July 2018 replace: HashFlare announced that that it's stopping mining providers and shutting down {hardware} on present SHA-256 contracts resulting from problem producing income. This mainly assist my principle that there’s no solution to make any substantial revenue with HashFlare and that you simply’re mainly placing your cash in danger. I’ve mentioned it earlier than and I’ll say it once more – STAY AWAY FROM CLOUD MINING SITES.

Not way back, I reviewed one of the most popular cloud mining platforms around: Genesis Mining. I attempted to determine whether or not it could be a worthwhile funding to spend my cash on their web site as a substitute of simply shopping for bitcoins. The underside line was that the corporate appeared legit, however I doubted whether or not it could be funding contemplating the alternate options (i.e., simply shopping for and holding bitcoins).

Right now I’d wish to take one other jab at cloud mining and assessment what’s most likely the second-most well-liked platform for a majority of these operations: HashFlare.

Earlier than I start, right here’s a fast clarification for these of you who aren’t but accustomed to cloud mining. Cloud mining is the method of “mining from afar.” As a substitute of buying a Bitcoin miner, storing it, configuring it, and cooling it (which prices quite a bit and consumes time), you “rent” a miner and have somebody run it for you. You then cut up no matter earnings that miner makes.

My major criticism of cloud mining firms is that almost all of them are simply Ponzi schemes in disguise—they take your cash, however they don’t really purchase and run miners for you; they simply carry on paying you from new customers that come onboard till unexpectedly, they disappear (as might be seen here, here, and even here).

HashFlare background

HashFlare was created by a workforce of crypto consultants calling themselves HashCoins. Not like with most shady cloud mining firms, you'll be able to really see who the workforce members are on their About page, which is all the time signal.

The web site appears to have launched its providers somewhere around the beginning of 2015, and since then, it’s grown immensely (it’s at present the one of many high websites on-line, according to Alexa). The present (tough) estimate is that the positioning has around 5 million visitors each month.

The corporate itself (Hashflare LP) was registered in the United Kingdom in late 2015.

Drilling into the cloud mining math

HashFlare means that you can purchase three several types of cloud mining energy (often known as Hashrate). Sha256 is used primarily for mining Bitcoin, Scrypt can be utilized for mining Litecoin, Verge, and the like, and ETHASH is used for mining Ethereum, Ethereum basic, and the like.

For the aim of this assessment, I’ll focus solely on Bitcoin cloud mining, however the identical course of might be utilized to some other mining algorithm.

Probably the most environment friendly miner at present for mining Bitcoin is the Antminer S9. It produces ~13 Th/s of mining energy. Shopping for the equal of this on HashFlare would price you $1,040 per yr. Shopping for the precise miner would cost you ~$853. This really is sensible as a result of in case you purchased simply the miner, you’d have further bills on electrical energy, cooling, and storage. Nonetheless, the precise miner doesn’t cost something after a yr, and HashFlare does.

If we use a Bitcoin mining calculator, we are able to see that 13 Th/s in a vacuum (which means no electrical energy prices, no mining pool charges, and so forth.) will produce $222 every month. Appears fairly worthwhile—we’ll most likely break even inside 5 to 6 months. Nonetheless, we haven’t calculated the MEF (upkeep and electrical energy charges) but.

The MEF is linear and equals 0.0035 USD per every 10 GH/s of SHA-256. Which means that for 13 Th/s, it could price $4.55 each day or $136.5 month-to-month. So every month, we’re really making $85.5.

A easy calculation of HashFlare earnings could be one thing like this:

$85.5 *12 – $1,040 = -$14 per yr

Wait—what? We’re really shedding cash every year? Effectively. . .it relies upon.

Funds are made to Hashflare in USD, however payouts are acquired in BTC. Within the instance above, we handled the Bitcoin trade price as fixed. If that is really the case, then sure, we’ll lose cash. Nonetheless, if BTC rises in worth, then lets say that we paid much less however the payouts have been price extra. Or might we?

Let’s check out two doable eventualities: BTC goes up, and BTC goes down.

What occurs to Hashflare profitability if BTC goes up?

As worth goes up, extra folks begin mining Bitcoin. Which means that it turns into tougher to show a revenue, and earnings is definitely diminished. So when you’re incomes extra {dollars} (since every BTC payout is price extra), you’re making much less BTC in complete. There’s a strong correlation between worth and mining problem, so we assume that they nearly cancel one another out.

What occurs to Hashflare profitability if BTC goes down?

The humorous factor is that even when Bitcoin’s worth drops, problem nonetheless will increase (typically). As you'll be able to see in the graph below, there have been solely a handful of events on which the community’s problem has dropped, and a few of these instances weren’t even associated to cost (e.g., one drop is attributed to miners switching over to Bitcoin Cash when it got here out).

However right here’s the true fascinating half, which isn’t distinctive to HashFlare and might be present in nearly each cloud mining firm. Should you take a look at their terms of service, you’ll discover the next:

5.2. The Contract Time period for HashFlare.io Cloud Machines is limitless by default, until acknowledged in any other case. The Contract is legitimate whereas worthwhile, till expired or till terminated (discuss with part 13), whichever comes first.

13.1. With out limiting some other rights now we have, we might droop or terminate entry to your Account, the Web site and/or the Service, nullify your Account Stability and/or maintain the power to withdraw mined funds in case you breach any of those Phrases of Service.

This mainly implies that if the worth drops to a degree at which you’re not earning profits in any respect, your contract will probably be terminated. Bitcoin has seen 80% price drops in the past, and that might significantly have an effect on profitability.

To sum it up, it doesn’t appear to be you’ll have the ability to make an enormous revenue (or any revenue) both approach.

Contemplating the choice: Hodling

The way in which I see it, it’s significantly better to take the cash you’re aspiring to spend on cloud mining and simply use it to purchase Bitcoin and hodl it (meaning “hold” in Bitcoin-speak). On this case, if Bitcoin goes up, you’re making a revenue, and if it drops, you continue to have your cash. Nobody can “terminate” your bitcoins in the identical approach your cloud mining contract might be terminated.

What does the Bitcoin group take into consideration HashFlare?

Whereas I've my thoughts made up about HashFlare, I make a behavior of cross-checking with further on-line evaluations. Nonetheless, since HashFlare has a referral program (i.e., you receives a commission for each buyer you deliver onboard), evaluations needs to be taken with a grain of salt.

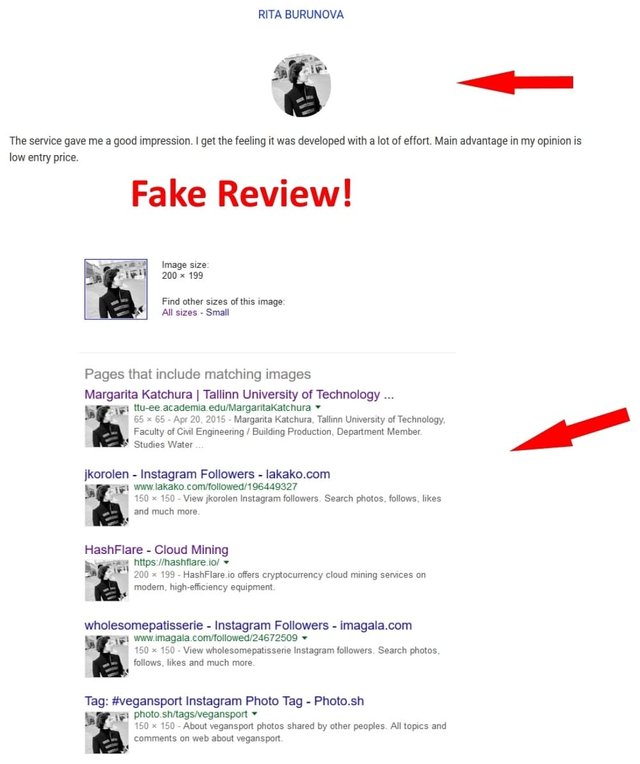

It looks as if there’s a wide array of negative reviews about the company. Most negative reviews complain about profitability, and a few complain in regards to the website being a whole Ponzi scheme,(including the use of fake customer reviews) and having just about no buyer assist.

Conclusion: Is HashFlare legit?

If I needed to give a brief reply, I’d say that the corporate might be legit however NOT funding. There’s a skinny line on the net between what constitutes a complete rip-off and what’s thought-about to be only a unhealthy funding alternative.

I’m not as deterred by the unhealthy evaluations as I'm by the straightforward math that simply makes it appear inconceivable to really revenue with HashFlare. Maybe a distinct coin/algorithm will yield higher outcomes—you should utilize the identical course of I did for Bitcoin on some other crypto HashFlare presents and see for your self.

Up to now, I heard somebody make a really amusing assertion that summarizes this assessment completely:

Personally, I wouldn’t make investments my cash in HashFlare, however in the long run, I encourage you to do your personal due diligence. Remember the fact that this submit shouldn’t be taken as funding recommendation—it’s simply my very own analysis about one other funding choice within the crypto universe.

Have you ever had any expertise with HashFlare? I might love to listen to about it within the remark part beneath.

HashFlare

Professionals

- Simple to make use of web site

- Reduces the effort of precise mining

Cons

- Does not appear worthwhile

- Quite a few allegations towards the corporate

- Sluggish to non-existnat assist

</div>

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit