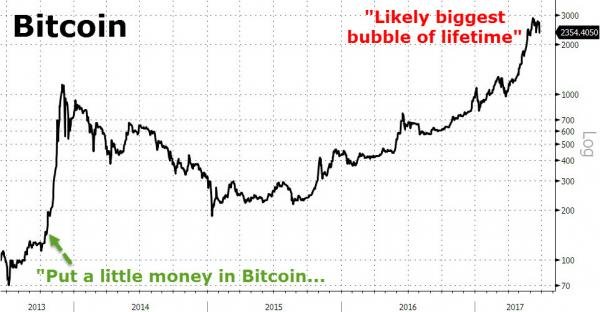

Last week former Fortress principal Michael Novogratz made headlines in the cryptocurrency world when he told attendees at the CB Insights Future of Fintech conference that he has cut holdings (in Bitcoin and Ethereum) after the cryptocurrencies' latest "spectacular run," warning that "Euthereum had likely hit its highs for the year," and "cryptocurrencies were likely the biggest bubble of his lifetime."

His caution was understandable: after all during a 2013 UBS conference, Novogratz said "put a little money in Bitcoin...Come back in a few years and it’s going to be worth a lot." We doubt even he knew how right he would end up being.

However, while his latest sentiment appears rather downbeat, Novogratz said he remained very "positively constructive" on the space overall, as he should: he still has 10% of his net worth invested in the sector. And, as Bloomberg reported, Novogratz says cryptocurrencies "could be worth north of $5 trillion in five years - if the industry can come out of the shadows."

So fast forward to Sunday evening Goldman's chief technician, Sheba Jafari, issued only his second forecast of where bitcoin is headed next which may accelerate Novogratz' crypto price target.

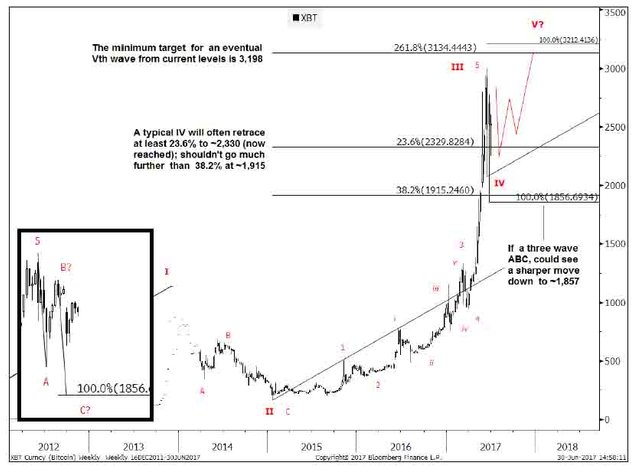

Recall, that as we first reported three weeks ago, Jafari said that "due to popular demand, it’s worth taking a quick look at Bitcoin here" and warned that "the market has come close (enough?) to reaching its extended (2.618) target for a 3rd of V-waves from the inception low at 3,134." She concluded that she was "wary of a near-term top ahead of 3,134" and urged clients to "consider re-establishing bullish exposure between 2,330 and no lower than 1,915."

She was right: on the very day his note came out, both bitcoin and ethereum hit their all time highs and shortly after suffered their biggest drop in over two years.

So what does Jafari thinks will happen next? According to the Goldman technician, Bitcoin is now "in wave IV of a sequence that started at the late-’10/early-’11 lows. Wave III came close enough to reaching its 2.618 extended target at 3,135. Wave IV has already retraced between 23.6% and 38.2% of the move since Jan. ‘15 to 2,330/ 1,915."

What does this mean for the uninitiated? In short, while bitcoin remains in Wave IV, it could go up... or down. She explains:

It’s worth keeping in mind that fourth waves tend to be messy/complex. This means that it could remain sideways/overlapping for a little while longer. At this point, it’s important to look for either an ABC pattern or a more triangular ABCDE. The former would target somewhere close to 1,856; providing a much cleaner setup from which to consider getting back into the uptrend. The latter would hold within a 2,076/3,000 range for an extended period of time.

However, at that point the next major breakout higher would take place, one which would take bitcoin as high as $3,915.

Either way, eventually expecting one more leg higher; a 5th wave. From current levels, [Bitcoin] has a minimum target that goes out to 3,212 (if equal to the length of wave I). There’s potential to extend as far as 3,915 (if 1.618 times the length of wave I). It just might take time to get there.

Goldman's analyst concludes with the following summary: "[Bitcoin] could consolidate sideways for a while longer. Shouldn’t go much further than 1,857. Eventually targeting at least 3,212."

Here we can only adds that fans of bitcoin should probably hope that his is not one of those Goldman trade recos where the firm's prop trading desk is on the other side of the clients' trade...

Article found at: zerohedge.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/bitcoin/@zer0hedge/goldman-sees-bitcoin-soaring-as-high-as-usd3-915-during-next-breakout

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think we ll see next breakout after 1st August , when the Block Size increased.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit