Ethereum Price Technical Analysis – ETH/USD Crushed Below $650

Key Highlights

ETH price is under immense bearish pressure as it declined below the $650 support against the US Dollar.

There are two crucial bearish trend lines forming with resistance at $670 and $760 on the hourly chart of ETH/USD (data feed via SimpleFX).

The pair is currently moving down and it is likely to break the $600 and $580 support levels in the near term.

Ethereum price getting crushed against the US Dollar and Bitcoin. ETH/USD is now below $650 and it eyes further declines below the $600 level.

Ethereum Price Monstrous Decline

There were continuous declines in ETH price from the $900 swing high against the US Dollar. The price traded below the $800 and $700 support levels to set the pace for more declines. It recently broke the $650 support and traded as low as $619. It started a minor downside correction and moved above the 23.6% Fib retracement level of the last decline from the $847 high to $619 low.

However, the upside move could not last long and the price failed near $700-720. There was a failure to break the 50% Fib retracement level of the last decline from the $847 high to $619 low. On the upside, there are two crucial bearish trend lines forming with resistance at $670 and $760 on the hourly chart of ETH/USD. The pair struggled near the first trend line and $700. It is once again sliding and it is about to break the $619 low. It seems like the pair may soon test the $600 level.

Ethereum Price Technical Analysis ETH USD

There are even chances of a break below $600 for a test of the $580 support. On the upside, the pair has to break the $720 and $750 resistance levels to initiate a convincing recovery.

Hourly MACD – The MACD is placed heavily in the bearish zone.

Hourly RSI – The RSI is showing no signs of a recovery and is currently at 30.

Major Support Level – $580

Major Resistance Level – $750

Bitcoin Cash Price Technical Analysis – BCH/USD Drops Below $850

Key Points

Bitcoin cash price is struggling a lot and it moved below the $900 and $850 levels against the US Dollar.

There are two bearish trend lines forming with resistance at $920 and $1,080 on the hourly chart of BCH/USD (data feed from SimpleFX).

The pair is about to break the recent low of $819 for a move towards or below $800.

Bitcoin cash price is under a lot of pressure below $850 against the US Dollar. BCH/USD is likely to extend declines below the $800 level in the near term.

Bitcoin Cash Price Decline

It seems like there is no stopping sellers since bitcoin cash price tumbled below the $900 and $850 levels against the US Dollar. The price recently formed a low at $819 and started an upside correction. It traded above the 23.6% Fib retracement level of the decline from the $1,161 high to $819 low. However, the correction wave could not last long above the $900 level.

BCH failed to move above the $950 level and the 38.2% Fib retracement level of the decline from the $1,161 high to $819 low. On the upside, there are two bearish trend lines forming with resistance at $920 and $1,080 on the hourly chart of BCH/USD. The pair is moving lower once again is currently trading below $850. It seems like the pair may continue to move down and it could test $800. There are even chances of a downside break below the $800 level in the near term.

On the upside, the $900 level is a major resistance area. A proper close above $900 is needed for BCH to initiate a fresh recovery in the near term.

Looking at the technical indicators:

Hourly MACD – The MACD for BCH/USD is gaining heavy momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BCH/USD is slightly recovering from the oversold levels.

Major Support Level – $800

Major Resistance Level – $900

Besides LTC, Lumens and NEM, EOS and NEO are at key support levels. While we expect this bear surge to continue, price action will now rely on fundamentals if support is needed.

Already we have confirmation from Charlie Lee that LitePay and LitePal are on the way while South Korea and China are discussing on ways of introducing fair legislation to prevent over-speculation.

Let’s dissect these charts:

Lumens Sellers At $0.30 Triple Bottom

XLMUSD 4HR Chart for February 6, 2018

The bad days continue and while there are chances of XLM even trending lower, we can at least be encourage of fundamentals streaming it.

Yes of course this token has got more potential in cross border payment and if it adopted by household as the founders say then prices might find support.

At the moment, $0.31 triple bottoms looks to be promising but if in case sellers push harder, then it’s another level down as prices move closer to $0.20 or the 78.6% retracement in the daily chart.

In fact, that’s the ball park depreciation rate we are seeing in most alt coins and we cannot brush that off.

$0.36 is Main Support

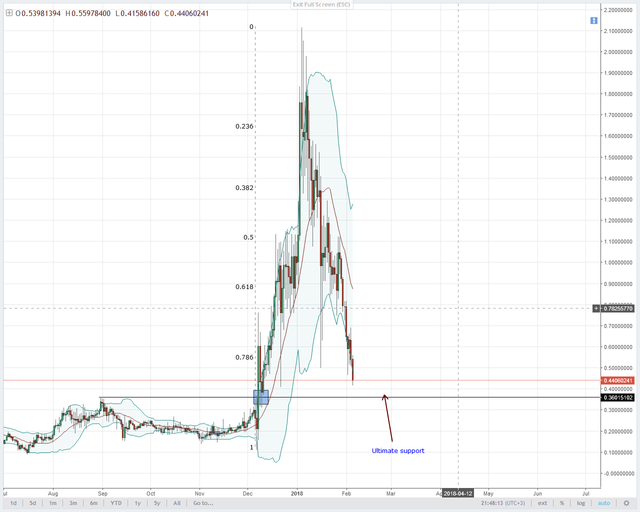

XEMUSD 4HR Chart for February 6, 2018

Technically, despite pockets of buy pressure towards the end of last week, NEM is still in a downtrend. After the heist and the subsequent compensation, NEM isn’t finding any support.

Fact is, in the weekly chart, the middle BB-the ultimate support line was broken after last week’s bearish engulfing candlestick and there is more.

A single glance at price action and bears seem to be aiming at $0.35 which happens to be August highs and a main break out level to complete a potential second phase of a huge bullish break out pattern-the retest.

These are potentials and it can be a quick reality now that most exchanges don’t allow deposit or withdrawals in XEM following that CoinCheck heist.

Besides that protective measure, NEM protocol is also tracking all funds courtesy of their tagging system.

EOS Prices Testing $7.5

EOSUSD 4HR Chart for February 6, 2018

Every higher high is a new selling opportunity for EOS bears but better still, the faster prices trickle lower, the better it is for hoarders looking to ramp up their long positions.

From the charts, we can see that prices are now testing $7.5 or the 61.8% Fibonacci retracement level and well below the 1st Fibonacci extension level in the weekly chart.

Chances are sellers might continue to step up and even test July 2017 highs of around $5.4 or the middle BB in the coming sessions and that is where we might starting picking out buy signals.

Before then, there seems to be more opportunities with sells than longs and therefore the best way to trade is to go with the trend.

LTCUSD 4HR Chart for February 6, 2018

LTC prices did appreciate and from a technical point of view, sellers are relentless and driving prices lower.

While we can remain confident that prices might find support at the psychological round number at $100, we shall have to wait and see if the recent announcement by Charlie Lee will shore prices.

According to him, two new payment systems-LitePay and LitePal are due to be launched this month.

Will adoption of LTC by merchants help spur and perhaps reverse this strong bear momentum? Let’s wait and see but in the meantime, any confirmation of last week’s bear pressure and strong close below $100 will effectively usher in a new wave of sell pressure.

NEO Prices Continue To Trickle Lower

NEOUSD 4HR Chart for February 6, 2018

Relative to other alt coins, NEO was a tad bit over-valued but as it is, prices are somehow at par with others.

NEO prices moved higher on Saturday. However, prices found resistance at the previous support –now resistance trend line as seller drove prices below consolidation.

In my opinion, I think prices might move lower now following yesterday’s close below $85. Ultimate support stands at $50.

Anyhow, fundamentals are not that bad. Should we get clear policy from China and South Korea, I really think NEO will lift off.

All charts courtesy of Trading View

#bitcoin #ethereum #ltc #neo #lomen #nem #altcoin #blockchain #eos

source

![]()

![]()

- Click on the

and get your the reward $ after in 7 days

and get your the reward $ after in 7 days

what is mean I'd say, some governments... some institutions, some people, but overall it's all about the mighty Dollar :-D

Bitcoin is basically... nothing!! :-(

Something that has nothing material as back up and relies on people's perceptions. As seen so far, from $20k to $6000 on one month... ?!?!?

I'm sure some people got rich at other people's expanse, but where and at what point will BTC produce money other than speculation?

What's sustaining the growth???

To many questions to few answers for the reasons of cutting off the bank and fees... BS, sorry?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.newsbtc.com/2018/02/06/alt-coin-analysis-neo-eos-ltc-nem-lumens-2/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a no-brainer. ASIA. Rents and salaries at 5-10% of what it cost in New york. Where should you mine your coins? Same level of knowledge. Rent a space of 1000 sqm is around 1500 dollar a month, normal salary at 400-500 dollar a month. Online business, make it where it is cheapest. Them in New york will be out of business within a year.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe they should enage New York Securities Pty Ltd in Perth Western Australia (Formerly Zurich Securities until after the court case). They may be able to provide assistance with raising funds, debt equity swaps and avoiding wasting money on external vendors. May also provide tips on how to be successful(for private) and utterly unsuccesful ( for multiple public ).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'd say, some governments... some institutions, some people, but overall it's all about the mighty Dollar :-D

Bitcoin is basically... nothing!! :-(

Something that has nothing material as back up and relies on people's perceptions. As seen so far, from $20k to $6000 on one month... ?!?!?

I'm sure some people got rich at other people's expanse, but where and at what point will BTC produce money other than speculation?

What's sustaining the growth???

To many questions to few answers for the reasons of cutting off the bank and fees... BS, sorry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit