Are you a cryptocurrency lover, and you’re willing to take your trading to the next level? Then this article is for you, as I’m here to reveal one of the most distinct aspects regarding cryptocurrency.

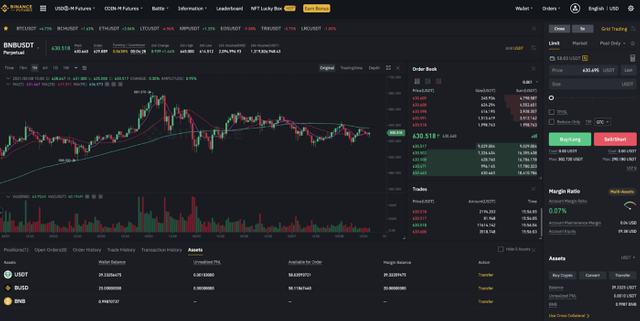

Binance still stands to be one of the most popular trading platforms as we speak, and it has lots of great features which you would love. You may be thinking of starting your trading journey on Binance. To me, trading Futures appears to be one of the most profitable options on the Binance platform. However, there are many risks involved, which means you need to be extremely careful and study how it works perfectly well. This is why I will give you the correct information you need regarding Binance Futures trading. Now, let’s get started.

What Does Futures Contract Mean?

A futures contract is an agreement or contracts to purchase or sell a product or currency at a predetermined price to reach a specific time in the future. Regarding Futures Contract, trades are not settled instantly, but rather two counterparties will have to make a trade that defines the settlement at a particular date in the future.

The future of cryptocurrency also exposes traders to the crypto world without having the actual cryptocurrency. This trading concept is similar to stock indices or futures contracts, where an investor can take risks on an asset’s future value.

Understand that the Futures market doesn’t allow users to purchase or sell the product or the cryptocurrency directly. Instead, they are performing a contract trade and the actual trading of assets that will happen in the future when the contract is realized.

Also, a trader can easily trade crypto futures on different trading platforms like Binance Futures. This also makes you trade lots of digital currencies without any interruption. But note that there is high volatility related to different trading platforms, so it shouldn’t be surprising to you when you realize some changes. And like I earlier said, traders must be mindful of how they trade because it has lots of risks, and it’s imperative to understand everything about it before trading.

Futures Contracts Trading on Binance

After going through the basics of Binance Futures, let’s be aware that trading futures contracts on Binance aren’t tricky as it seems. Yeah, trust me; it’s just straightforward, only if you can focus more on how it really works. If you’re an existing Binance user, you can get started with futures trading in just minutes.

With a crypto futures contract, you can buy or sell different cryptos at a determined and regulated price on a particular date in the future. In a futures contract, crypto buyers assume the responsibility to buy the cryptos concerning the contract. At the same time, sellers can produce the appropriate crypto-asset upon the closing of the contract.

Perpetual Futures Contract

Since we’ve known about Futures Contract on Binance, we should be aware of the strategies in trading perpetual futures contracts. A perpetual contract is not the same as the traditional form of futures, as it’s a particular type of futures contract. A perpetual futures contract doesn’t have an expiry date because you can hold a position for as long as you think the profit or loss is enough or when you see it reasonable to trade. The trading of perpetual contracts depends on an underlying Index Price, which consists of the average price of an asset, and this is according to major spot markets and their relative trading volume.

Exit strategies for futures contracts

There are three main actions in which futures traders can execute. These actions are:

• Offsetting

• Rollover

• Settlement

Let’s explain these actions one after the other.

Offsetting: This refers to the act of closing a futures contract position. When this is closed, you’ll be creating an opposite transaction of the same value. If a trader is short 50 futures contracts, such trader can now open a long position of equal size, which will, in turn, neutralize his initial position. Also, we should note that the offsetting strategy makes a futures trader realize his profits or losses before the settlement date.

Rollover: This happens when a trader decides to open a new futures contract position. This comes after offsetting their initial one and after extending the date of expiration. Let’s use this instance: if a trader is long on 30 futures contracts, which is meant to expire in the first week of June, but such trader feels like prolonging his position for six months, such a trader can offset the initial position and open a new one of the same size. This execution will make the expiration date to be set to the first week of November.

Settlement: This refers to a Futures that does not make a trader offset or rollover his position, which will make the contract settle at the expiration date. If some parties are involved in this, the involved parties can now exchange their funds according to their position.

It's been nice having you here. Also, if you need more information about Binance and Binance Futures itself, do not hesitate to visit the links below:

Link to Binance Futures: https://www/binance.com/futures

Twitter Link: https://twitter.com/binance

My Binance ID: 36276075

https://accounts.binancezh.cz/en/register?ref=36276075