework. AEPS service is conceptualized & approved by the reserve bank of India (RBI) and launched under NPCI (National Payment Corporation of India). By AEPS service, now most of the rural areas where banks can’t reach, they are using banking services, which show the great success of this strategy. This project is running under the digital India project.

By using AEPS, you can use all following banking services using your aadhaar card and fingerprint authentication.

How Can You Start Your Own AEPS Business?

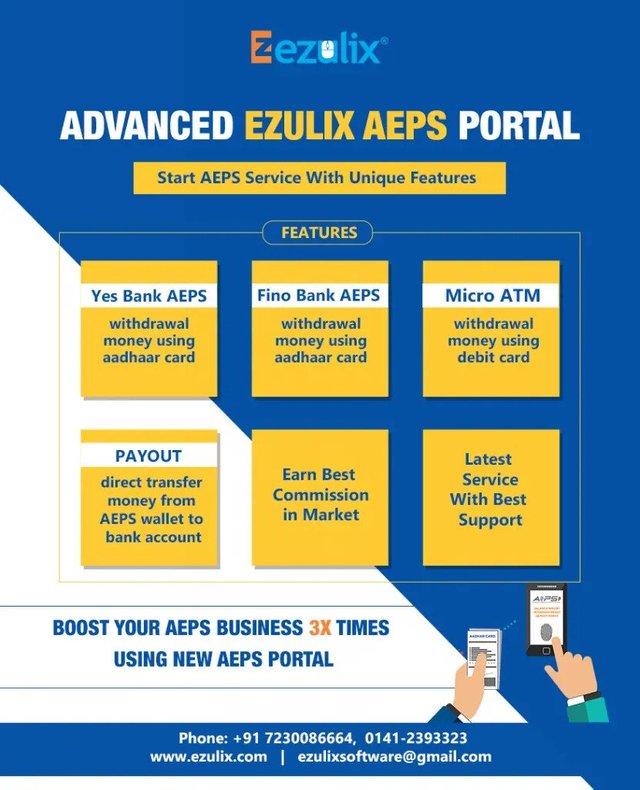

If you are planning to start your own business then this can be a great opportunity for you. You can start your own AEPS business (mini banking business) at low investment and can make it a handsome source of Income. To start AEPS business, you will require AEPS software. By using AEPS software, you can offer all AEPS services.

There are many AEPS software provider companies in India. You can tie-up with any of these companies and can start your own AEPS business.

Keep Reading: Best AEPS Service Provider