In the ever-evolving landscape of decentralized finance (DeFi), investors are constantly on the lookout for innovative ways to maximize their returns. One such intriguing option that has gained popularity is the Apple Pie Miner smart contract. At first glance, it may seem like just another platform for staking and earning passive income. However, beneath the surface lies a complex system that offers both high risk and high returns.

Understanding the Basics

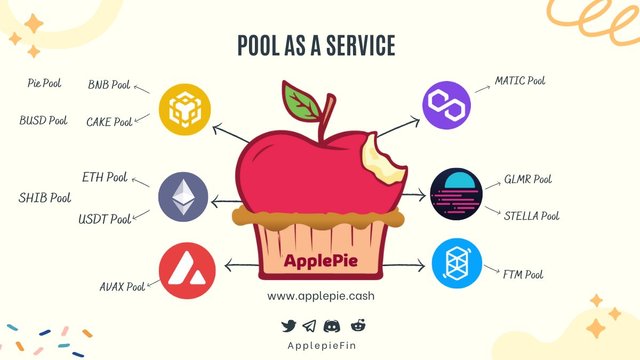

The Apple Pie Miner smart contract operates as a locked staking rewards pool. Users lock their assets into the contract, and in return, they receive 'Pie' tokens on the decentralized application (Dapp). These Pie tokens represent their stake in the contract, and the protocol promises to pay investors up to 10% of their daily contributions as a form of passive income.

The Allure of High APR

The primary attraction of the Apple Pie Miner smart contract is the enticing Annual Percentage Rate (APR) it offers. With a promise of high returns, it has managed to capture the attention of risk-tolerant investors seeking to capitalize on the volatile nature of the crypto market.

Digging Deeper: Beyond the APR

While the high APR is undoubtedly appealing, it's crucial for investors to understand that the Apple Pie smart contract is more than just a vehicle for staking. Beneath the surface, there are several key aspects that deserve careful consideration.

1. Smart Contract Security

Security is paramount in the world of DeFi, and the Apple Pie Miner smart contract is no exception. Investors need to be aware of the security measures in place to protect their assets. A thorough audit of the smart contract and the underlying code is essential to ensure that vulnerabilities are minimized.

2. Liquidity Risks

The nature of locked staking involves committing assets for a specific period. This brings with it the risk of illiquidity, especially in volatile markets. Investors should be prepared for the possibility of being unable to access their funds until the lock-up period expires.

3. Market Volatility

While the high APR may seem like a golden opportunity, it's essential to acknowledge the inherent risks associated with market volatility. Cryptocurrency prices can fluctuate wildly, impacting the overall value of the investment.

4. Governance and Decision-Making

Participating in the Apple Pie Miner smart contract means becoming part of a decentralized governance system. Investors should understand how decisions are made within the protocol and have a say in key matters that may affect their investments.

Proceed with Caution

In conclusion, the Apple Pie Miner smart contract presents an enticing opportunity for those willing to take on the associated risks. However, it's crucial for investors to approach this with caution, conducting thorough research and due diligence before committing their assets. The high APR is only one aspect of the broader picture, and understanding the intricacies of the smart contract is imperative for making informed investment decisions.

#ApplePie #PIE #100xreturns #BNB #pancakeswap #trade #autoyield #earnreward #staking #pinksale

More Information

Website: https://applepies.co/

Whitepaper: https://applepiefin.gitbook.io/applepie.financial/

Github: https://github.com/applepiefin

Twitter: https://twitter.com/Applepiefin

Telegram: https://t.me/applepiefin

Medium: https://applepiefin.medium.com/

Instagram: https://www.instagram.com/applepiefin/

Discord: https://discord.com/invite/x76F624yVe

Reddit: https://www.reddit.com/user/applepiefin/

Facebook: https://www.facebook.com/Applepiefin

User name: Lovtiek

https://bitcointalk.org/index.php?action=profile;u=2243938

Bsc Wallet: 0x50926468328d73Fe5897af1C9452888Bd8c61341

Poa Link: https://bitcointalk.org/index.php?topic=5482029.msg63523161#msg63523161