Winklevoss Twins' Bitcoin ETFs petition was denied once again by the SEC

CoinGape.com

First and foremost, what is the big deal about Bitcoin ETFs and why is everybody fussin' over it?

A bitcoin ETF is basically a way to indirectly invest in bitcoin where the investors owns aproximately the same value as if holding bitcoins, but without actually holding bitcoins. This is huge, and especially for institutional investors. How so? Well for a Bitcoin ETF to be listed on any broker, it would have to be regulated and there would have to be significantly protective policies that keep investors funds safe. This basically means that a bitcoin ETF would provide large investors with the safety and regulations that are currently still absent in the cryptocurrency market. This would make room for massive adoption, and mos importantly it would increase recognition of Bitcoin amongsts the wolves over in Wall Street.

The petition

In 2013 the Winklevoss twins tried to register the BTC ETF. This petition was denied 4 years later in march of 2017. At that point the SEC pointed out that it was not approved due to the lack of bitcin market regulation. Later on, the twins submitted a review petition regarding the rejection on the Bitcoin ETFs petition. This last one is the one that was rejected a few days ago. Something that should catch our eyes as critical investors is that the vote this time around was not unanimous. The final vote was 3 to 1.

Impact on Bitcoin market cap and price

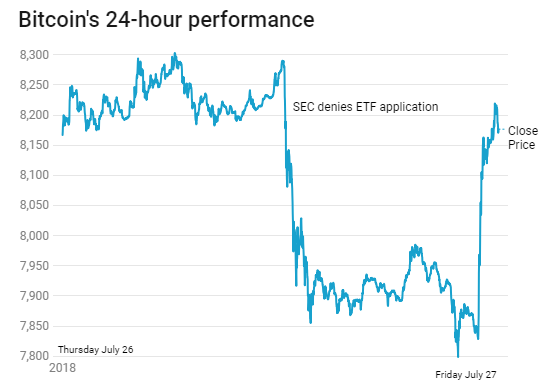

After the publication of the SEC's decision, bitcoin fell by about 3.6%.

This isn't exactly the end for Bitcoin ETFs proposals

This party is just getting started*

According to an article by Reuters which was published in January of 2018, there were about 14 different bitcoin ETFs or related products with pending applications. These were later withdrawn as the SEC asked.

There is another bitcoin ETF application that is filed and pending. This is the VaEck SolidX Bitcoin Trust. The SEC hasn't commented according to an article by CNBC which also states that VanEck and SolidX filed a joint application for a bitcoin ETF, and the agency needs to take action within 45 days which sets the date for August 16th.

Another important piece of important information in the article by CNBC is that the SEC delayed deliberations on five other bitcoin ETFs filed by NYSE Arca, Inc., and Asset manager Bitwise has recently filed for an ETF that would track a basket of cryptocurrencies.

##Bitcoin survives the news

Taken from CNCBC

The news did take a toll on bitcoin price, especially since part of its most recent rally last was partly due to rumors of possible approval of bitcoin ETFs by the SEC. However, it recovered quickly and manage to close around the value of $8,200.00

CBOE bitcoin ETFs petition: A whole new world

This petition has not been approved nor denied. This petition differs significantly from the recently rejected Winklevoss' proposals.

Some of the highlights about this petition:

- Insurance policy of $125M on the fund

- Target of high net worth individuals (Wall Street) cough cough, with individual shares of the fund representing 25 BTC a piece

Read more about CBOE bitcoin ETFs petition.

Remember to do your own research, and analysis! Do not simply believe what everyone is saying out there. Some "experts" have been claiming that bitcoin ETFs petition are a done deal and that it will be approved this 2018. I beg to differ.

What do you think? Do you think bitcoin ETFs will be approved this year? What kind of impact will another rejection or a sudden approval have on the cryptocurrency market?

Let me know in the comments below.

'Til next time,

-Ana.