The US House of Representatives passed the 21st Century Financial Innovation and Technology Act on May 22, which is seen by the cryptocurrency industry as another milestone victory.

Although the SEC is very dissatisfied with this, it seems that US regulatory agencies are still pushing for cryptocurrency products to enter the market for trading, and the green light is gradually turning on in more countries and regions

On May 22nd, the US House of Representatives passed a bill aimed at creating a new legal framework for digital currencies, the Financial Innovation and Technology Act of the 21st Century (FIT21), with 279 votes to 136 votes.

Among them, 71 Democrats and 208 Republicans voted in favor, while 3 Republicans and 133 Democrats voted against.

Next, the bill will enter the United States Senate for a vote, and if passed, it will go to President Biden's desk for approval. Although Biden clearly expressed opposition in a policy statement, he did not indicate that he would veto the bill.

1、 The Republicans are pushing for it, and there are also many supporters within the Democratic Party

It is reported that the bill was mainly initiated and promoted by the Republican Party, aiming to establish a regulatory system for the US cryptocurrency market, formulate consumer protection measures, grant the US Commodity Futures Trading Commission new jurisdiction over digital commodities, and clarify the jurisdiction of the US Securities and Exchange Commission over some digital assets in investment contracts.

It is not difficult to see from the vote results of the bill that the vast majority of Republicans voted in favor, while more than one-third of Democrats also voted in favor.

As one of the Democratic lawmakers who disregarded opposition from the White House, Josh Gottheimer believes that the US encryption industry needs rules, and Congress also needs a reasonable, thoughtful, and bipartisan legislation, which will be an important milestone.

In addition, two-thirds of the Democratic Party votes against it. For example, Representative Maxine Waters believes that the bill allows cryptocurrency companies that have been evading securities laws and have earned billions of dollars through illegal issuance or assistance in buying and selling cryptocurrency securities to openly evade responsibility, while the Republican proposal legalizes these activities.

On the Republican side, lawmaker Patrick McHenry, who supports the bill, said that his term in Congress is coming to an end, but the legislation for the cryptocurrency industry will not end and is unstoppable. Just as it has been repeatedly declared to be on the brink of extinction, yet still exists.

Due to the downfall of FTX, Sam Bankman Fried, former CEO and leader who had vigorously lobbied Congress for a bill, was imprisoned, and last year the progress of the US cryptocurrency bill hit a freezing point.

However, as more and more people agree that the United States should maintain its leading position in the global encryption industry, the bill has come back to life.

2、 Blocking stone SEC, dissatisfied but unable to stop?

In addition to opponents in Congress, the US Securities and Exchange Commission (SEC), which has long been seen as a roadblock by cryptocurrency industry organizations and supporters, especially its chairman Gensler, is also dissatisfied with the passage of the bill.

At the time of approval by the House of Representatives, Gensler warned that the bill "will create new regulatory gaps, undermine decades of precedent in investment contract supervision, and expose investors and capital markets to incalculable risks."

Gensler noted the high-profile lawsuits, fraud cases, bankruptcies, and failures, and insisted that cryptocurrencies should be subject to the same legal constraints as other assets. He stated in a statement that under the bill, investment contracts recorded on the blockchain will no longer be considered securities, thereby depriving investors of the protection they receive under securities laws.

He also stated that, in addition to other criticisms, the bill will allow issuers of cryptocurrency investment contracts to prove that their products are digital goods that are not regulated by the SEC, and the institution only has 60 days to question this.

However, Gensler's statement seems more like a form of dissatisfaction but unstoppable complaints. Because just two days ago, the SEC issued a hint that it may approve applications for spot Ethereum ETFs.

Today, the SEC needs to make a final decision on VanEck's spot Ethereum ETF application.

The market is also generally optimistic. Bloomberg ETF analysts have raised the probability of approval for spot Ethereum ETFs from 25% to 75% in one breath, and the price of Ethereum has risen from below $3100 to over $3700 in the past three days, with a cumulative increase of over 20%.

In addition, a week ago, there were media reports that the Chicago Mercantile Exchange (CME) planned to launch Bitcoin trading to meet Wall Street's demand. This is a signal for this traditional financial institution to open up Bitcoin spot trading, and it has already gained a leading advantage in cryptocurrency derivatives exchanges in the past few years.

3、 More countries are gaining regulatory approval for encryption related products

More encrypted financial products from more countries and regions are on the way to obtaining regulatory green lights

According to Bloomberg, on May 22nd, the UK financial regulatory authorities approved the first batch of cryptocurrency exchange traded products (ETPs), which is a step towards catching up with other financial centers in digital assets. However, according to the current regulations of the Financial Conduct Authority (FCA), they are only open to professional investors and are more stringent than in the United States.

WisdomTree and Invesco Digital Markets have both stated in their respective statements that they have obtained FCA approval to list a pair of physical supported cryptocurrency ETPs that track Bitcoin and Ethereum on the London Stock Exchange. These products may start trading as early as May 28th.

In addition, issuers such as ETC Group, 21Shares, and CoinShares have applied to list their encryption products in the UK. As of 12:00 pm on Wednesday, the entries for WisdomTree, 21Shares, and Invesco Digital Markets on the FCA website have been approved.

Hong Kong is even earlier!

On April 30th, the first batch of Bitcoin and Ethereum spot ETFs approved by the Hong Kong Securities and Futures Commission (SFC) were officially listed for trading on the Hong Kong Stock Exchange. Six digital currency spot ETFs from Bosch International, Huaxia (Hong Kong), and Harvest International have already made their debut in the Asian market.

Since its listing, Bitcoin and Ethereum spot ETFs in Hong Kong have risen by more than 11% and 17% respectively, with daily transaction volumes on the Hong Kong dollar counter exceeding HKD 38 million. At present, the total asset size of these 6 ETF products has exceeded 300 million US dollars.

The first large financial institution in the United States to enter the cryptocurrency market, with payment giant PayPal issuing USD stablecoins

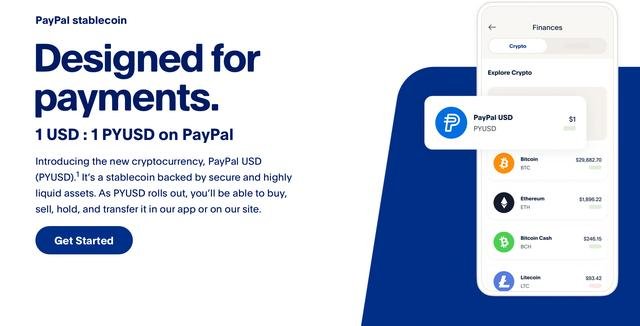

Last August, American fintech company and payment giant PayPal (NASDAQ code: PYPL) announced the launch of the stablecoin PayPal USD (PYUSD) denominated in US dollars, which means that PayPal has also become the first player in the digital asset field, not just a platform that supports cryptocurrency transactions.

This is also the first large financial institution in the United States to enter the field of cryptocurrencies.

Perhaps influenced by the news, on August 7th, PayPal's stock price rose 2.66% on the US stock market, closing at $64.42, with the latest market value of $70.7 billion.

Cryptocurrency stablecoins are cryptocurrencies bound to fiat currencies such as the US dollar. It is reported that PYUSD is fully supported by US dollar deposits, short-term US treasury bond bonds and similar cash equivalents, and can be converted into US dollars 1:1.

Stablecoin makes it easier to purchase cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin, and settles transactions in digital assets faster than government issued currencies.

PayPal CEO Dan Schulman said, "The transition to digital currency requires a stable tool that is both digital native and easily connected to fiat currency like the US dollar."

PayPal stated in the announcement that in the future, eligible US users can directly purchase PYUSD in US dollars on the app. Users can transfer PYUSD between PayPal and compatible external wallets; Choose PYUSD to pay the bill at checkout; Support the exchange of cryptocurrency and PYUSD.

In June 2022, PayPal obtained a digital currency license in New York State, allowing platform users to trade Bitcoin, Ethereum, Bitcoin cash, and Litecoin assets.

PYUSD will be issued by Paxos Trust Company. Starting from September this year, Paxos will begin releasing monthly reserve reports for PYUSD.

PayPal stated that PYUSD will connect transactions between fiat currency and digital currency for consumers, merchants, and developers. As the only supported stablecoin in the PayPal network, PYUSD leverages PayPal's decades of experience in large-scale payments, as well as the speed, cost, and programmability of blockchain protocols. PYUSD aims to reduce payment friction in virtual environments, quickly transfer assets, support user remittances or international payments, and achieve direct flow of digital currency to developers and creators.

As an ERC-20 token issued on the Ethereum blockchain, PayPal USD can be easily adopted by exchanges.

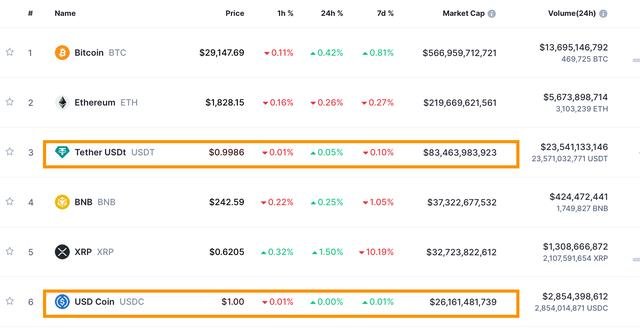

According to the Coinmarketcap website, currently, the world's largest stablecoin by market value is Tether USDT, with a market value of 834.64 billion US dollars; Next is USD Coin, issued by encryption provider Circle, with a market value of 26.161 billion US dollars. Other well-known stablecoins include the stablecoin BUSD issued by Binance.

Previously, Meta's predecessor Facebook had planned to launch the stablecoin Libra in 2019, but the project was terminated due to regulatory concerns that it could disrupt global financial stability.

Recently, there has been a shift in regulatory attitudes towards stablecoins. In July, the Financial Services Committee of the United States House of Representatives proposed a bill to establish a federal regulatory framework for stablecoins, which will focus on the registration and approval process rules for stablecoin issuers. US Congressman Patrick McHenry stated that PayPal's announcement indicates that stablecoins will provide a pillar of security for the US 21st century payment system.