I keep getting told about the Dark Web and Cryptocurrencies. How criminals and terrorists are using this system to trade. And how people are using Bitcoin and Altcoins to launder money. Recently a colleague of mine had his account closed on him. Not just put on hold but closed. Why? Because of fraudulent activity surrounding a transaction. When my colleague got concerned that someone was acting fraudulently with his account he was extremely distraught. He then asks to speak to the police that they have contacted to deal with fraud and gets the response that they haven’t been in touch with the police. At this stage it was just that the transaction seemed that it could be fraudulent. Another party had contacted the bank and made them aware of this. So on pushing further it seems that because it was a bitcoin transaction it may be fraudulent. That is all the reasoning was for them to CLOSE an account. And who was the other party. The corresponding bank from where the money was coming from. He did get it sorted and got his account opened again. However 2 weeks later it happened again. Now how much did this guy try to transfer. $500. Yes that is all. A $500 transaction and the bank decided it may be fraudulent. Just an assumption too I might add.

So why then is the current epidemic of fraud happening throughout the US, UK, Australia, Europe and the rest of the world. They all have systems in place to stop these activities happening. If a bank can close an account because of a $500 bitcoin transaction, in which was effectively someone just putting $500 into his account was deemed worthy of fraudulent treatment then surely they can track other transactions. We have to give the bank numerous forms of ID, address verification and so forth. Many countries around the world have opted for the financial transaction reporting systems for any transaction over a stated amount. Therefore they have the systems in place to ensure this fraudulent epidemic can be halted faster. In the UK the banks wave the flag that they stopped 64% (£1.2B) of debit and credit card fraud last year, but that’s 36% they let slide or around £675 million. Well it’s no wonder they let that money slide right on through given they were having to deal with another customer that was merely undertaking a legitimate transaction using a form of currency that obviously threatens their existence.

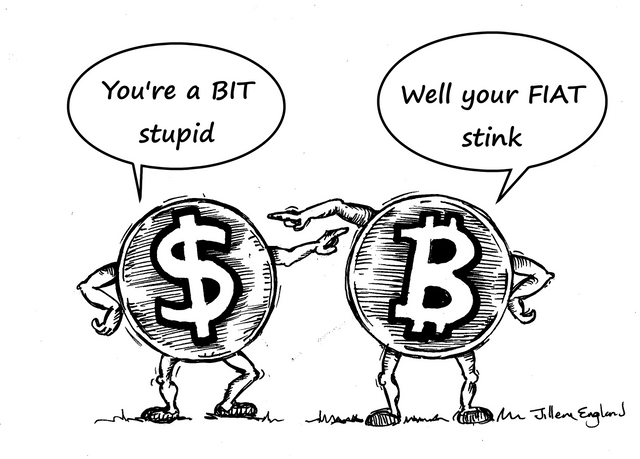

Now just to address a couple of other issues. I would suggest that the only thing fraudulent about the combination of Cryptocurrency, money laundering and terrorism is the way that Governments and Media around the world portray and perpetuate this lie. A quick search on google just shows how exaggerated this claim is. While there are reports on various terrorist groups looking at the use of cryptocurrencies, it is merely only anecdotal evidence at this stage. However, change that search to banking and money laundering and there is a whole different perspective offered by google. Just choose your favourite multi national bank and google it alongside the words money laundering and you will find multiple cases of these banks being fined year after year for breaches. One such bank was fined $300 million for alleged breaches of around $250 billion. Now, lets see if I can do the math. 1% of $250 billion is around $2.5 billion. So $300 million must be around 0.13% of $250 billion. Now if a bank has that amount of money in it’s control then how much money will it make from this amount. Rest assured, given the bank knew who it was dealing with, given the regulations behind banking, then it would have been charging a premium for the utilisation of there services. And I am pretty sure a premium fee is going to be far greater than 0.13%. And this particular bank was fined only 2 years previously as well as on many other occasions.

http://www.bbc.com/news/business-20669650

https://www.theguardian.com/australia-news/2017/aug/03/commonwealth-bank-accused-of-money-laundering-and-terrorism-financing-breaches

https://www.stuff.co.nz/business/world/96869035/australian-banks-are-exposed-to-millions-in-money-laundering

Now I do not advocate giving the banks more control over our affairs than what they already have. In fact it is way to much. It is not us, Joe Public that are actually the problems here. It is the banks. When they are only given fines, that are merely crumbs to the profits they make off money laundering, then they will continue to allow the criminals to transfer money through their systems. I’m not going to launder money because if I do I will go to prison and this will ruin me financially. Therefore, if a Bank launders money then it to should face financial ruin. Now whether the people who worked within the banks should also be punished is another story. But if the banks were ruined because of their illlegal activities, and they lost jobs and reputations, then maybe the Banks and the bankers who facilitate these transactions would stop.

What needs to happen is that the rule of law starts within the crypto industry. There are certain aspects of human existence than can allow us to work in harmony by utilising common decnecy. This is really what the decentralised system is. This is what the blockchain is. So when laws are broken then people should be arrested. And when aspects such as The Dark Web were exposed, it was a good thing. When a company comes into existence then it needs to operate in a manner which ensures that it gives out exactly what it wants to get in return. When Investors buy coins, they are bought for an investing function. Investors all want those tokens to rise in value. Investors are not buying into a concept technology idea because they think it is going to change the world. They are buying into it because hopefully it will change THIER world. Investors know they are not buying a security. Investors also know the volatile nature of this type of trading and accept that. Much like on Forex, Shares or the Casino, there is an inherent risk factor which is well known. Do they really care about the regulations? No. They care about a sysytem devoid of the manipulation that exists in the other markets and without banks and regulators it can happen. Now so long as all participants within the new world of Cryptocurrency play by the rule of law and let it work as a free market environment then it truly will be something that can only be good for us all. My main concern is when the banks and regulators do get involved. Forget trying to worry about Crypto and illegal activities. Clean up your own home first and let us deal with the issues of Cryptocurrencies.

Mike England

https://www.rptoken.io

[email protected]

Token Sale till January 10th 2018

Authors get paid when people like you upvote their post.

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

If you enjoyed what you read here, create your account today and start earning FREE STEEM!