ARK was developed by a team comprising key players of the Lisk network including co-founders from Crypti, a number of prominent validators from the Lisk network and Francois-Xavier Thoorens, a primary Lisk developer. ARK’s roadmap includes a smartcard as a means of payment, the ability to transact across blockchains and IPFS integration. The Lisk-forked cryptocurrency is intended for broad consumer acceptance.

Lisk is a cryptocurrency based on JavaScript and designed as a platform for distributed applications and ARK was created as a consumer-friendly and faster-moving version of it.

The following five key features are implemented in ARK.

- Smartcard Launch. The ARK smartcard is compatible with the ARK network and can be used to make payments. This is an ambitious step as there are some complex technical challenges in having cards process cryptocurrencies. Managing Director Mike Doty does however have an extensive background in hardware, including a degree from Caltech. ARK also has various partnerships with major smart card providers in the pipeline. One objective of the smartcard is to foster adoption by making ARK usable to people who have not managed and stored cryptocurrencies before.

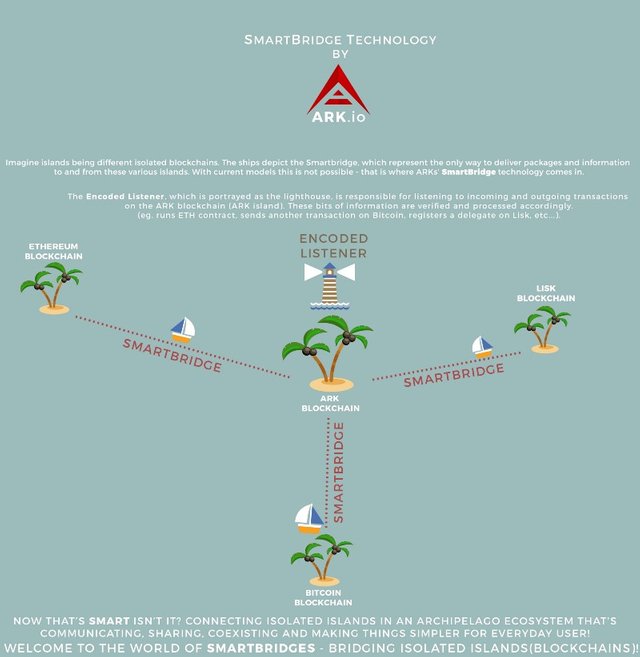

- Smartbridge Technology. ARK will be able to execute a variety of cross-network operations through its ability to communicate natively with other blockchains. This replaces Lisk’s sidechain capabilities in a number of ways.

- More secure and faster DPoS consensus. Ark has added pre-approval of blocks by delegates using PBFT (Practical Byzantine Fault Tolerance). This is done before blocks are added to the blockchain and results in reduced forking. Latency is reduced through a revised network topology and by using routing tables. These enhancements streamline communications among the delegates. The network has been made more secure and scalable by separating communication with clients and network transaction traffic from the consensus system through relay nodes coupled to the delegates.

- Faster transaction processing with uncle forging. Delegated proof-of-stake systems can scale fast as the validators are essentially trusted to take as much data as allowed and forge into a block, resulting in validators not competing. Such systems are however slowed down by the validator of the next block needing to wait until the previous block [the ‘father’] is forged, sent to, and verified. ARK reduces latency between blocks and supports scaling by rather allowing nodes to forge based on the ‘grandfather’ [the block prior to the block being forged] to form an ‘uncle’ [sibling to the current block being forged].

- Voting protocol changes. Both ARK and Lisk are delegated proof-of-stake systems, where token holders vote on the nodes that will serve as transaction validators. Holdings determine the weighting of votes. In Lisk, this weight is applied to all votes. This means that someone with 10 times the amount of LSK relative to someone else can have a 1010 times influence on voting if he or she voted the maximum of 101 times [10 time influence multiplied by 101 votes]. In ARK, each delegate’s voting weight is distributed equally across all votes. The vote from 10 times the amount of Ark therefore still only has 10 times the influence on voting, irrespective of how many delegates are voted for.

ARK’s role on the platform

On the Ark network, ARK tokens are used as a method of payment. Similar to the Omni protocol, ARK tokens also carry data messages across the network. Lastly, ARK tokens are used to pay transaction fees.

ARK’s fee structure is similar to that of Lisk. Transaction fees are currently set at 0.1 ARK per transaction. Additional fees are charged for registering a delegate, multi-sig and voting.

Token distribution

The supply of ARK tokens is currently capped at 125 million and all the tokens will be seeded into the genesis block.

Participation

To participate, sign in on the ARK website. BTC and LSK can be traded for a stake in the ARK network. Shapeshift can be used to convert other cryptocurrencies into BTC. LSK contributions are currently capped at 22 Million LSK [22% of the Lisk supply]. There is no cap on coins contributed through Shapeshift or Bitcoin.

Funds usage

Twenty percent of the funds will be released to the ARK development team from escrow, 24 hours after the token exchange has been completed. These funds will initially be used for early developer hiring, the organization of a legal team, the fees for corporate formation and other business related expenses.

The funds left over will be used to build the ARK network, manufacturing Smartcards, developing SmartBridge links with other blockchain networks and the marketing of ARK’s services.

Project timeline

• Launching of the ARK Mainnet - February 1st, 2017

• Development Smartbridge links to the Bitcoin, Ethereum, and Lisk networks and a P2P card network. (Dependent on securing at least 10,000BTC during the Token exchange) - Late 2017

• Implementation of additional Bridged Blockchain Support and a Smartcard P2P payment system. (Dependent on securing of at least 15,000BTC) - Early 2018

• Ecosystem Development - End of 2018

Congratulations @thedude123! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit