Since I made the switch from FOREX to cryptocurrency in July 2017, the market has seen more action than a lifetime of FOREX trading and, as a result, various standard analytical tools are (and I quote dodgeball) "as useful as a cock flavoured lollipop". However, one that I still stand by is the use of bollinger bands.

Although at heart only a moving average with 2 standard deviations surrounding it, it does give good indications of market price action.

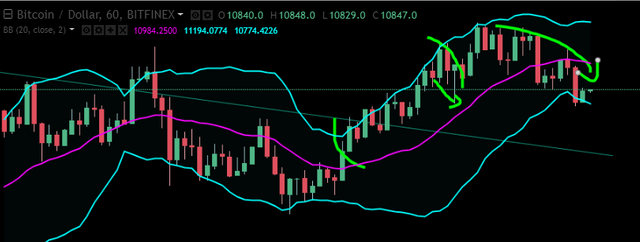

For example, in this figure when the price hits the top band it immediately falls and when the price hits the lower band, it rises. This is a general rule.

Furthermore, the length of an increase can be used when Bollinger Bands and RSI (relative strength index) are used together. For example, see below:

As seen in the bracketed area, despite hitting the upper bollinger band, the price continues to rise, this is due to large price forces (in this case large buying forces). At first it may seem as if the Bollinger Band analysis has failed, this is where the RSI comes in. Without going into extreme detail of RSI (something I may do in a later blog post), if it hits 20 you generally buy and if it hits 80 you generally sell (it's much more complex in reality though). As shown below, the price rise traces the bollinger band until the RSI hits, or almost hits, 80 (dotted line) and whilst this breakaway is temporary, a second hit of RSI 80 leads to the permanent breakaway from the bollinger band, this "double-dip" of hitting an RSI limit is very common and is something that I will discuss in later blog posts.

On final thing about the bollinger bands to take into account is a squeeze in the bands. This is really simple:

As shown above a squeeze in the bollinger bands is synonymous with periods of low volatility (sable prices) where as expanding/wide bollinger bands are linked with periods of price change.

And that is how I use bollinger bands. There are many other applications of this tool and can be combined with other indicators, such as the MACD, to generate predictions, however these are the ways I have found most useful and the techniques I have found that generate the largest gians.