1- Capital controls on citizens around the world.

We see some examples in china where people want to move their money out of the country but are limited. There are other controls in Europe where people are limited on the amount of money they can withdraw from their banks. And banks are also charging interest on depositor’s money. I believe this trend will continue and will come to the U.S. soon.

Bitcoin and altcoins allow people to put their money into a crypto wallet/hardware device and move money out of countries undetectable without pulling physical cash out of the bank banking system. Bitcoin is the easiest way for people to access a cryto currency wallet. So I believe this will make bitcoin a major beneficiary to govt capital controls. There will be a lot of money moving into this small market and will push prices unbelievably higher.

2- The coming banking crisis.

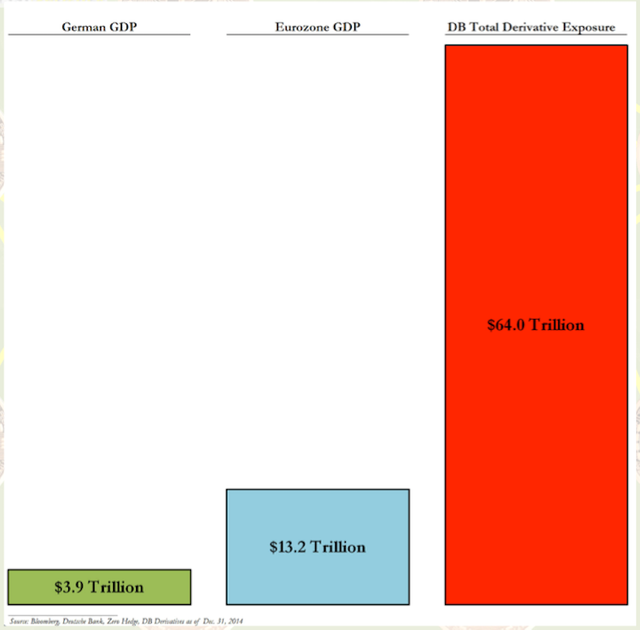

Too big to fail banks with large derivative exposures will threaten to collapse the system. At its peak Deutsche bank had over $75 trillion in derivatives. The overall estimated derivative held my banks are $1.5-2 quadrillion. So this next crisis we will see banks collapse and bring down economies and counties worldwide. There will a be a shake in confidence in the global financial system that will make people withdraw their money out of the banks unless a law prevents or limits the amount of money people can withdraw out of the system. Again this limit on cash withdrawals has already been happening in Europe. Transfers of wealth will be made in hard assets and crypto currencies. Investor will be looking to park their wealth in physical gold, silver…. And yes also bitcoin. This trend has already begun!

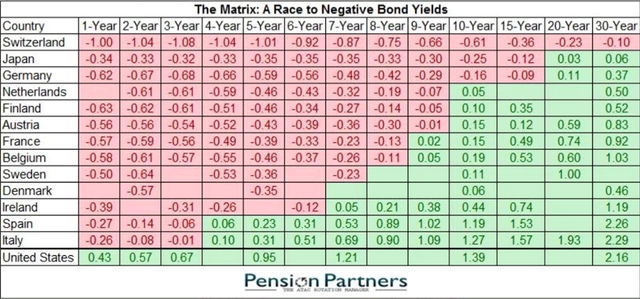

3- Negative interest rates

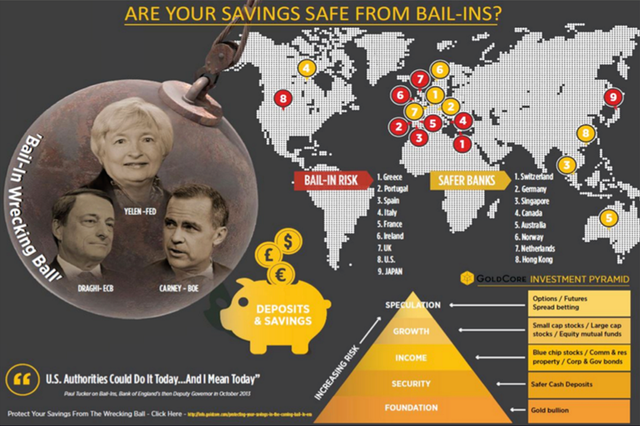

The only way to save the banking system or to keep these zombie banks solvent a little longer would be to implement what we are seeing in European Countries and Japan, Negative interest rates. Negative interest rates have never been applied before in monetary history. This is an experiment going on right now that is actually steal money from depositors. Negative interest rates also goes hand in hand with limiting deposit withdrawals and an outright cashless society. This is one of the major reason why there has been heavy investments into the gold market this year. In an event of another banking crisis there will be bail-ins where depositors are considered creditors and their money will be used to bail the bank out. So in short, everyone with money in a bank will lose a portion of their deposits. Same pattern from the crisis where big bank losses are socialized making the inequality gap even wider. This knowledge is not know to the public at large because the mainstream media is not reporting about this huge potential danger. When this event does comes to the U.S., we will see a large move of wealth go into safe haven assets like precious metals. Some of that flight to safety money will find its way into a new market, which is already being seen as an alternative to traditional banking…. Bitcoin.

4- Bitcoin is competing with the largest market cap financial instruments (Major Market Currencies)

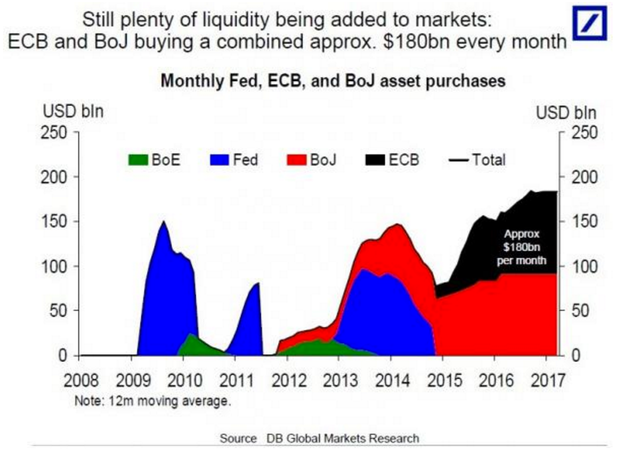

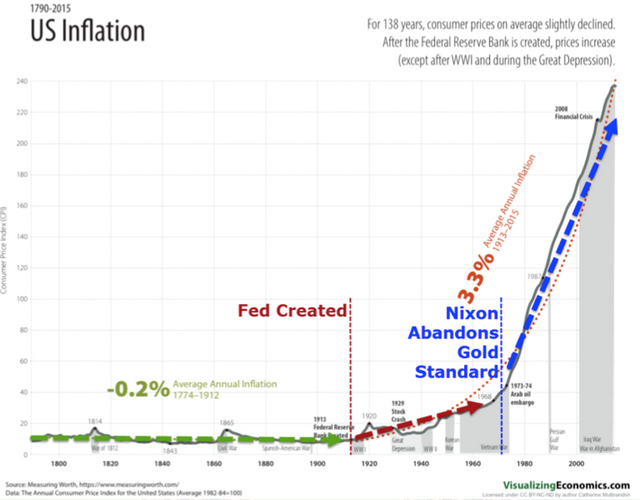

Bitcoin is only valued at $9 billion at this moment of me explaining this and this is very small compared to how much money central banks have printing since the last financial crisis. Central bank around the world will continue to inflate the money supply because that’s how their business model is structured. If the money supply contracts then the whole central banking scheme is at risk of failure. In the awake of the 2008 financial crisis, the federal reserve bailed out the banks by printing up trillion of dollars to prevent a total collapse in the system. Central banks are still printing up money and buying asset to prop markets up. This manipulation in asset prices wont end well. The next round of money printing and capital controls will be one for researchers to study for the next several centuries.

So going back to bitcoin, When the block chain technology is adopted into mainstream society, this will no longer be a great investment idea because bitcoin/crypto-currencies will be accepted as money and the prices of these crypto-currencies will adjust to larger market capitalizations (the rush of money from financial markets to bitcoin) and this is where a transfer of wealth will be made for those getting in early.

5- Bitcoin is Starting to be seen as an alternative store of value which brings about more competition to provide better wallet security, Hardware devices, and other products and services linked to storing or securing bitcoin.

There are more exchanges, wallet sites and hardware devices that allow you to hold your bitcoins now more then anytime in recent history and this trend is only going to accelerate. I believe this ease of access to a bitcoin wallets and the ease of buying bitcoins will benefit bitcoin first. But then I believe there will be the mass discovery of the altcoins (bitcoin 2.0 projects) that provide similar benefits but other uses of the blockchain technology that will help solve major problems in the market. I think once this discovery happens there will be a mania in the crypto currency world. Bitcoin and other altcoins will be ready to enter a bubble phase and this is where a new set of millionaire and billionaire will be created. I cant put a time on it because it all depends on when these events unfold in front of us.

6- It is still relatively early to get in because most people don’t have a clue what bitcoin is.

If you don’t believe me then go and ask your neighbor this, “Do you know what bitcoin is?” or “have you ever heard of bitcoin?” or “what is the price of bitcoin?” Some may have heard of bitcoin but won’t know the price or the value that bitcoin’s block chain technology brings to the table. I asked this question to professionals working in the corporate world and some are even IT guys that haven’t even heard of bitcoin. The people that have heard of bitcoin think that bitcoin is only associated with illegal activity. This is false. Bitcoin is used as an online money to purchase things of perceived value. Sometimes those things of perceived value are illegal purchased by individuals. But what medium of exchange isn’t used for illegal activity. Exactly, illegal purchase will always happen with any form of money that exist as long as there is a market that accepts that form of money. Bitcoin is online money that is limited in supply and accepted worldwide. Don’t be the last person in your community to accept bitcoin because by then the price and perceived value may be a lot higher.

As a matter of fact, the price of bitcoin in 2010 went from under .10 cent to now $590 in 6 years. And people are still clueless of what bitcoin is and how value is created from the block chain. Its only going to keep getting more interesting as this global financial crisis starts to unravel. And this is a great speculation with the highest potential return of any investment class simply because it is competing with money. And when the mass adopted happens I think the price will be unbelievably higher. And people holding bitcoin now will be wealthier.

7- It’s also in my believe that there is going to be a point in the near future where central banks are going to start printing money to buy crypto currencies. I am speculating here but when confidence is lost in central banking, govt and central banks will do anything to try and regain confidence but also capitalize on a huge momentum opportunity. But I think this next global financial crisis will be an opportunity for crypto currencies and will open the door for bitcoin and further on to other crypto currencies.

Alternative Financial Network-It's our goal to educate main street with real financial news, trends, and potential profiting investments.

Follow us on YouTube:

http://www.youtube.com/c/AlternativeFinancialNetworkTV

Follow us on twitter:

https://twitter.com/AlternativeFN

Follow me on twitter:

https://twitter.com/RoHerreraSegura

Well said, I'm pretty sure your a Dollar Vigilante subscriber. I also believe that the early Bitcoin adapters will be benefiting from the near US economy collapse.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit