This article is published for the informational purpose by CryptocoinZone. CryptocoinZone publishes reviews about cryptocurrency exchanges, wallets, trading platforms, lending platforms, ICO, cloud mining and gambling.

In this quick guide, we investigate how can blockchain be used for insurance in terms of available platforms. These companies differ in terms of costs and approach to the crypto insurance. Still, they all have one thing in common – they use blockchain in insurance.

Stay put, as we go through most popular crypto insurance platforms, such as Teambrella, Dynamisapp, ChainThat, InsurETH, and LenderBot. As a conclusion, we provide an industry status analysis, in terms of how developed the blockchain instance market really is.

Blockchain in Insurance

The insurance industry was always known for trust issues between parties, specifically between insurance companies and customers. The distrust causes many deals to fall through while costs tend to rise over the years.

This is where blockchain might come in with its peer-to-peer solutions. Crypto world aims to become completely decentralized, providing participants of the market to hold their destiny in their own hands. Blockchain offers ledger records, providing information about the market trends transparently while cutting out the needless middleman in insurance.

Although the development of blockchain insurance is still in its beginning stages, there are several potential impacts that crypto blockchain can have on the insurance industry.

These are:

improved trust: with ledger records and smart contracts, the trust would be established based upon the historical results by the platform in question. Secure payments and obliging contracts are a combination that brings trust back to the game.

more efficient markets: without middle companies, parties can directly and easily communicate and sign deals. With one whole part of the process brought out, the speed of the market would increase substantially.

enhanced insurance claims: smart contracts would improve claims by offering transparent data in the blockchain. In this way, all activity would be traced back to the original parties, preventing frauds (for insurance providers) and simplifying application process (for insurance seekers).

detection and prevention of scams: combining above-mentioned effects, smart contracts, as well as ledger records would provide a clear distinction between available balances and past transactions. Thus, frauds would be easily detectable through historical transfer data checks.

Teambrella

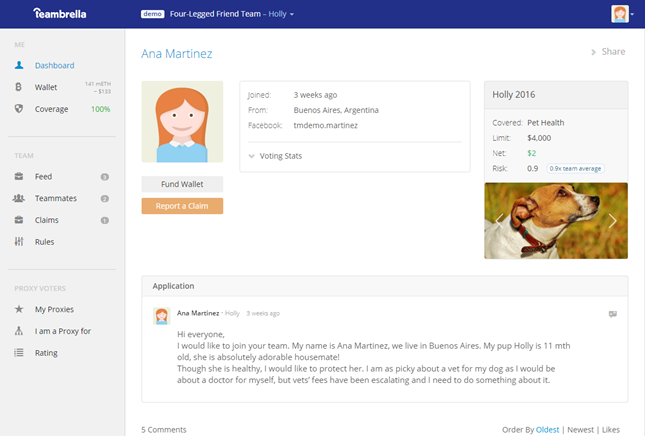

Although still in alpha and beta version, the platform already offers complete blockchain insurance marketplace for its users. Teambrella proposes a single marketplace where insurance providers can give out reimbursements for insurance seekers. How does it work? You have to create or join a team.

Parties that are part of the team provide a fraction of payments through a voting system. You register an account, deposit funds and then join the team. These funds are controlled by all team members until reimbursement decision takes place.

If reimbursement, with all proofs provided, is accepted by the whole team, then each member pays out his equal part. Level of reimbursement, the entrance of new members, voting and fund control depends on peers in the team only. You can check out the demo below.

The only accepted money on this platform is Ethereum, with personal wallet withdrawals needing 3 confirmations to be successful. Security mainly encompasses daily investigation by the Teambrella’s employees, flagging risky business conductions. There are no fees at this moment since the platform is yet to open up its operations outside of beta version.

Dynamisapp

Dynamisapp is a peculiar blockchain insurance platform in many aspects. The platform verifies your employment through the connection with your LinkedIn profile. It takes data from your employment status and connects it with other social media. Or at least, that is what it will do in the near future, seeing as the platform is yet to release the marketplace.

