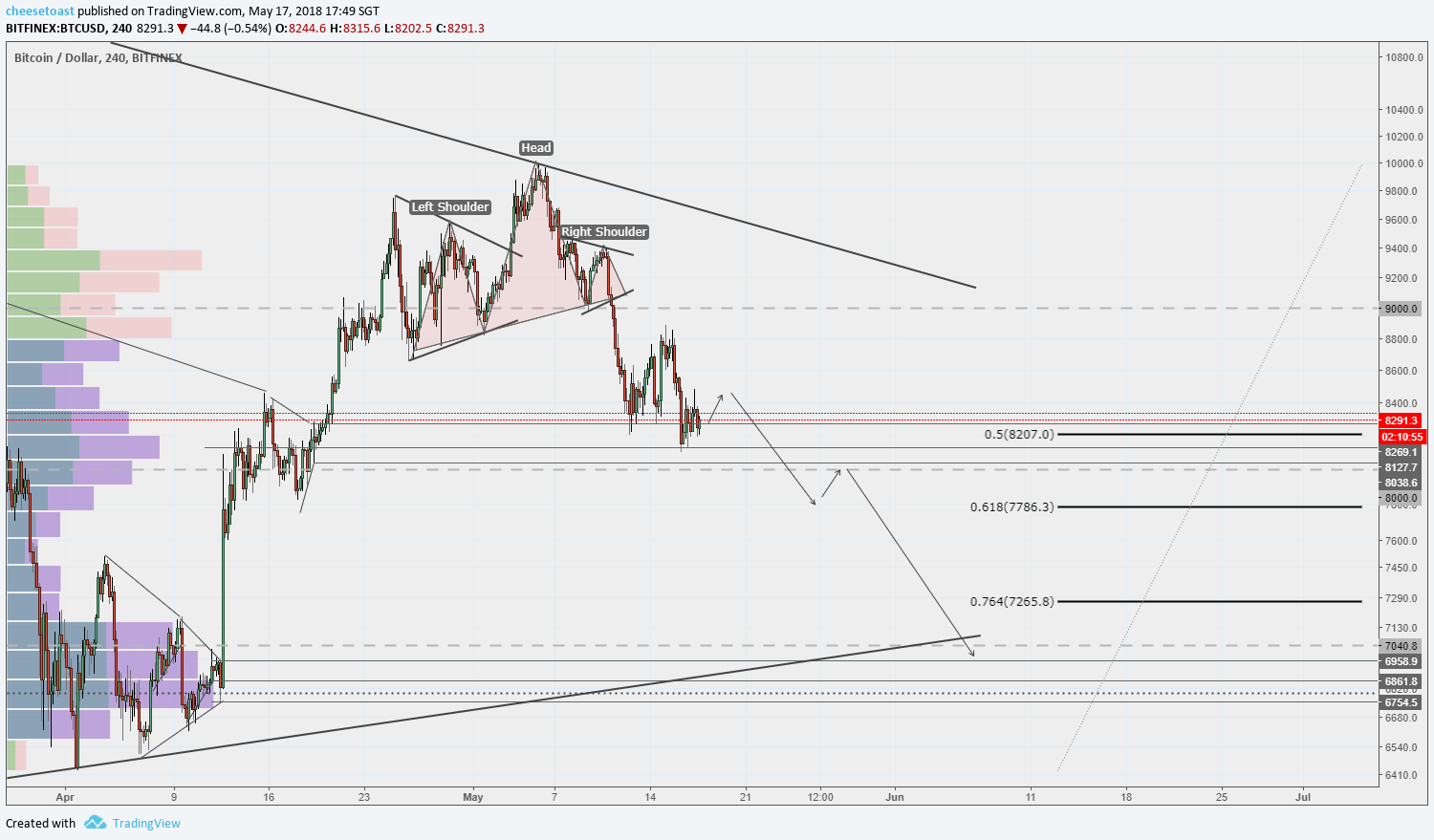

The Bitcoin chart is looking very fragile. There is no strong evidence of any buying interest to be bullish now. Short trades are the higher probability based on the technicals and favored to hedge your overall position and gain $USD.

(Right-click and open image in new tab for full-size)

Follow this analysis on TradingView: https://goo.gl/p5CmHE

Price is now hovering around the 50% Fibonacci Retracement level which coincides with a previous consolidation zone. A clear break of this consolidation would affirm the bearish scenario for Bitcoin.

It appears the recovery now is slowly grinding up and expect price to break this level through the 61% Fibonacci level and consolidation zone.

You will notice that the $8,200 level is becoming a key area of significance and would act as decent Supply zone should price fall away sharply to position limit orders for a short trade.

The next area of interest is between $6,800 and $7,200.

There is also a nice breakout pattern forming on the larger time-frame to keep an eye on as prices bounces between the two trend lines.

Disclaimer: This is only my opinion, make of it what you wish. It is not financial advice.

This is relevant and great piece of information regarding Bitcoin prices an upcoming happenings.

Thanks for sharing keep share knowledgeable articles. Please keep sharing your good work.

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the comment, appreciate it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit