For the unwary, there are a lot of ways to lose money in the world of cryptocurrencies. That's a topic that could fill a whole book. Instead, I'm going to show you a way to maximize your cryptocurrency gains in a passive or semi-passive manner while taking very minimal risks. I have digital assets dating back to 2013 spread out all over cyberspace in the form of wallet and exchange accounts but I recently took to lending out a portion of my cryptocurrencies (AKA crypto) and tokens to earn loan earnings on two exchanges that I use: Poloniex and Bitfinex.

This method of earning semi-passive income from your crypto is much, much safer than investing your crypto in HYIPs (High Yield Investment Programs, AKA Ponzi schemes) or at Peer-2-Peer lending sites where there is no recourse if the borrower refuses to pay back loan fees and the principal. I utilize dollar cost averaging to apply 1% of my gross income as a Sr. Network Engineer to buying BTC and ETH once or twice a month. However, my total monthly loan earnings from all my loaned coins well exceeded the amounts I purchase once or twice a month. I'll share with you the results of my 5 week experiment/test in lending out coins on these exchanges.

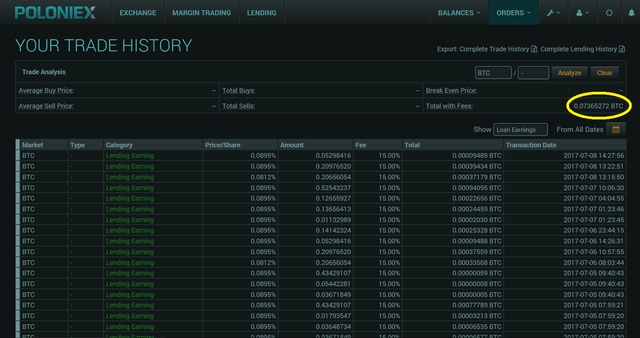

Below is a picture of my BTC loan earnings at Poloniex over the course of about 5 weeks [June 1 - July 8]. Loan earnings totaled 73.7 milli-BTC which, based on today's BTC price, equals $189.33 worth of earnings from loaning out 1.3 to 1.6 Bitcoins over that span. BTC loan earnings were also lent out to work that compound interest magic for me. I now send most of my monthly cryptocurrency purchases straight to one of these two exchanges so I can lend them out to maximize my cryptocurrency returns.

This BTC was gained by bypassing the usual exchange purchases and earning cryptocurrency directly via loaning them out on one of the world's largest BTC exchanges. I saved fiat by not being taxed and nickeled-and-dimed by middlemen to purchase crypto and to move it where it needs to go. Therefore, for the less mathematically inclined, that $189.33 of loan earnings in BTC is roughly equivalent to earning about $300 at a job job in fiat earnings to buy BTC or ETH. First, you are taxed on your gross earned income, then you get "taxed" yet again by the Cex.io or Coinbase exchange fees (if you're US based), and finally you're "taxed" by the BTC or ETH miners via transaction costs associated with finally getting your purchased cryptocurrencies into the intended wallet.

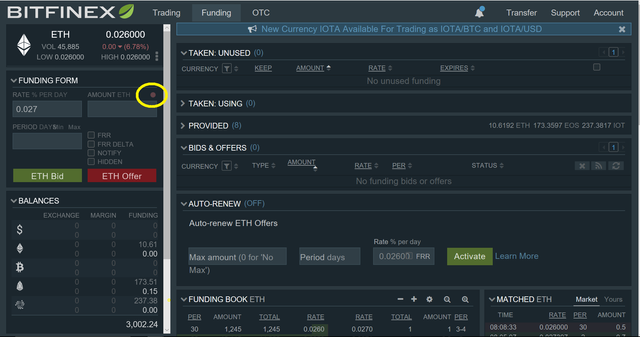

Here's the results of a few days of Altcoin loan earnings at Bitfinex:

I experimented with ETH lending for a month at Poloniex for comparison's sake. The results were underwhelming: the equivalent of 19 cents from loaning out 14-15 ETH for a month. I've since moved most of my lending ETH to BitFinex, now that my month long ETH Poloniex experiment ended last week.

Note that I made a third of a whole EOS coin in 3 days from 173.3 loaned EOS. It was worth only about a dollar at that time but this was earned without having to lose control of my coins by handing it over to the borrower like one would in a HYIP scheme or a P2P crypto loan, because the exchanges themselves handle the mechanics of the loans. Loan fees are automatically deducted from margin trader accounts from their margin collateral held by the exchange. These traders use your provided cryptocurrencies to do margin trading on these coins, opening either a short or a long position in that particular coin.

One can make big gains using margin trading but a trader could also lose most or all of their margin collateral - even their whole exchange funds, on some exchanges - due to just one bad short or long margin trade. These margin trades are some of the highest risk, highest reward investments possible with the possible exception of HYIPs.

In contrast: by loaning out your crypto on trusted exchanges you're indirectly profiting off of margin trading at minimal risk by providing market liquidity, while smartly not taking on leveraged high risk in margin trading. By providing market liquidity, you also contribute to the overall health and utility of that coin's economy. Essentially: you're providing picks and shovels to the "miners" (or margin traders, in this case) for this particular gold rush.

Historically, it's usually been the miner suppliers that have benefited the most from gold and other mineral rushes. The longevity of a company like Levi's Jeans is a great example of this. Now you could just set your crypto loan offers to try to auto-renew at whatever rate you managed to have filled, which would make it passive income, but to maximize gains it's best to do a little bit of rate management to meet changing market rates.

How to earn semi-passive income from your cryptocurrencies:

- Open accounts at Poloniex and Bitfinex if you don't already have one. Make sure to enable 2FA on your exchange and email accounts for additional security.

- Deposit your cryptocurrencies at both exchanges. I recommend that you use coins that you intend to be part of your Long Term Buy and Hold coin portfolio that you weren't intending to cash out anytime soon, in case of any short term deposit or withdrawal issues.*

- Open a Loan Offer following Steps 4 and/or 5 below.

- Poloniex: Transfer deposited funds to your Lending wallet. Click the Lending tab. Click a deposited coin from the table on the right under My Balances to check out offered rates from lenders and borrowers. Click on the amount listed under "Offer BTC" (or whatever coin you chose) and this will auto-fill a max available amount to be available for lending. Fill in the fields for interest rates and period of the loan, and click "Offer Loan."

- BitFinex: Transfer deposited funds to your Lending wallet, if necessary. Hover your cursor over the Funding tab and scroll down and click on the intended coin. The center bottom column shows the offered interest rate by lenders, amount of that coin at that rate, and the period of the offered loan. The bottom right column displays the open and partially filled (red) loan orders from borrowers. Fill out these two fields: Choose a competitive interest loan rate and a loan period in days. Click this red dot shown in the picture below if you intend to loan out the max available amount you have for that particular coin:

- If you've made a competitive offer, your loan offer will soon be filled. Congrats! Now you're lending out assets like a bank and earning interest income just like a bank! And thanks to these exchanges, you didn't even have to turn control of your own crypto over to the borrower in order to get these returns.

General Tips to Maximize Loan Returns:

- The difference in interest rates being offered at both exchanges vary greatly at this time. You can increase your loan earnings by as much as 10x or more simply by choosing to lend your coin out at the right exchange. One month of ETH lending on Poloniex bore this out.

- I prefer to loan BTC at Poloniex and ETH and DASH at BitFinex to take advantage of higher loan interest rates at these exchanges . Sometimes, you may not have a choice if you're trying to lend out a coin or token such as BTS, EOS, or IOTA that is only offered at one of the two exchanges.

- For coins you intend to make available for loans, you generally want to have your coins loaned out at all times or as often as possible to maximize returns even if that means loaning coins out at a lower rate. You can use auto-renew functions to automate some of this.

- If you want to get your coins loaned out quicker, you pick an interest rate that's at or below the lowest rate. However, with some patience and watching the ebb and flow of these interest rates, one can sometimes double or triple their loan earnings simply by waiting a few minutes, hours or a day for higher rates to come around due to the vagaries of supply and demand. On the other hand, waiting a few hours or a day could instead result in lower interest rates and you'll have had lending coins sitting around collecting digital dust.

- Both sites offer reports on your loan earnings so you can check to see how your loan funds are doing. At Poloniex, if you go to the Orders\Trade History\Loan Earnings tab and click on a particular coin you can also see your total loan earnings for a particular coin like the picture shown at the top of the article.

- Check on your loaned coins once or twice a day to make sure they're being loaned out. Sometimes, your auto-renew rate may be set too high for current conditions and it may have never triggered. This checking and manual setting of rates is why I consider this as semi-passive as opposed to passive income.

For myself, my BTC offered loan interest rates ranged from 0.089% to 0.2451 per day, with an average of about 0.15 - 0.20% per day over these 5 weeks. Assuming no gaps in lending: A BTC lender could potentially double their loaned BTC in 500 days at 0.20% per day with minimal risks using Poloniex. Of course, in the real world, unless you were willing to always undercut the lowest lender, you're going to have gaps in lending and have to make adjustments to your loans on offer as the market rates shift up or down.

If BTC follows its historical trajectory and goes to $25K in the next few years, then that $189.33 on BTC loan earnings could grow to $1,893 from just 5 weeks of safely lending out BTC to margin traders.

Again, these would be gains made from coins I didn't have to get taxed on to purchase and move it. These savings and semi-passive gain doesn't even take into account gains made from lending out ETH, DASH, BTS, XMR, XRP, IOTA, and EOS. The author estimates the total loan earnings over 5 weeks to be in the $200-250 range earned from about 5 - 6 BTC worth of various loaned coins, with the bulk of that earned by BTC loan fees on 1.3 - 1.6 BTC.

------------------------------------- WARNINGS BELOW ---------------------------------------

There's one caveat to BTC lending in the near term: I recommend not loaning out BTC during Aug. 1 when there is a risk of a soft or hard fork(s) for Bitcoin ending up in two (or more) flavors of BTC. You'll want your BTC in a wallet or wallets where you control their private keys. You should move any loaned BTC to your private wallet(s) well before this date or risk seeing an exchange keep your forked BTC Classic or whatever it might be named.

*Note of Caution: Holding all of your coins on these two exchanges is not recommended. Only loan out coins that you're willing to face the potential of having your coins tied up for a while if a deposit or withdrawal goes awry. While I consider both exchanges to be safe, they're very, very busy and when things have gone wrong users have reported customer service issues such as long withdrawal or deposit times - weeks or months in some cases. However, I've yet to hear of a customer of either exchange who didn't get their coins eventually - even if they had to take to social media to be heard in some cases. A few weeks ago: two ETH withdrawals worth 2 ETH in total took about 5 days to resolve for this author, so be aware of this potential risk.

*Note of Caution 2: Also, be aware that both exchanges can be hacked as large targets and you could lose some or all of your deposited funds. However, in the past they ultimately reimbursed customers who lost funds from the hack at Poloniex and the hack at BitFinex. They also allegedly air gap the majority of their deposited funds for greater security.

-------------------------------------- END OF WARNINGS --------------------------------------

If any of these tips helped you please upvote this post and comment below. I'm especially interested in hearing your own personal crypto loan stories, both good and bad. Thanks & To Da Moon!

Good info..thanks @allyourcrypto!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the comment and the upvote!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @allyourcrypto! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well done and good info. Have an upboat. :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

BTW, what's to stop someone from say loaning out 10x what you loaned out?

13 to 16 BTC invested here would have earned almost $2K in loan interest in a little over a month? Not too bad at all!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nada actually.

As far as I can tell, the only impact should be that you might effect rates via supply and demand - more BTC available should drive the interest rate down a little but I have no idea how much. Of course, you'd also be risking that much BTC to a potential hack on one of these exchanges.

It's actually kinda neat to see how even someone with a small stack can influence local exchange interest rates due to the fact that we're still in the very early stages of this revolution.

Inning 2 of 9 is how I've often heard this how this phase of BTC societal acceptance has been described.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful information. Question: what is the min you can lend on these exchanges? For example, can you lend 1 ETH?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit