During the second half of 2017, the media hype about the crypto industry bloated the crypto market cap to almost 840 billion USD. Multiple ICOs were launched in order to capitalize on the newly minted technology called blockchain. International tech companies started developing blockchain technology solutions. Platforms such as Ethereum displayed real world potential to disrupt the fundraising sector.

With so much information and especially disinformation about crypto, it is difficult to grasp the fundamental nature and value of different cryptoassets. User interface to utilize ICO tokens is currently non-existent. So how can anyone objectively judge the current need of a token? There are more than 10 platforms similar to Ethereum. So how do they differ form each other and why Ethereum is by far the most successful one? Only a small number of cryptocurrencies can be intrinsically public, open source and decentralized. So why do private cryptocurrencies still exist? Fortunately, a framework for understanding cryptoassets was developed (Cryptoassets by C. Burniske and J. Tatar).

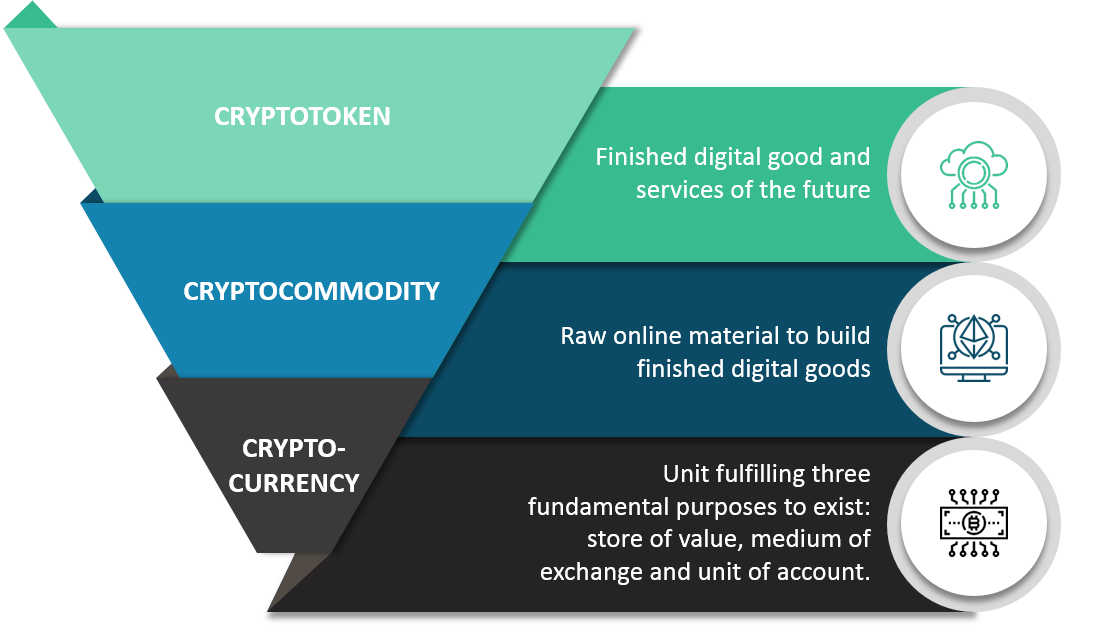

Cryptoassets can be split into three asset classes. Each of them have unique features. Cryptocurrencies were the first successful attempt to digitalize money. Cryptocommodities (or cryptoplatforms) can provide raw digital resources. Cryptotokens represent customer-facing digital goods and services.

Created by the author (icons by Eucalyp)

Let‘s look over each of them in more detail

Cryptocurrencies should fulfill three fundamental purposes to exist. Firstly, a cryptocurrency has to be perceived as a store of value. Similar to what gold commodity ultimately achieved in 1821 and later lost to US dollar in 1944. Secondly, it has to serve as a medium of exchange. Like any other fiat currency it has to be something that many holders would be able to exchange with a vendor for goods and services. Thirdly, a currency has to be a unit of account. A nominal monetary unit used to represent the real value (or cost) of any economic item, i.e. goods, services, assets, liabilities, income, expenses, etc. The question remains how fast can a trusted public cryptocurrency achieve all attributes of being a currency?

Cryptocommodities can be viewed as raw material building blocks. Similar to copper, oil, sugar, corn, etc. cryptocommodities serve as inputs to create finished digital goods. The business transition from offline to online is happening in every sector of the economy. In a similar fashion, the assumption that only offline commodities can exist ignores the fundamental shift online. The value in an online economy is created by digital commodities such as network bandwidth, storage capacity and computing power.

Cryptotokens are used to coordinate finished digital goods and services. Imagine an open economy fueled by a trusted public cryptocurrency. It has a platform built on top of for sharing storage capacity among members of the ecosystem. Then, a token could represent a right to use a service, e.g. extract data from a certain storage location. Tokens will be the goods and services of the future, when cryptocurrency and cryptocommodity infrastructure is ready to scale.

Digital assets are the foundation of tomorrow‘s world much like traditional assets have been for centuries. And this time it is up to passionate computer scientists and dedicated developers to achieve innovation. The future will be very crypto — see you there!

✅ @benasbiz, let me be the first to welcome you to Steemit! Congratulations on making your first post! I gave you a $.02 vote! Would you be so kind as to follow me back in return?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit