AUD/USD remains depressed around 0.7730, down 0.17% intraday, as the previous day’s optimism fades during Tuesday’s Asian session. While the US Treasury yields could be the main catalyst for the aussie pair’s latest weakness, floods in Australia’s most populous stats New South Wales (NSW) also tease the bears.

Having declined the most in two weeks, the US 10-year Treasury yields added 1.5 basis points (bps) to inch closer to the 1.70% threshold by the press time. The bond bears’ return could be traced from mixed signals from the Fed and Treasury.

While the Fed Chair Jerome Powell repeated the US central bank’s readiness to keep policies easy as long as required, citing economic challenges, Treasury Secretary Janet Yellen expected a return to full employment in 2022. Further, Fed Governor Bowman cites challenges for small firms.

On the other hand, the three-day-old rainfall in the NSW has gained strength off-late and propels State Premier Gladys Berejiklian to say, per Reuters, “Overnight, unfortunately, some weather conditions have worsened, and those weather conditions are likely to worsen during the day so many communities will experience increasing heavy rainfall.” The report also mentions evacuations of 18,000 people and 15,000 more in the pipeline during the ‘catastrophic’ flood.

It’s worth mentioning that signals from the People’s Bank of China (PBOC) have been suggesting no further easy money but have mostly been ignored. Though, the Western alliance comprising the European Union (EU), the US, Canada and the UK, to punish China over human rights violations in Xinjiang weigh on market sentiment. Furthermore, vaccine and virus jitters are an extra burden on the mood.

As a result, S&P 500 Futures fails to track Wall Street benchmarks to the north whereas stocks in Asia-Pacific trade mixed.

Moving on, today’s testimony by the key US policymakers to justify the covid stimulus could drop the hint for further easy money. However, any challenges mentioned to the policies may not refrain from extending the quote’s latest weakness.

Technical analysis

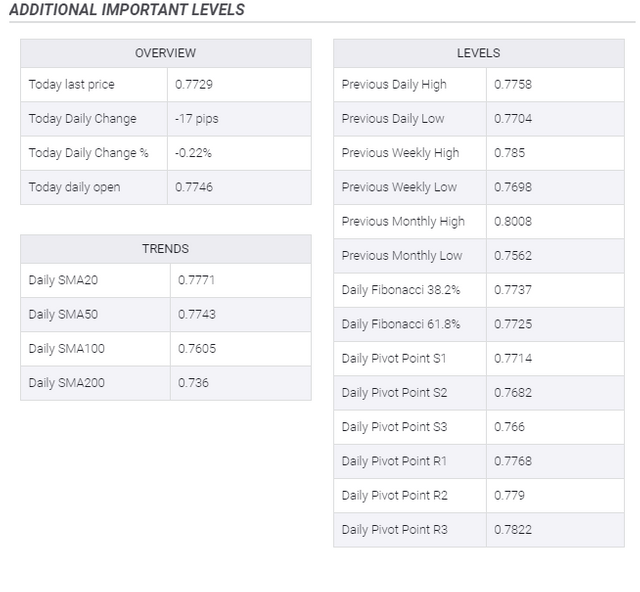

AUD/USD sellers eye 50-day EMA around 0.7720-15 and an ascending trend line from December 21, 2020, near 0.7670, unless rising past-21-day EMA close to 0.7755. Also challenging the AUD/USD buyers is the monthly top near 0.7840.