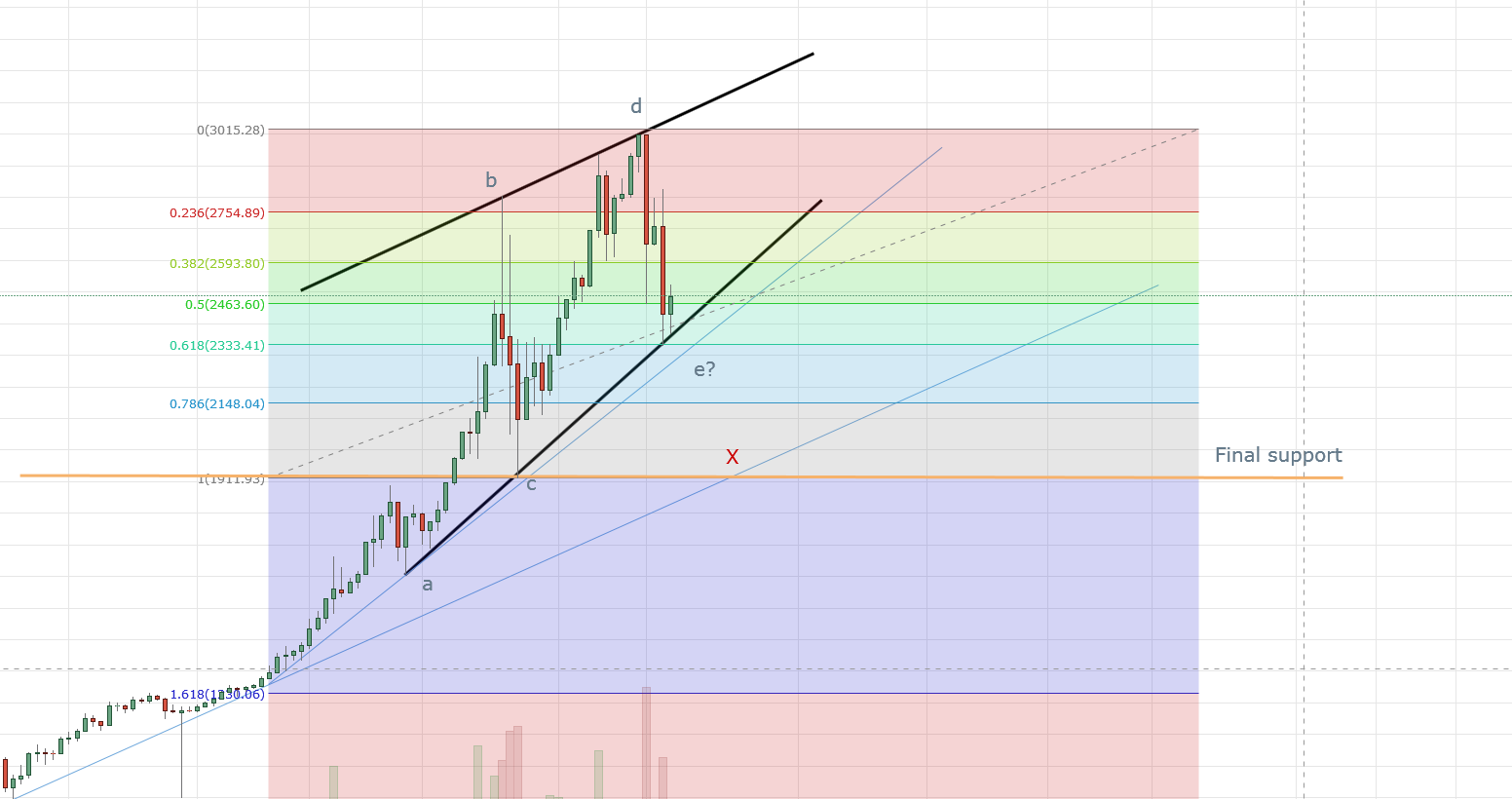

This could possibly be the final pull back before breaking above 3k again.

For those of us that have value bought in around the pullback it can be good news for us.

But let me share another possible scenario, where that is not 'e' wave of elliot wave theory. We could be heading towards the red X, which will mark another buying oppotunity. It will coincide with the main trendline of the bull run, creating a strong support that will be tested.

If the final support breaks, which will form a lower low, there bear trend will be confirmed. At that point of time, for those of us believing in crypto's can start accumulating.

In summary, we still want to remain bullish till the final support has been broken. We will evaluate the charts again when that happens. The pull backs now are good oppotunity to increase your position to enjoy a short term profit.

For those Fibo chartist, good for you if you gotten in at 61.8% region, perfect value buy.

Now we wait and see the bull strength, if it comes down to the 2330 region again, we might want to close it out for a breakeven while waiting for a re-entry(:

To avoid confusion, this could be the final impulse(trending) wave in elliots theory, no one can ever spot the end of the wave perfectly, have in mind a big bear might be near if 3k breaks out.

Checkout yesterday's chart on BTC, we were expecting a take profit region of 2850-2900, not too far from where it landed.

It landed on our standalone resistance at 127.4-132.8% @ 2820, we expected a pullback before a higher high. But the dip happened a little too early, as we expected stronger resistance at a higher high. But no worries, still in the green, there is no perfect charting. We can just keep updating our chart to cater to new possible scenarios.

Every factor counts,

entry, position management(trailing your stops), take profit

Disclaimer

*I am not a guru...

*These chart and infomations provided are my personal view and ideas on the market, use it at your own risk.

*Trading is risky business. You and only you are responsible for your trades. Do trade with caution.

*Trade with money you can afford to lose, not the money you and your family needs to survive on.

*Trading is all about consistancy, there is no holy grail that takes you straight to heaven.(let me know if you have found one)

PS:

Follow me if you like my analysis.

Comment to discuss or what pairs you will like me to chart

Resteem if you would like to help me gain followers

Upvote? If you want to toss me a penny

The more people we have following my post, the more detailed my analysis will get and more discussions can be formed.

Thanks for the tips :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem! As long as it is useful!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Another great analysis! (One that I happen to agree with, too, so I may be a bit biased. :) Your charts and analysis are super-helpful - thank you for sharing them with us all and giving us each the opportunity to evaluate another, knowledgeable perspective.

What charting package are you using? It looks like you're doing daily bar analyses, do you look at shorter period ones as well? I'm just using gdax and there are only basic indicators with very little customization available. I have Poloniex and Gemini accounts, but since I'm not trading on them and pricing is different than what I can do with gdax, I haven't been using them. I'd love to get my hands on a package that let's me do custom period EMAs at least, preferably with Bollinger Bands and a few others in there too.

I'm thinking I've been too focused on intraday moves, trying to capture daily bottoms, while not paying enough attention to the macro picture. Even though I toggle charting periods several times per day for reference, I am not actively charting anything, rather just eyeballing common patterns.

Thanks again for the post - let's continue the conversation!

Best,

Bob

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just hope more people can join in the discussion! As our 1 person's view might be too boxed in at times! I am using just a basic package at tradingview, they offer quite a lot of charts from different exchanges. For crypto, my usual software(with my full system) doesn't offer me charts. Therefore, I have to resort to using an alternative. I use EMA(50/200) normally too, to get a feel of the overall direction.

As for lower timeframes, I normally will only go till H1 which I was charting for a quick long take-profit yesterday! Just to share, I normally chart Daily/H4 and make an entry on H4/H1 respectively! And I prefer H4 entry(less mental stress).

Thanks for the resteem again buddy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It'd be great to get more people involved. More people = more data! That's part of why I'm resteeming - to widen the circle :) Perhaps we could start a trader chat channel? Who else do you read/follow for crypto insights?

OMG - TYTYTY for telling me about tradingview, I just finished playing around with it for a few minutes and it looks to be exactly what I've been looking for. I've been focused on the EMA(5/13), which seems pretty spot-on for intraday moves.

I don't know what the H1/H4 indicators are, are those from elliot waves?

As much as I would like to play with tradingview more, after staying up too late on here last night, I vowed I would go to bed early and catch up on my reading of Security Analysis. :D

Have a great night, and happy trading!

Best,

Bob

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey buddy, I was running through my replies and I realized i forgotten to reply to you on this.

Regarding the chat, hopefully we can create one, but at the moment I want to gain more traction on the post first!

If you are referring to the waves inside the triangle, yes thoses are elliot waves!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Catching up on replies myself. Let's talk about doing a traderchat series of posts or something collaborative. We could become the CNBC of Steemit! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

scary to me bro.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is always scary when there is so much uncertainty everywhere, have a plan always and you'll be fine. Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i'll be holding until 2020.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sounds about right 2 me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Either way, bull(take profit) or bear(accumulate) have a plan(:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you have good posts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit