This week another company reaped the benefits of adding ‘blockchain technology’ to the firm’s business model. The publicly listed company, Ameri Holdings (AMRH), revealed on January 10 that it was going to utilize the emerging tech within its operations. The company got a swift market valuation boost from the announcement. According to reports Ameri Holdings was previously considered unprofitable, and it’s cash reserves had been dwindling.

A Stagnant Cloud Company Goes Blockchain and Its Public Shares Soar

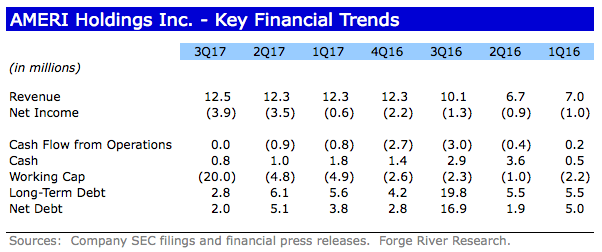

Over the past few weeks, we’ve reported on a few companies using the blockchain hype to their advantage. For instance, the Long Island Iced Tea Corp. changed its name to ‘Long Blockchain,’ and the company’s shares soared. The drink company is now planning to create a mining facility and pivot away from the iced tea business. Three days ago we also reported on a so-called ‘blockchain firm’ that the U.S. Securities and Exchange Commission (SEC) shut down because it had no revenue and no product. Now Ameri Holdings (OTCQB: AMRH), a ‘digital cloud’ company, is joining the blockchain bandwagon, and a columnist from the publication Seeking Alpha is skeptical about the situation.The researcher says AMRH’s financial records are concerning. “Core growth is completely stalled, operating income has been significantly negative, cash levels have been declining, and the company is in a massive $20 million working capital deficit,” explains the recent report.

We believe that nothing has changed in the business fundamentals of AMRH. The company’s revenue growth has stagnated over the past three quarters— In addition, losses have continued to grow on surging general and administrative expenses. Cash flow has been negative recently, and cash levels stand at $0.8 million — Working capital is a significant concern.

Ameri Holdings’ Promises of Blockchain Adds Crazy Trade Volume and a Valuation Increase of $39 Million

Then on January 10, the company announced that blockchain technology would be added to the firm’s business model. The press release promised AMRH shareholders the distributed ledger technology would bring greater efficiency and transparency to its supply chain. Further smart contracts were mentioned for vendors, and the word blockchain was used frequently throughout the announcement. The researcher notes that AMRH shares soared by over 71 percent immediately after the blockchain announcement.“Amazingly, 13,615,785 shares traded hands compared with the usual average of approximately 100,000 per day,” explains the report.The report finds the pump in share price concerning, especially when its tethered to a firm that’s produced very little revenue.“We believe the $39 million increase in equity market capitalization is unwarranted and believe investors should be watchful of the potential for the stock to trade higher providing another short sale opportunity,” the research report notes.

Stagnant Companies Reaping Benefits Off the Blockchain Hype Is Currently a Sign of the Times

Companies like these, and recent regulatory crackdowns against blockchain firms with no product, have caused a lot of skepticism towards initial coin offerings (ICO)and the slew of ‘distributed ledger technology’ announcements. There are definitely a lot of people who believe a $39 million increase in equity market capitalization is unusual for a stagnant company that suddenly goes blockchain, but a lot of individuals see it as a sign of the times.