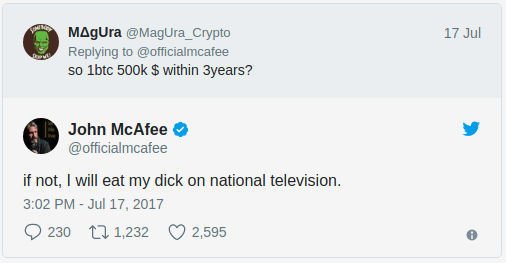

On July 2017 John Mcafee placed a bet on twitter saying that bitcoin will be worth $500k within 3 years (by 2020):

4 months later he doubled that bet saying that the model he used to predict that price also predicted 1btc to be worth $5k by the end of 2017 so adjusting that model, he now sees 1btc to be worth $1M by 2020.

By the date of that tweet Bitcoin closed on $10,058.80 and on Dec 31 it closed on $14,156.40 almost tripling his previous prediction.

Mcafee is not the only bullish out there on Bitcoin price, Mark Yusko founder and CEO of Morgan Creek Capital Management predict 1btc will eventually be worth $400k. James Altucher also said on a CNBC interview that 1btc can easily get to 1M by 2020:

On the other hand, there are also a lot of bearish personalities out there saying bitcoin is a bubble and it will be catastrophic when it pops. One of them is Peter Schiff, CEO of Euro Pacific Capital Inc, who says that "Bitcoin has no value and that it can't be used as money, it's a speculative digital asset and it will implode the moment there’s a sign of minimal trouble, and when that moment comes Bitcoin and all other cryptocurrencies are going to trade to zero or pretty close to it and people buying it at current prices will lose practically everything".

Those are pretty strong words that may make one's hair stand on end, I'm very new to the world of cryptocurrencies and for the last couples of weeks I've been reading a lot and learning about all this cryptocurrency thing and I personally think both positions are a little biased, I mean I do wish Mcafee is right, even more I hope his prediction falls short again an that 1btc would be worth $2M by 2020, but being honest with my self I don't think neither positions are 100% accurate and I explain why:

I've found a couple of posts on steemit explaining what gives a cryptocurrency value which, if you are a newbie like me, I recommend you to read:

https://steemit.com/cryptocurrency/@aggroed/what-gives-crypto-value-a-letter-to-potential-investorshttps://steemit.com/community-tokens/@dan-atstarlite/what-gives-a-cryptocurrency-value

Personally, I think Bitcoin right now is overvalued, we all have seen the bullish run it took in 2017 making us excited to see such a big return in our investments and at the same time making a lot of us cry regretting not have taken the wave earlier on. Look I first heard about bitcoin I think around 2009 when it was worth practically nothing and in my infinite ignorance I thought it was useless, I mean I thought "why would I spent time configuring my computer and let it on working to produce something which besides to be whortles I couldn't spend anywhere because come on who would accept it as a mean of payment?". Man, I really wanna smack my head against the keyboard right now...

So why do I say it's overvalued you may ask, let's see, the following is an extract from the Bitcoin whitepaper:

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for nonreversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

They were addressing two main problems:

- Increased transaction costs cutting off the possibility for small casual transactions.

- The need of a trusted third party to take part in the transactions.

The project succeeded attacking the trust problem and preventing double-spending but a bottleneck was reached with the transaction costs, right now there is no possibility for small casual transactions.

Right now Bitcoin is acting more like a stock than like money which is what it was intended for. Bitcoin is still in its infancy and there is still plenty room to grow, being the original cryptocurrency and being backed by a vast community and developers, but I think all the recent hype and price surge is due to the media exhibition which has attracted a lot of people whit little to none knowledge of the backgrounds and possible implementations of the technology but whiling to invest in it only looking for quick gains, so much so that Coinbase, the largest exchange for bitcoin, is adding 100,000 new customers a day, and recently most exchanges have closed new registrations simply because they can't handle the volume of people.

Note: If you're looking to invest in Bitcoin for the first time you can get a $10 bonus when purchasing $100 worth of Bitcoin joining Coinbase through this link

So I think Bitcoin itself may increase a lot more in value over the following months and years, with so many people entering the market right now the Bitcoin value can only go higher and higher. Spencer Bogart, Blockchain Capital Managing Director, pointed 3 important points in a CNBC interview that support this bull trend:

- Less than 2% of the people own any bitcoin and yet 14% says they prefer bitcoin to stocks, that will be a 10x increase in adoption if these people actually go and put some money in bitcoin.

- 32% of young people say they prefer Bitcoin to Stocks

- 42% of Millennial males say they plan to buy Bitcoin in the next five years

You can see the interview in the video placed at the beginning of this post, if you haven't you should definitely see it.

The downside I can spot to Bitcoin is that with more and more altcoins being released every day and some of them offering better solutions to privacy, small and real-time transactions, and basically real-world usage it's just a matter of time for Bitcoin to be displaced by one or more of these Altcoins and to be seen in the future as the prehistoric ancestor of the new worldwide currency.

So basically these are the main features I think the next biggest "rule them all" crypto need and will have:

- Low to no fees, allowing microtransactions, this is essential for massive adoption, although right now Bitcoin may handle the vast majority of volume in transactions, those small or microtransactions are the ones which will drive the majority of volume in the future.

- Real-time transactions, for me this is the second most important feature for massive adoption, you won't go to Starbucks and pay for a coffee with Bitcoin just to wait hours for the transaction to be approved so you can drink your latte.

- Privacy, it's not only for hackers or black market transactions, people want privacy.

- Security, not necessary to go to deep on this, your hard earned money needs to be secured.

- Variety of uses, this would be an addon which will depend on people adoption, it will simplify life if there is a one-for-all coin but in the end, this could be solved with real-time conversion services.

Expanding the "variety of uses" point, a lot of tokens are being released to be used as means of payments inside certain platforms for goods and services, some of them are rising high in value, personally, I think those are serving more as a mean of raising capital for the development of such platforms but eventually will be dropped and replaced by a one-for-all coin which in the end handles more liquidity, if you think about it, you have to buy a coin, usually ether only to exchange it for a token to use on certain platform, as I said before this could be solved by a real-time conversion service but this takes us back to the first point of this list: Low to no fees.

In the end, only time will tell what will happen to Bitcoin, if it overcomes the problems of high fees and transaction times it might keep being the king of cryptos but as time goes by and new and promising projects are being developed I'm inclined to think that it will be dethroned by one of its younger competitors. So do your homework and research other projects and coins, several of them have already surpassed Bitcoin in percentual growth, see Verge and Ripple for example, I think this might be the second and last opportunity to ride the cryptocurrency wave early on and probably become millionaires in a matter of months.

I'll be, in the following days and weeks, researching these potential coins and publishing about them.

So what do you think will the future of Bitcoin be? Will it overcome its current bottleneck or will it be dethroned by one of its children?

Thanks for reading

Leave your comments bellow

ar2ro!! Thank you, your Post. i upvoted.^^

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit