The following are some serious questions and thoughts I have concerning Bitcoin, I hope people comment and start a conversation to see if I'm alone in my thinking.

Does the price of Bitcoin even matter?

When long term investors purchase Bitcoin they are buying into the idea either knowingly or unknowingly that the system of fiat currency is coming to an end and cryptocurrency will be the replacement. Watching the financial world debate the price of one Bitcoin to eventually be anywhere from zero to a million dollars is irrelevant, because if cryptocurrency is to replace fiat one Bitcoin will eventually be worth…. One Bitcoin.

Will the System Give up Control

The coming days where financial banks crumble and the government gives in to the libertarian ideals of giving away monetary control to the crypto-verse is an unlikely future. If someone offered you right now one million dollars for every one Bitcoin you owned would you do it? Of course you would. Stop and consider just how much money the Federal Reserve can print, or how much JP Morgan, Goldman Sachs and other financial megaliths control. The current market cap of all crypto is sitting around 525 Billion USD (January 2018). When you understand the trillions of dollars moved and controlled by these organizations you recognize how easy it would be to buy the ENTIRE CRYPTO MARKET. What happens when the majority of Bitcoin is owned by the Federal Reserve? They own the new world currency, and the systems keeps on moving. The only way you avoid this is by never selling you Bitcoin for fiat… Ever, for any price no matter what.

Bitcoin is your Protest

You mustn’t sell your Bitcoin, you must use and earn your Bitcoin. The system will only change if and only if the mainstream allows the acceptance of Bitcoin for goods and services. Selling your Bitcoin for fiat is simply using crypto as a casino, not as a monetary revolution. If you are trying to sell your old car, running a yard sale, own a cash business like a coffee shop, or barbershop make it known that you accept Bitcoin, or whatever crypto you wish. Don’t trade that Crypto for fiat either, HODL it or even better USE it! The percentage of people who will pay for your goods and services in crypto will be small, so holding on to it will not hurt you financially. As time moves on; if more and more people start paying in crypto it will come with a wider array of adoption from other businesses. Let’s say you are a guy selling his old car as an example. Say that someone buys it for 0.2 BTC. You don’t sell the BTC for fiat, you find a good or service that you can trade for a portion of that BTC. Let’s say the guy who cuts your lawn agrees to cut your lawn for a full year in trade for 0.1 BTC, so you give it to him and have successfully used BTC as a peer to peer digital cash as it is intended to be used.

A Store of Value

Unfortunately I have to agree with Roger Ver that in order for Bitcoin to be a store of value it must have a use case outside of being a store of value. I say unfortunately not because I don’t like Bitcoin Cash or Roger Ver, but more so because I don’t agree with the idea of BCH = BTC. I do agree with the economic logic behind his arguments however, despite disagreeing with his masterplan of usurping Bitcoin. He has a major flaw in his reasoning however and that is summed in a question of “why would anyone sell or trade a currency today that will be worth double its value in a week, quadruple its value in a year, and 100X its initial value in a decade?” In this scenario we must understanding why the current economic policy of inflation incentivizes spending. The old saying from grandparents goes “when I was your age going to the movies cost a quarter.” or “I remember when I could buy a car for 1,000 dollars.” Are all very true statements, and looking back on the 1950’s where you could buy a gallon of gas for 18 cents http://www.thepeoplehistory.com/1950s.html seems like a steal compared to what we pay for todays $2.60 per gallon inflationary prices. When you know that your money is going to be worth less in the future you are more willing to spend it in the present.

The Deflationary Problem

BTC (and all deflationary currency) is like taking 2018 and 1950 and reversing them. What we will hear more from future grandparents is likely to be “When I was your age a box of pizza was 10,000 BTC, now it’s 0.001 BTC! I should’ve just saved my BTC! Why was I so careless buying things I don’t need?!” This is a very serious problem with BTC and one in which we don’t have a real solution for yet, so it very well may be that Bitcoin is going to be worth an almost incalculable worth. How much is Bitcoin worth? It depends how long you hold it for.

What Do We Do With Our Bitcoin Then?

My opinion is that we have three options.

- Buy and HODL an amount of BTC that you are not willing to sell even if it crashes to nothing.

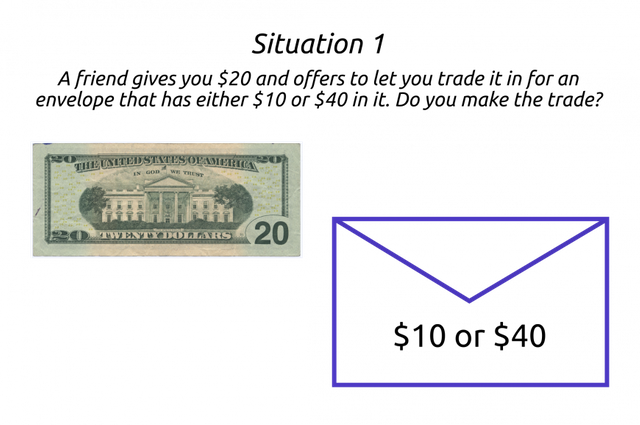

- Buy an amount of BTC, when it doubles in value take your initial investment off the table and let the world figure it out at no cost to you no matter the outcome.

- Use and accept BTC in full knowledge that it will be worth more or less than what it is at the time of the transaction, and be ok with whichever future happens.

I would love to hear your thoughts about my sentiments in the comments.