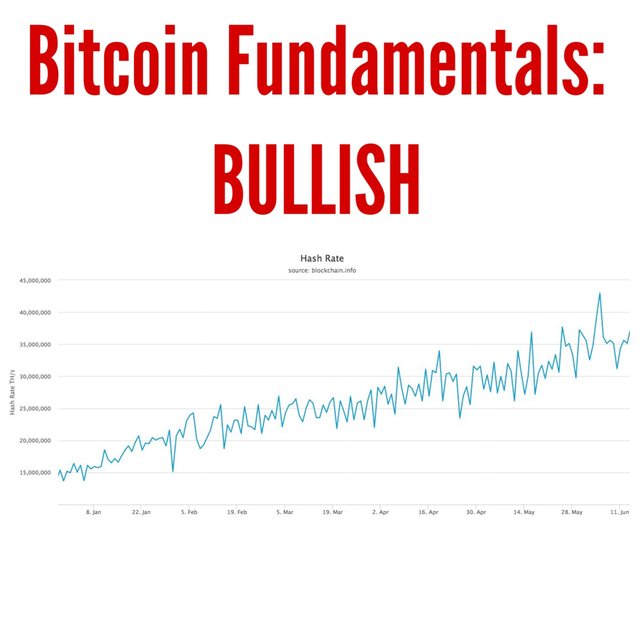

The bull case for Bitcoin from a fundamental standpoint:

Taking a look at the chart above, we see a very steady increase in hash rate even though bitcoin prices have been on the decline over the last few months. There is a clear divergence between the price of bitcoin and hash rate.

What can we infer from this data?

As more miners join the network, the network hash rate increases. This tells us that regardless of the fact that bitcoin prices have been falling, miners are very much interested in mining Bitcoin. So it seems that miners are taking a long term view, ignoring short-term downtrends in the market. If the hash rate were to be falling alongside bitcoin's price, then there would be cause for concern. That would tell us that miners are less interested in mining Bitcoin and could be turning their focus to mining other cryptocurrencies or not mining at all.

The upward trending hash rate suggests that network support is very strong and will probably continue to grow. Since miners are arguably the most important asset to the Bitcoin ecosystem, the chart suggests that Bitcoin has very strong fundamentals and will probably bounce back in the coming months!

What are your thoughts? Let me know in the comments section.

I hope you found this post informative!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.actionforex.com/contributors/fundamental-analysis/98414-bitcoin-hash-rate-telling-a-bullish-story/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit