Reports of the opening of a massive short position, as well as the transfer of a significant amount of BTC, coming so close to the onset of the recent Bitcoin slide has reignited talk of manipulation in the market.

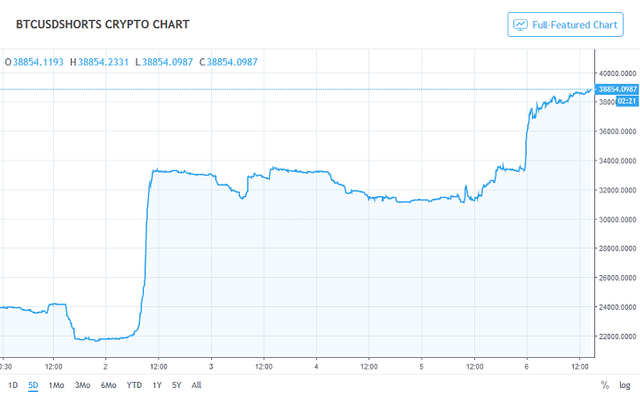

Massive Bitcoin Short Position Opened Before Wednesday’s Drop

On Wednesday, the cryptocurrency market experienced a significant decline as token prices plummeted in a matter of minutes. Bitcoin fell three percent in ten minutes, continuing to slide below the $7,000 mark for the first time in September 2018. Ethereum, as well as other altcoins, were left out in the market bleeding. Such was the magnitude of the plunge that the market lost $20 billion in total market capitalization in less than a day.

In the days leading up to the decline, two major transactions happened. On Sunday, an unknown trader opened a 10,000 BTC short position, to the tune of $74 million. This move drastically increased the total Bitcoin market shorts to 32,000 BTC. Whether the said trader had insider knowledge of the coming price drop remains unknown.

Another interesting occurrence that preceded the drop was the news that a wallet – possibly associated with the defunct Silk Road darknet marketplace or the Mt. Gox debacle – withdrew more than 100,000 BTC. With the BTC trading volume shooting up to $5.5 billion by Wednesday, it is possible that those funds (or at least a portion of them) may have been dumped onto the market.

Bitcoin Price Manipulation Concerns

In mainstream markets, events like these would be more than enough to suspect insider trading and market manipulation. Earlier this year, the United States Department of Justice (DOJ) and the Commodities Futures Trading Commission (CFTC) announced that they would be investigating claims of Bitcoin price manipulation.

The subject of illegal price-fixing activities is also a factor in the SEC’s reticence to approve a Bitcoin ETF. So far, the Commission has either denied or postponed its decision on the various Bitcoin ETF filings.

Much Ado About Nothing

While these questions remain, there is also the possibility that none of these events have anything to do with the recent price slump. As eToro’s Mati Greenspan puts it, “Correlation ≠ Causation.”

Maybe after more than two weeks of steady gains and sideways increase, it was time for another drop, which means huge profits for the whales. It isn’t out of the realm of possibility for whales to engage in mass profit taking when BTC approaches a resistance level.

Do you think the recent Bitcoin price drop was due to market manipulation? Keep the conversation going in the comment section below.

Images courtesy of Coinmarketcap, Tradingview, Shutterstock

Read original article

Posted from our news room : https://news.sye.host/recent-bitcoin-price-drop-likely-due-to-market-manipulation/

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This user is on the @buildawhale blacklist for one or more of the following reasons:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit