After shutting down the country’s bitcoin exchanges, the Chinese government is monitoring the booming cryptocurrency over-the-counter (OTC) market. A recent government report shows that 680 million yuan, approximately $103 million, were traded in the last two weeks of October on the top three international OTC trading platforms.

Chinese Government’s Analysis of Bitcoin OTC Trading

Ever since the Chinese government demanded in September that bitcoin exchanges in the country shut down, China’s on-exchange bitcoin trading volume has all but disappeared. Concurrently, yuan trading volumes on OTC platforms have significantly increased.

The National Committee of Experts on Internet Financial Security Technology published a report last week on the status of the Chinese OTC bitcoin market. The committee was formally established in August of last year under the guidance of the Ministry of Industry and Information Technology. The committee “monitored recent bitcoin off-balance-sheet transactions through the National Internet Financial Risk Analysis Technology Platform” settled in CNY to produce the report.

There are two types of cryptocurrency trading – intraday and OTC, the report began. “OTC usually has no fixed place, prescribed membership, and strict rules and regulations; mainly the one-on-one transactions are conducted by the counterparties through private negotiations.”

In addition to P2P trading such as on Localbitcoins, Chinese citizens also conducted transactions in-person or using live chat tools such as QQ, Wechat, Telegram, and Slack. “A wide range of payment methods, including bank transfer, cash remittance, third-party payment, [and] gift cards” were used, the report stated, adding that:

Alipay, Wechat and bank transfer are the main payment methods for OTC BTC-CNY transactions.

Money Moves to OTC Platforms Overseas

China Monitors Booming OTC Bitcoin Market After Shutting Down ExchangesThe report explained that when the regulatory policies were introduced in September, domestic bitcoin OTC trading platforms gradually exited the market. Subsequently, trading volumes in CNY began to climb at international bitcoin OTC exchanges such as Localbitcoins, Paxful, Coincola and Bitcoinworld.

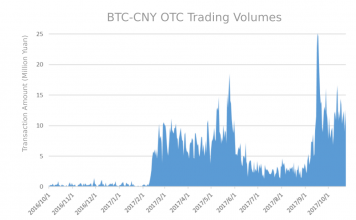

Based on the BTC-CNY OTC data from Localbitcoins and Paxful, “it can be seen that before February 2017, BTC-CNY turnover is relatively small. With the major domestic bitcoin trading platforms banning bitcoin in early February, the size of the transaction has exploded,” the report read. Furthermore, it pointed out that since June 2017, when the major domestic trading platforms had resumed their operations, “the transaction size has obviously decreased,” adding that:

With the liquidation of domestic ICO and Bitcoin transactions in early September, over-the-counter trading has boomed again.

The same data shows that the BTC-CNY share of over-the-counter trading rose from about 5% to about 20% on those platforms, the report revealed. By contrast, the BTC-CNY intraday trading shows the opposite trend, specifically “the trading volume in the intraday market increased significantly in June-August and continued to decline since September.”

680 Million Yuan Traded OTC in 2 Weeks

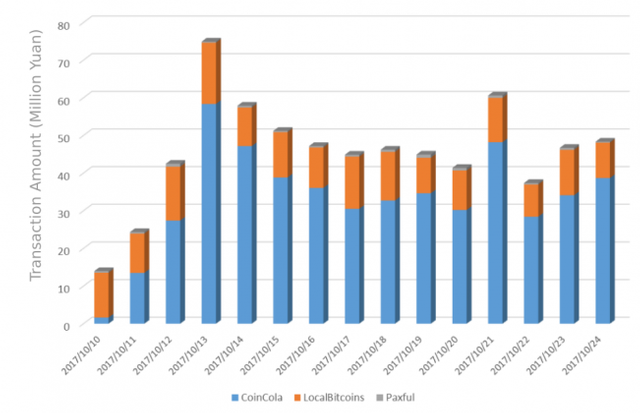

China Monitors Booming OTC Bitcoin Market After Shutting Down ExchangesThe report also analyzed data from three leading OTC platforms over the two weeks period in the second half of October.

Trading volumes on Localbitcoins, Paxful and Coincola account for up to 70% of all OTC trading volumes settled in CNY, the report revealed. “Through the analysis of the BTC-CNY transaction data of the three platforms of Localbitcoins, Paxful and Coincola in the past two weeks,” the report found that:

The transaction volume of the three platforms totaled 680 million yuan, of which the transaction volume of the Coincola platform in Hong Kong increased significantly.

“With the deepening development of bitcoin, OTC trading has been increasingly active. OTC opponents use both anonymity and transaction payment channels, and there may be fraud trading risks,” the committee concluded its report, adding that “The National Internet Financial Risk Analysis Technology Platform will continue to monitor.”

What do you think of the Chinese government monitoring the OTC bitcoin market? What do you think they will do about it? Let us know in the comments section below.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/china-monitors-booming-otc-bitcoin-market-shutting-exchanges/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit