Is the bubble ready to burst?

"Double, triple, quadruple bubble ... see how the stock market is approaching a dangerous line ..." - Garth Neeks

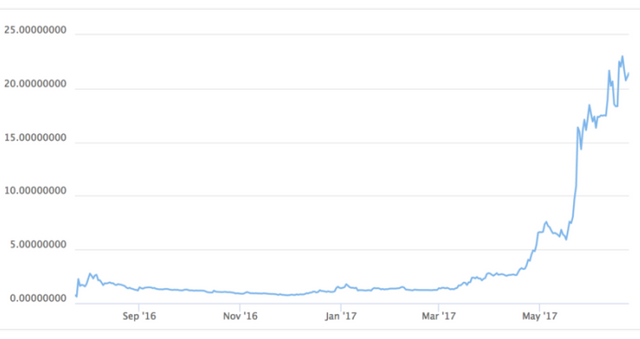

The popularity of trade in crypto-currencies, especially the Efirium, has spread like wildfire in recent months. Since January, the coins of the Etherium have grown by about 4000%, while many still want to invest in it, because of fear of losing growth in the "next Bitcoin." However, market prices and dynamics look more alarming for several reasons, beginning with the growth of the influx of naive investors and ending with the pressure from coins previously invested in various ICOs. So, now is the time to think about taking the profit off the table and wait for the correction before entering. Blockbuster technology and the Etherium have great long-term potential, but now they face short-term obstacles. Why wait and try to hold the position during significant kickbacks, when you can sell now and buy out on panic sales?

General pattern: Lake and Streams

For analogy, imagine the ecosystem of the Etherium (Ethereum plus all the alternative coins over it, such as Augur, Golem or Gnosis) in the form of a lake. Since January, a huge amount of money has flowed into this lake, which led to a sharp increase in the price of the Aether and the achievement of extremely high water marks in the lake. The reality was that there were simply not enough reliable places for water from this lake; People preferred to keep their capital on the air, because historically it grew faster than any other subsidiary of an altkan.

We bring to your attention ICO

These initial offers of coins (ICO) have provided many new investment opportunities to the broadcasters. Like the IPO in the days of the dotcom boom, the Efirium investors were eager to put their airs on the startups of companies based on the Etherium network. In exchange for their ether, they received tokens. Once the tokens were on the stock exchanges for public trading, early investors could take on speculative gains due to a sharp increase in frenzy or continue to believe in the future rise in the price of tokens as companies grow and develop.

These altcoyins are a kind of river that flow into the "lake", which absorb the capital in the air. Without a continuous flow of capital from the fi nished investors to the ecosystem of the Etherium, the "lake" will experience a shortage of "water", and the value of the ether coin will stand still or fall.

Meanwhile, investors who continue to hold the broadcast, "are eagerly waiting for the capitalization of the Etherium to overtake Bitcoin's capitalization, thereby toppling the latter with a dominant role. They do not realize that this has already happened: they should compare the market capitalization of Bitcoin with the capitalization of the entire ecosystem of the Etherium, which includes all its tokens. If you look at the top capitalization of crypto assets, you will see that 7 of the 10 largest of them are based on the Etherium. Those who expect another rapid price doubling, it is possible so and it will not wait, as the funds will spread on increasingly new tokens based on the Etherium.

Silly money follows smart money

The rise in prices for the air in the last few months has led to a huge interest on the part of the press, which began to actively discuss the future of technology. This attracted in the speculation quite poorly informed about the crypto-currency space of investors, fueled by fears not to miss the "next Bitcoin." This, in turn, led to a sharp increase in the price of the capital of psychologically unstable speculators, who are not particularly versed in technology.

"There are certain things that can not be adequately explained to a virgin by words or pictures. Also, no description I could offer here even comes close to what a person who has lost the real amount of money feels to him. " - Fred Schwed Jr. (author of "Where are the yacht clients?")

Any security dominated by retail investors will have high volatility, caused by excited sentiment. Even a veteran of the stock market is unlikely to have a strong enough stomach to consistently tolerate a 25% fluctuation in prices for the week. The only reason that most speculators in the crypto currency is able to cope with this volatility is a firm belief in future price pullbacks to the previous high levels. This means that if this confidence is destroyed and the market corrects, most likely, this correction will be very fast and strong.

The fact is aggravated by the fact that potential investors have no idea what the technology is. To prove this, it is enough to look at the growth of the Ethericum Classic Course $ 5.86 from April 30 to 21.53 dollars today. The Etherium Classic (ETC) is a product of a split in the Etherium community last year and is not interchangeable with the main chain of the Etherium. Commentators market predicted the imminent demise of ETC. Despite the fact that it has the same fundamental technology with the ETH network, ETC has essentially nothing to do with the mass adoption of the Etherium in recent projects (which also applies to the formation of Alliance Enterprise Ethereum). Despite the fact that the Ethericum Classic definitely has an investment potential, it seems to me very likely that it was the new investors that significantly increased its price, simply not understanding the difference between the two branches of the Etherium - just as adding ".com" to the name of the company in 1999 Year led to an increase in stock prices on average by 74%.

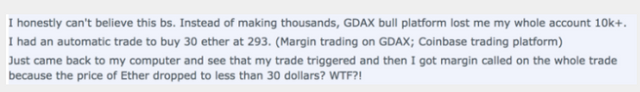

Even more exacerbating the problem is the inflow of retail investors with a limited understanding of how finance works. When the ETH exchange rate on Coinbase collapsed for a time to 10 cents (from the current range of about $ 300) as a result of a large sell order, the margin positions of hundreds of traders were liquidated.

While Coinbase formally requires traders to confirm that they are accredited investors with assets of at least $ 5 million, all that investors should have done to get a three-fold leverage on their capital is to click on the button, thus declaring their own Accreditation. There is no need to comply with the KYC legislation (know your customer). Needless to say, after this collapse and as a result of liquidation of positions, it became clear that many of these "accredited investors" were not such. Instead, they were speculators who took an undue risk in anticipation of high incomes.

- Disappointed lamentations of one of the affected marginal traders

Honestly, I can not believe this nonsense. Instead of earning me thousands of dollars, the GDAX platform lost all the contents of my account (more than $ 10,000). I had an automatic order to buy 30 air at $ 293. When I returned to the computer, I saw that my order worked, and then the system requested an additional margin on the account, as the price of the air dropped below $ 30. What the hell?!

The call to Coinbase to "cancel" the deal and the threat of litigation with the class of actions was initially not heard, but then Coinbase announced that the deal would not be canceled, and promised to compensate investors for losses. This further contributes to reckless investment. Today, the flagship exchange demonstrated that it will help traders who willingly took on unnecessary risks. Saving traders who play with the shoulder, Coinbase in fact encourages the reckless behavior of investors, creating a serious moral hazard. Naïve investors will continue to arrive, only worsening the situation.

- Volatility even for crypto-currency standards

Media Review will surprise you: Etherium buy everything in a row

A cursory review of the Internet shows that the public interest in the Etherium went far beyond its original niche. Mass introduction of technology is, of course, excellent, but it is the interest in being able to get rich quickly is the cause of the latest mania.

Father Vitalik Buterina, a 23-year-old creator of the Etherium, wrote on June 13, on Twitter, that he overheard as a manager in a cafe seduces a 71-year-old aunt of a friend with a "no-win" investment in the Etherium:

Wall Street Journal recently quoted the words of the owner of the cosmetics business, where he expressed his views on the prospects of the Etherium against Bitcoin:

A lot of my friends are selling their bitkoy and buying airwaves, "says Zachary Mallard, owner of the men's cosmetics business in New York. Mr. Mallard has in recent months acquired a bit of air, ignoring Bitcoin, because he believes that his potential fork limits the possible profits.

In all of New York, they could not find a person with financial or technical experience to quote it?

BroBible, a website dedicated to student fraternities, published an article entitled "What is Etherum and how will it make you fucking rich?" First, the editors of the site should have first learned how to correctly write "Ethereum" before recommending it as Investment product. Secondly, the editorial note "fucking" seems a bit questionable as a predictable level of assessment.

- Trading against people who take seriously investment advice from Brobible, perhaps now is the time to record profits

And these ridiculous bullish views on the market are now everywhere. Subredits oriented to the Etherium are full of memories about the purchase of Lamborghini and technical analysis, which tells how quickly the air will reach $ 1,000 per coin. A pool of investors, led only by instructions of technical analysis, could just as well rely on astrology. Beginners mourn for 'small' profits from their investments, which grew by only 90% + over the past month. The bullish mood is so great that when there is no news, this generates a tendency to lower prices ... meaning that as soon as hot air from optimistic press releases ceases to arrive, the course of the Etherium will be blown away. This is not the atmosphere that speaks about rational investment.

As Bernard Baruch wrote about the stock market boom of 1929:

"Taxi drivers told you what to buy. The shoe cleaner could briefly tell you the financial news of the day while he rubbed and polished your shoes. The old beggar, who regularly patrolled the street in front of my office, now gave me advice and, I believe, spent all the money that I and others donated to him for food. My chef had her own account with the broker and carefully followed the ticker. Her paper profits quickly evaporated in the storm of 1929. "

Last week, a Uber driver told me about his investments in crypto-currencies. History does not repeat, but it rhymes.

Institutional investors are happy to observe this

Will institutional traders support growth? Unfortunately for bulls, the entrance of large institutional players in the near future seems unlikely.

The latest publication from Goldman Sachs (written only after investors asked them to analyze Bitcoin) stated that the crypto-currencies are in a bubble. The boom ICO quite clearly confirms this hypothesis. As soon as government regulation is strengthened (which contradicts the decentralized anarchic nature of the technology), institutional interest will undoubtedly develop into actions, but at the moment, direct investment in investment banks by crypto currency is unlikely.

ICO = Idiots constantly overbought

Evaluation of the cost of many ICO is simply insane. The etherium for the most part became a "machine for the ICO." These companies receive funding for level C (late stages of financing, when the product is about to enter the market or has already been released) for still quite raw products - we are talking about tens of millions of dollars of capitalization collected at a stage when the team without experience has only technical documentation. Many of them will fail. Ephirium in the course of the crowdsdale collected only $ 18 million. Last year, a team of one startup immediately after the completion of the crowdsyle went on vacation in Spain. At that time, the SEC did not pay attention to such things. They could with the impunity of all in plain sight squander the means of investors. This is the Wild West of capitalism.

A good place for an office of a freshly baked company, is not it?

In order to better penetrate the current state of the market, let us recall two recent ICOs with more red flags than at the Beijing Olympics if they were evaluated by the professional venture capital community. Despite this, these ICOs collected astronomical amounts of funds.

Example one: Bancor - a start-up on the market, which could not properly make its own market

Bancor collected about 153 million dollars in about 3 hours. Even they did not expect this: the campaign to raise funds exceeded the original target threshold of 51 million dollars, and thereby causing an increase in the number of issued tokens by more than 50% from the originally intended. At the same time, such active participation in the ICO caused difficulties in the work of the mother network - the Etherium. This is rather ironic given that network congestion is the type of criticism that is most often expressed about Bitcoin.

Shortly after the ICO, a recent article entitled "Bancor is Flawed" (Bancor faultless) criticized the concept of the (not yet existent) Bancor system at many levels. While Bancor issued a long answer, a huge number of questions raised by criticism raises questions about whether investors really knew what they were investing into. My guess is that most investors do not know what Bancor really is.

An example of the second: Patientory - Startup facilitating the conduct of medical records, having no experience in this area

Patientory recently held an ICO, collecting $ 7.2 million. Less than a month later, he already had a market capitalization of about $ 20 million, having retreated from a maximum of $ 60 million (now capitalization is already $ 9.5 million). The executive director of the company has less than four years of professional experience and no technical education (has a master's degree in business management and is a bachelor of applied sciences in African studies and Spanish). Here such person heads the company, whose market capitalization has grown in the moment from 7,2 to 60 million US dollars. It should be noted that this happened despite the fact that the company does not have a ready product or a constant source of income, let alone profit. For those who wish to receive more detailed information, the criticism of the Patientory business plan is available here. The fact that patient data can be made available to the public through a public blockage and that they can stay there forever is just one problem among many.

Although I gave only a couple of examples, even they are quite representative for the market as a whole. While other companies have much more reliable plans (BAT and Mysterium - a couple of convincing, in my personal opinion), the market value of each such company is inextricably linked with the rest. Once a few large block-start-ups fail, investor confidence in the ecosystem will be destroyed. People will be in a hurry to sell their tokens before they become completely useless.

Efirom you will not be full

Even if we assume that failed startups will not cause a short-term correction, the ICO as a whole has led to the concentration of ETH in the hands of these overvalued start-ups. Their managers can not pay salaries and pay bills in ETH - they will need to convert ETH into fiat money. As soon as many start closing positions on the air, other companies will be just as stimulated to sell their stocks in order to get as much money as possible. While startups are interested to hold at the ETH in order to maintain a stable exchange rate in the air, they should be aware that a possible drop in prices would harm their reserves.

- I think it's a bubble. I do not know when and how much it will be adjusted. When everyone boasts about how easily they earn, this is clearly a bubble.

Let's sum up the results

I'm optimistic about the future of blocking technology and very bullish about Efirium. Nevertheless, I would not buy at this price taking into account the above context. If you bought significantly below the current price and continue to hold, excellent. But the growth potential compared with the risk when buying at the current price seems to me not good enough. Smart money entered much earlier (and, probably, soon can leave). If you first heard about the "Ethery" from The New York Times ... you do not belong to "smart money".

Perhaps I am completely wrong. Perhaps an endless influx of investors' dollars will hide the inevitable failure of most of these companies that raised funds for the ICO. Or, maybe you can better predict the time of the collapse. If this is so, what, act. But what if the fall occurs when you sleep? Do not forget, these markets work 24/7. And what if the collapse is so fast that your stop loss will be executed at a much worse price than you expect? The recent case on the GDAX confirms this. If you want to get some extra profit, you will have to take these risks.

Briefly about the main thing:

1. Over the past few months, the price of the Ethereum has soared, which indicates the potential of the blockbuster

2. Stupid money followed clever money

3. The cost of broadcasting can be adjusted due to the growing outflow of capital from companies that previously conducted ICO

4. Many of these ICOs will fail, punishing stupid money and fueling a correction

The key conclusion

In the next six months, the Etherium will take a serious blow. Take profits and wait for correction.

Good Post keep it up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree cryptos have seen an incredible rally as of late, however, if you look at the big picture, the biggest bubble in history is fiat and fiat denominated paper (worthless/ponzi) assets. Stocks, bonds, paper money supply add up to what number?? $1 quadrillion++ So it is just impossible for $95billion in total cryptos to be over valued in comparison. This market will have to move up a minimum of 10x within the next 6-12 months.

Here are my Top 10:

https://steemit.com/cryptocurrency/@cryptosphere/top-10-cryptos-of-the-future-july-22-2017-a-weekly-ranking-of-the-best-place-to-put-your-money-in-the-cryptosphere

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good points in this blog. I was about to start a similair discussion. The price of a coin should depend on the quality of the product, the team behind it, if proffesional investors believe in it, and a lot more facets. An interesting website I found: https://www.coincheckup.com The site is my go to place for crypto investment analaysis and indepth coin research.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit