➜ Stakers in this cycle will be rich.

Discover the curated goldmine of potential ⇩

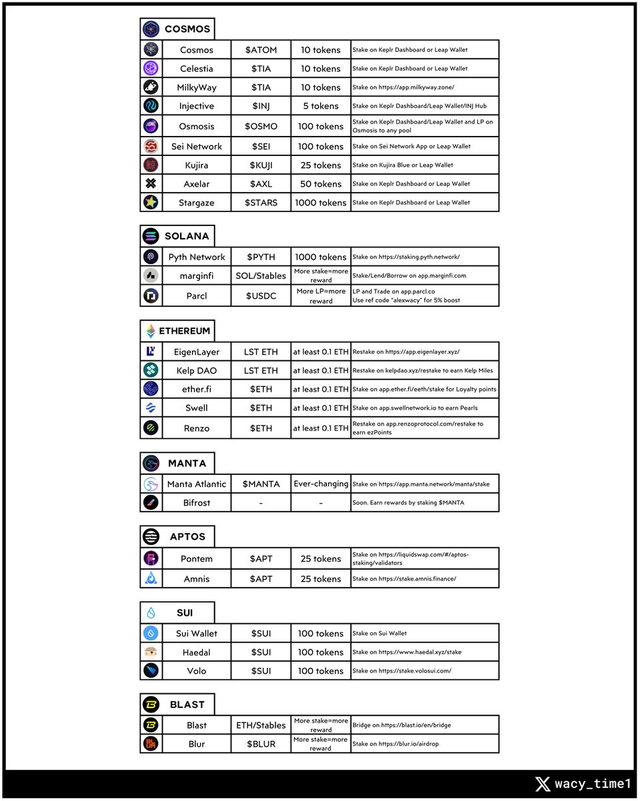

◢ Cosmos:

- Stake 10 $ATOM on Keplr/Leap

- Stake 10 $TIA on Keplr/Leap

- Stake 10 $INJ on Keplr/Leap/Injective Hub

- Stake 100 $OSMO on Keplr/Leap

- Stake 100 $SEI on Sei Network App/Leap

- Stake 25 $KUJI on Kujira Blue/Leap

- Stake 50 $AXL on Keplr/Leap

- Stake 1000 $STARS on Keplr/Leap

- Stake 10 $TIA on

@milky_way_zone

This strategy can be considered as "Balanced".

- To determine the recommended stake amount, multiply it by 2.5-3

- For a low-cost approach, divide these amounts by 2

◢ Solana:

Stake 1000+ $PYTH on staking.pyth.(network)

Stake/Lend/Borrow $SOL / stables/others on

@marginfiLP/Trade with $USDC on

@Parcl

(Use referral code "alexwacy" or any other for a forever 5% boost)

About $PYTH, more stake=more rewards (imo). In other cases, the more you can invest, the greater the reward.

◢ Ethereum:

- Stake $stETH or another LST ETH on

@eigenlayer

to earn points - Stake $stETH or another LST ETH on

@KelpDAO

to earn Kelp Miles - Stake $ETH on

@ether_fi

to earn Loyalty Points - Stake $ETH on

@RenzoProtocol

to earn ezPoints - Stake $ETH on

@swellnetworkio

to earn Pearls

If you have limited funds, consider allocating a max $ETH to one project. EigenLayer pools are scheduled to open on January 29th.

◢ Manta Network:

- Stake $MANTA on Manta Atlantic; min amount is ever-changing.

- Keep an eye on

@BifrostFinance

◢ Aptos:

Stake 25 $APT on

@PontemNetworkStake 25 $APT on

@AmnisFinance

Aptos shows promise, but it's worth considering if you have free liquidity or if you're a long-term holder. Also, if you can invest more, consider staking 50-150+ tokens.

◢ Sui:

Stake 100 $SUI on Sui Wallet

Stake 100 $SUI on

@HaedalProtocolStake 100 $SUI on

@volo_sui

Imo, Sui Eco has the potential for a bull cycle. While it may not be exceptionally massive, it's worth considering if you have free liquidity.

◢ Blast:

In both cases: more invest = more rewards. It a relatively risk-free option. Consider it only if you have a significant amount of free liquidity.

➤ Tips:

Remember, it's not advisable to invest in all projects at once unless you plan to hold all these tokens for the long term.

Instead, carefully select the projects that you genuinely like and are prepared to hold for at least a year.

This approach will allow you to avoid unnecessary worries due to temporary price volatility and in a year you will sell your staked tokens for a much higher price and reap numerous rewards.

Credit: @wacy_times on X.com