The company uses Ethereum smart contracts and the crypto coin as a measure of payment and funding. You will be able to participate in monthly payment premiums, applications & claims evaluation, be part of the DAO shareholder base and to open up unemployment insurance claim.

The company, unlike at Teabbrella, does not require scanned ID or proof of address. You will need friends and colleagues providing you with application reviews as a mean trust certification.

ChainThat

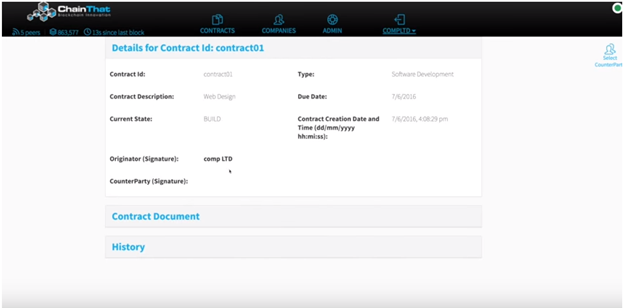

Insurers, reinsurers, brokers, and MGAs all can use services at ChainThat website, a peer-to-peer (P2P) platform based on Ethereum transactions. As with all other insurance platforms out there, you have premiums, risk management, and reimbursements available. You can operate one-on-one but also create multi-party contracts through smart contract payments. You can check out the demo below.

You have vaults and ledger records to prevent double spending and frauds, while ETH wallets need to be filled out as you register. Verification is a must in order to create a trusting community among the peers of the market. The site is not designed as straightforward as Teambrella and is aimed towards experts in the field.

InsurETH

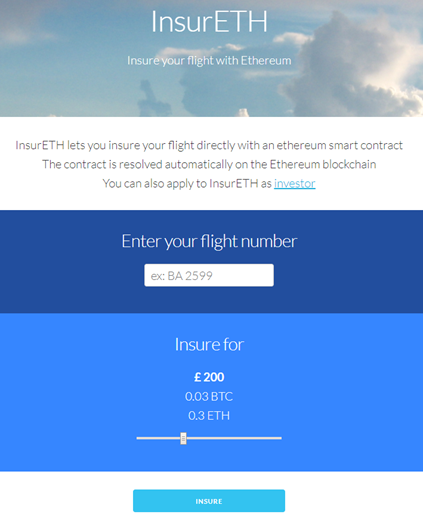

InsurETH is a company providing blockchain insurance services for air flight users. Using smart contracts, you can be insured through ETH payments. All you have to do is to provide your flight number and put the amount of ETH. You can check out the simple transaction page in the picture below.

Apart from the flight insurance, you can also use contact code as an investor, providing the smart contract link to your clients. You do not need to register an account to use the service nor do you verify your identity as an investor.

LenderBot

Being a micro-insurance proof of concept software, the LenderBot is the newest addition to the Stratumn’s product portfolio. Through its development, the goal of the bot is to insure highly-valued products, such as computers, laptops, mobile phones, and tablets.

As an insurance seeker, you provide signed documents, with funds being linked with blockchain’s ledger records. The program is available through Facebook Messenger app and offers P2P contracts to take place. The platform is yet to be fully developed and released.

Conclusion

In this review, we have taken a look at how can blockchain be used for insurance. It seems that the market is yet to fully develop. Stratumn’s LenderBot and Dynamisapp, although very interesting, are yet to be released. InsurETH offers very simple service for flight insurance, while Teambrella and ChainThat are still in their beta versions.

We except 2018 to be the year of development for blockchain, as many of these platforms are said to start full services.

This article is published for the informational purpose by CryptocoinZone. CryptocoinZone publishes reviews about cryptocurrency exchanges, wallets, trading platforms, lending platforms, ICO, cloud mining and gambling.