Bitcoin and other cryptocurrencies have tanked this past month and a half, peaking at $20k and crumbling down to $8k at a rapid pace. This has been for a variety of reasons, spanning from January blues to stricter regulations to concerns over Tether. Have we reached the dawn of the next era for Bitcoin?

In my opinion, we have. It is currently looking like 2018 will test Bitcoin and other cryptocurrencies as regulators discuss it more and more frequently. Opportunistic journalism will, as always, exaggerate movements in both directions (hint: It's not just FUD, it's also FOMO). More companies will feel forced to have a stance on the cryptocurrency phenomena, likely all echoing the same statement of "it's too volatile, but we like blockchain."

It should be interesting to see how this all plays out, but my investing strategy has not changed. I will still have a limit order in at around $8,300 (which Bitcoin bounced above just after this video was recorded, but will keep limit in).

I suspect the bubble hasn't popped yet as the speed of Bitcoin's rise didn't give much opportunity for many people to buy in and many felt they have missed the wave. If we start to see another substantial pump, many will jump on board, fearing missing out for a second time. Of course, this is only speculation as bubbles are difficult to call.

However, this is my viewpoint and I will stick with it. As always, moments like these illustrate why you should be diversified into other asset classes besides cryptocurrencies so that you aren't overexposed to the risks in this field. Best of luck to all of you and happy investing!

Hello Crypto Investor,

I’ve really valued your level-headed insights into cryptocurrencies and investing strategy so far and I was wondering what your thoughts are about the US stock market right now.

Based on several metrics (below) I thought that it was over-valued in early 2016 and destined for a correction so I pulled all of my funds into money market and low risk investments like bonds. Obviously I regret that now, considering how the Dow has exploded in 2017 and the early part of 2018, and in hindsight I probably should have kept at least 25-50% of it in stocks. My questions is, would it be reasonable to try moving back into stocks if there is more room to run, or would that just be FOMO investing? I missed out on a lot of gains being on the sideline and it’s difficult seeing the S&P continue to rise. If staying in bonds is better, do you think there is a substantial risk in high-yield/corporate bonds as opposed to US treasuries/money market, especially in light of rising interest rates? I have read several articles that argue LIRP/ZIRP has caused a massive bubble in the bond market and I don’t want to make a bad move twice.

Disclaimer: My main area of expertise is in math/the physical sciences (with some economics background) so I don’t want to step too far out of my circle of competence, and would value your opinion about the current market.**

**I know you cannot offer investment advice, and all decisions are ultimately my own, but again, I would value your insight coming from a finance background.

https://www.advisorperspectives.com/dshort/updates/2017/09/06/market-cap-to-gdp-an-updated-look-at-the-buffett-valuation-indicator

http://www.multpl.com/shiller-pe/

https://fred.stlouisfed.org/series/INDPRO

https://fred.stlouisfed.org/series/UNRATE#0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great video as per usual. I think the regulation aspect is inevitable and there will be more coming our way. That being said the upside of regulation is it legitimizes the market and will eventually bring in new investment.

That being said I think the BTC price will go up in the long run but what impact do you see implementation of lightning network having in the shorter term?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin is king because of it's liquidity, but it is an old man in this market surrounded by more youthful coins and tokens. The Bitcoin crash is inevitable, but I don't believe the lighting network will save bitcoin. Even as we speak, the light network is being implemented, but the User Interface is not user friendly and it full of bugs. Also Coinbase and other wallets will be slow to implement the LN network, because they haven't even fully added support for SegWit(Segregated Witness) . Anyone else believe that 2018 will be Bitcoin's last chance to redeem itself?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you have no clue what youre talking about. bitcoin will not go below $6000. If your eyes are open you will see that the FUD is getting more and more serious and yet the effect it has on the market is a small fraction of the initial effect. The hodlers are strong and they are right to be. Any institutional investor (with 100 million to invest) who invests in bitcoin between 6000-8000$ has a extremely good chance (~80%) of making billions in the short term (next 3 years) and about a 5% chance of having bought into the world future international currency (20 + years) which would be valued between 5-13.4 TRILLION dollars. These odds are astronomical in comparison to a lottery ticket. No comparison. Your issue is you don't truly understand the technology behind bitcoin and the power that the popularity brings to the techs adaptable nature.

let me ask you something. do you really think that the reason bitcoin jumped up from 9k to 15k in a day because of regular buyers like you and me? NO. That was clearly instiutional investors getting involved. This entire crash is nothing short of market manipulation.

The institutional investors want the weak hands out so they can buy the BOTTOM STACK of bitcoin.

All institutional investors SHOULD and have BEGUN to invest 5% of their investable assets in bitcoin with the intention to hold it for 20+ years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most institutional investors won't invest in Bitcoin as it has no intrinsic value at it's core apart from being the first kid on the block. It's also lacking behind in several aspect that would making it a useful currency. The changes are painfully slow due to lack of consensus within the core developers. Proof of work will also be problem as it requires a certain profitability for miners to have an incentive in maintaining the hashrate of the network.

It will still hold value over time but it won't be much different than collectors items such as post stamps (which could be used as currency once upon a time, believe or not). As soon as you can easily exchange or buy other blockchain tokens without going through bitcoin, we're going to see it lose its feathers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WRONG. They will invest in bitcoin because it has the least inherent risk. Bitcoin has not scaled yet but it is in he process and it certainly has the capacity to scale. The lighting network is expanding everyday and the block sizes will eventually be increased. The bitcoin core developers don't agree but even still, it is way more likely to succeed than the competition because it is the first kid on the block and the most well known. Proof of work will not be a problem for an extremely long time and by then they will have figured something out. Being the first boy on the block is huge. I would say that bitcoin's only competition is ethereum and cardano atm so they are probably something like a 4% and 3% chance of becoming the international currency, respectively. Here is what institutional investors are thinking about bitcoin : https://s3.eu-west-2.amazonaws.com/john-pfeffer/An+Investor%27s+Take+on+Cryptoassets+v6.pdf

Also your argument that bitcoin has it's feathers because it is the largest financial gateway makes no sense. That money comes and goes very quickly. Negligible in comparison to the 3 main reasons people buy bitcoin and keep the money in the network : HODL(the largest percentage of bitcoin has been bought for this reason), quick and consistent profits (panic sellers), and lastly to buy bitcoin only to sell it later and make the weak hands get out. The reason that bitcoin prices falling causes alts to go down isn't because of the pairings. It's because the fact of the matter is this : If you dont believe in bitcoin, if the market doesnt believe in bitcoin, then there is no reason to believe in any other cryptoasset.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Myspace was the first kid on the block. Do you use myspace?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Look im not saying that no crypto currency can take over bitcoin's spot. im saying that being the first kid on the block is a huge advantage . Bitcoin is the decentralized, leaderless standard at the moment despite the fact that it is still centralized. I do believe that other currencies can get ahead. For example, If cardano is able to decentralize and implement a treasury model in a reasonable amount of time then maybe they can get ahead but bitcoin still has the best chance as of now. Then it's ethereum, and then it is cardano.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I honestly think Bitcoin will probably have a relatively high value (maybe more or less then the current value) as it finds a niche with block chain collectors much like post stamps.

Other blockchain platforms are already ahead if you take the monetary value out of the equation. This is my opinion, I look at this from technological and utility point of view.

''Cryptotrading'' doesn't interest me in the less. I actually exchanged most of my Bitcoin fund for other blockchain tokens that solve problems. I think that's where something truly as value or not. Blockchain platforms like Cardano, EOS, Ethereum and etc do strive to solve many problems with the technology and the world at large.

Bitcoin is bogged down with many ''cryptotraders'' or miners who can't look past the $$$. Many of the criteria that held value for Bitcoin are slowly being taken over by other currencies or platform. Anonymity, exchange and storage of value have all been improved by other players in the blockchain ecosystem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Barron's magazine featured a "value investor" Murray Stahl in Nov 2017 on why he bought bitcoin:

https://www.barrons.com/articles/q-a-why-a-value-investor-decided-to-buy-bitcoin-1511810246

Bill Miller boasted about how half of his fund was in bitcoin.

The pressure of keeping up will push other managers to follow these leaders. The big money will necessarily move into Bitcoin and Ethereum because those have the largest network effects and brand name.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

stiglg, I agreed that institutional investors have manipulated the price on more than one occasion, but this does not account for the drop in the entire market. Exchanges like Binance and Bitstamp have recently opened for new customers and Coinbase is struggling to keep up with demand due to the sheer volume of money entering the market. People are frighten and don't know about the technology behind Bitcoin, they only care about the insane profit margin, that is why we are seeing a pull back. Education is key here, and it will strengthen weak hands and will secure blockchain in the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The institutional investors are playing around with the emotions of those who have entered the space without knowledge of the underlying technology. The institutional investors are well aware and of the tech as they are currently paying hundreds of thousands of dollars to extremely intelligent people who are explaining it to them. The whales sell in accordance with news so as to mimic AND escalate fears. People have at this point become so irrational that they believe a ponzie scheme with a market cap of 3 billion dollars has artificially inflated the price of a digital commodity that is backed by mathematics by over 200 billion dollars. The fear is working and if people keep this up then the institutional investors will obtain a significant proportion of the bottom stack of bitcoins. In my opinion this is why satoshi disappeared. It is his gamble. If the banked have been unbanked and bitcoin succeeds, he will send them 1 million bitcoin. Even if he is dead, this will be executed. But im a good satoshi guy...who knows!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, I don't believe your premise of the irrationality of investors and your theory that institutional investors are ready to jump in any day now when markets finally bottom. I do not believe that either is the case. You may be right and I may be wrong though. I am willing to admit that. But I will try to explain my thoughts.

Institutional investors are professionals. They do not invest as a hobby. It is their jobs and they know what they are doing. They understand the market cycle. They understand the implications of a parabolic run and then a climatic peak and they can see one a mile away. They get out before the bubble pops when mania besets a market. They mostly got out at on the bull run to $17K in early December. You can see this in the volume of coins traded. We had big volume on that run. Who do you think was selling out? All the news stories were around were saying that bitcoin was going to $100,000 or even a million. Who was not taken in by these crazy stories? The institutional investors. They sold out into the mania that was last December. I do not think that they are coming back for a long time.

Retail investors are acting rationally. We have been exiting since the blow-of top at bitcoin $20K. When a building is on fire, the last people to leave are the ones who get burnt. Some people can afford to hold on, for what may be years, until they get their money back. Most people are not so fortunate. I know that I am not.

Almost everyone in crypto is in here to make money. Let's be honest. But people can see that there are difficulties ahead. The easy money days are gone. That's not the market that we are in now.

What happens to prices if tether and bitfinex fall? They will go off a cliff.

What happens to crypto prices if the stock market crashes and we enter a new recession? They will go off a cliff.

What happens when people realise that 95% of altcoins are garbage? The market will go off a cliff.

What happens (in the short term) if governments seriously regulate crypo? The market will go off a cliff.

But hey, there's the lightning network to look forward to... :)

I believe that bitcoin in 6-8 weeks could be $12K. It's possible. I also believe that in the same time span, bitcoin could be $4K. So that's plus or minus $4K. Am I going to put my money into bitcoin? Of course not. I would get the same odds right now taking my money to the casino and betting it all in red. That's not a rational thing to do with hard saved/hard worked for money. The market understands this position and has done since bitcoin $20K. What is happening is a great unwinding of the market.

But who knows what the future holds. This is just my guess. You might be right. Fingers crossed for you. I hope that it all goes well for you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

institutional investors are professionals. Thats why that guy the guy above linked put 7 million dollars into bitcoin when it was 700$. he also agrees with the other institutional investor that i linked who believes that bitcoin has a chance to be worth all of the world's fiat. Youre right, institutional investors are here to make money and they are educated. They have been educated about bitcoin and so they see it as money. It's value for now, and in my opinion, for decades to come, is volatile. Institutional investors will take advantage of this so that if bitcoin among all the other crypto currencies that are here now or are to come, becomes the world's international currency, they will have obtained each satoshi for as cheap as possible. They have programmed bots to watch the market and have individuals constantly looking at news entering new information as it becomes available. You might want to pretend that this market is 100% like gambling because the odds are low for any of these coins to be THE coin that becomes the world international currency (a coin almost certainly will) but in the short term (<5 years) it is easy to select which coin is most likely to become the world's international currency (<5% chance in the long term no matter which one you think it is).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your definite views :) They are interesting to read :)

I would think that greater than 95% of people put money in crypto to make money. We all want to make money. But wanting it doesn't make it happen. Putting savings into the market in the blind hope that the market will rise is gambling. This works in a bull market and people think that they know what they are doing. Buying the dips and holding works when the market is going up. Buying the dips and holding is a terrible strategy when in a bear market. It will kill a portfolio. It will grind it down to nothing. People need to be extremely vigilant and careful in a bear market. They need to protect their capital.

I agree with you that long term bitcoin (or something else) may possibly be even bigger than now. That could be months away or that could be years away. Nobody knows.

Be careful my friend and good luck with whatever strategy you employ

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There are 1500+ candidates to become future world currency at this moment alone and many of them already perform better than BTC. Have you counted in the chance that BTC might go down to zero when atomic swaps will remove requirement to use exchanges and BTC as a liquidity pool?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin does not act as a liquidity pool for the amount of money you are talking. if you want to sell bitcoin for fiat, do it. if you want to sell bitcoin for alts...go right ahead. bitcoins function as a liquidity pool accounts for a very small portion of why the price is so high. the price is high because there are so many hodlers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On the other hand, why are there so many hodlers? Because they know there is a demand for bitcoin. And why is there a demand? Is it a good measure for payments, can it store value reliably? No, it isn't and it can't. But it is a good pool of liquidity. And when it wont serve this purpose too then hodlers might as well turn to bagholders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

most of the "hodlers" youre talking about have left the market because well, they are panic sellers. Most bitcoins are hodled because bitcoin has the largest chance of becoming the world's international currency. By the way if you ever see it approaching this you should sell and buy gold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's why I diversify crypto investments and don't try to accumulate as much BTC as possible

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was really watching all these news and rumours of everyone and I were really questioning my self if you would post on this topic.

I think that recent events like Tether FUD, india, korea , chinesse ban all of these lately news have played a big role in the bitcoin's path over the last few weeks. There is also the bitcoin futures which started about 1 month and a half ago who took a big role.

I feel like Bitcoin is really manipulated right now with all these stuff and people are playing with it. One major factor of why the whole market drop is obviously bitcoin price. Cryptocurrencies interest drops towards the masses of people as the bitcoin price drops. If you go outside and take some random people who have heard by crypto once they only heard about BTC.

What is the problem? Well, lately bitcoin dominance dropped as there was a lot of ethereum potential considering ERC20 Tokens and ICOs invasion so therefore a lot of people moved away from bitcoin. Then, bitcoin lost a lot a lot while ethereum gained a lot. This chart explains it really well.

Now, the market's future is in our hands. People either move back to BTC in order for it to come back stronger, else ethereum will take #1 place in the near future and then we will need time and patience untill masses of people will get educated about cryptocurrency. There was nothing catchier than a coin who jumped 10.000$ in few weeks for an average person.

What are your guys thoughts on this? Steem on!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do think that ETH is skyrocketing now! However, I think that ETH is the hero who save the market, as it resembled in the last 2 weeks the strongest safest Coin (especially USDT does not look like so).

Look carefully today. There is no such panic like when BTC touch 10K (15-17 Jan), although BTC went today too far lower!

Moreover, it is more realistic to think that ETH will be 10X (10K), than BTC reach 10X (100 K), otherwise, the bubble will be too ...!

Now the price correction is going smoother toward ETH rather than whole coin crash.

At least that is my opinion!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's also what I advise most people that cant run into fiat when market crashes - to jump into ETH as its the most stable and suffers the smalles losses. If we compare all the market to ETH most of the coins are on green 💚💚

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why do y'all think ETH has been more resilient? That's my biggest question now. Do people collectively see it as a safe bet? To me that doesn't make sense. Why would be any safer than BTC? Or is there orchestrated flow of cash (or could even be Tether manipulating) ? I see all crypto going lower.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From my point of view is safer as a lot of people start to believe in Vitalik's vision and actually there is aplicability ( ERC20 Tokens, cryptokities, smart contracts etc. )

There is also a better way out when bitcoin market is manipulated by different sources like bitcoin futures.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also whens the switch to proof of stake happening? People might be accumulating for that in this dip. Probably a flippening then...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey crypto folks,

I see the following headwinds for cryptocurrency this year:

regulation - it is coming, all governments seem to getting very serious on this matter. In the long run it could be good for the market (unless they outright ban crypto), but in the short term it could have quite negative consequences for valuations as, at the very least, it should put an end to wash trading, pump & dumps, etc, which keep prices artificially high

altcoin crash - there are over 1500 altcoins. The vast majority of these do not have a valid business model. Their only reason for being is speculation. Like the dotcom bubble, these will probably crash to nothing.

stock market crash and possible recession caused by this. Has anyone looked at the S&P 500 lately? It looks like bitcoin in December when things were going nuts. What happens to the cryptomarkets when the stock market is crashing and some people are potentially losing their jobs? I am guessing that this would hit crypto hard. Crypto has never had to deal with a recession. People tend not to gamble with their money when they don't know where their finances will be in the near future.

bitfinex/tether crash - we all know that this is a possibility. No need to say any more on this potentially dire eventuality.

I would imagine that any one of these on their own could hit crypto prices by 50%. I am not saying that we are going to see all four this year. But we will probably see a few at least, which would hit crypto hard.

Who knows the future, but we could easily see markets down 80% from where they currently are. I am hopeful that at some time in the future (2019?) things might have started to pick up. But I am, I think justifiably, bearish for crypto in 2018.

What does the hive mind think? I would really appreciate your views.

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crash of stocks might have an opposite effect. What other asset classes do you see that could absorb money from stocks?

Also Tether crash would be significant, but its not the end of the world. USDT market cap is what 2B? Is it much compared to total crypto market cap of >400B?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A crash of stocks implies loses and the feel poor effect. Second order effects could be people losing their jobs. Some people even losing their homes. I don't see how any of those could be anything other than negative for crypto currencies?

When the shit hits the fan, cash is what people rush to - not risky investments? Also the safety of gold? People rush to risky investments, like crypto, at the end of the market cycle, which was the mania in December.

Your second point regarding tether is not valid. I will try to explain why. Many people confuse market cap with amount of money that people and organisations actually exchanged for crypto. Market cap is what the last person paid for a coin multiplied by all the number of coins in existence. Not what was actually paid into the system. I read somewhere recently that the amount of money actually exchanged for cryptocurrency was estimated at no more than twenty billion dollars. So you can probably now see how two billion dollars can effect the market. Not to mention the shear panic of people and organisations who lose potentially all of their money.

I hope this makes sense? These are just opinions of mine. You could well be correct. What are your thoughts?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When one side looses, other side wins. During normal times cash is a guarantied 2+% loss per year. During crisis this percentage may be much higher and those "winners" might see crypto as good investment considering its historical gains after crashes.

If market cap for all crypto is no more than 20B, then why this couldn't apply to USDT too? Can we know if all issued USDT are held by people/traders?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No I did not say market cap for crypto was $20B. I said that the amount that people and institutions have invested in crypto is $20B. Sorry if I did not make that clear. The money spent purchasing crypto coins is estimated at no more than $20B.

To illustrate...

Let's imagine that all of the bitcoins have been mined. There are 21 million.

Next imagine that first 20,999,999 were bought for 1 penny.

Next imagine that the last coin was sold for $20,000.

The market cap of bitcoin is now $20,000 * 21 million coins = $420B.

The money put into the market was $229,999 and 99 pennies.

The market cap is $420B.

Obviously this is an extreme and over-simplified example that I constructed in order to illustrate the point that market cap is not the same thing as the amount of money that people have actually spent.

Tether is a different case entirely. Each tether in existence is supposed to have been created by the exchange of exactly 1 US dollar. So tether is the only cryptocurrency that there is where the market cap also is the (supposed) amount of money that was paid for it.

Total crypto market cap = however many hundred billions

Total amount of money paid for crypto = no more than twenty billion

Total amount (supposedly) paid for all tether coins = two billion

I hope the makes sense?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In this case USDT makes for about 10% of total invested money into crypto and impact will be more significant than I imagined

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, it looks that way. Will have to see how things pan out...Also we have to remember that Bitfinex is basically the same company as Tether. We found this out from the Panama Papers. Bitfinex are the largest crypto exchange in the world. If Tether goes belly up then possibly Bitfinex do to. Who knows what that could do to the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I’m not too worried about it considering what the price was 60-90 days ago. Got to take this crypto market with a grain of salt and hold on tight!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never forget me bro, I knew you would make it big on this plateform...I'll promote ya another SBD just cause your doing this industry a service. Keep it up my good sir ; )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is still the first month of the year. We have a long way to go. Before the end of 2018 it will surpass the old ATH once again like it always does.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Almost always. The first $1000* "bubble" didn't fully recover until last year. BTC's price was between $300 and $1200 between 2013 and 2016 -- This past year the market cap exploded. Its hard for most people to adequately grasp what is happening let alone being able to predict prices in the future. My gut says a one million dollar Bitcoin could still be a part of the future. Let alone a $10k Ether and a $10k EOS. Long term crypto is a buy, but which tokens to buy / hold and when to make movements in and out. These are all matters of debate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good point, to add to this, last time this happened it gave space for new projects to get off the ground(Ether among them). This rush was built on the foundation of the work done since the bubble popped back in 2013.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@writewords really nicely said !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ty

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing your strategy on buying at these prices. It is reassuring, given the significant drop.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I look at the situation from the perspective of the technical analysis and I see, that everything is normal.

I agree with John Dow, who told 100 years ago: "Everything there is to know is already reflected in the markets through the price". The risks and fears, FOMOs and FUDs all reflected on the chart. Massive must be followed by the massive correction and for me, it makes no difference, what is the reason of the fall: Tehter, regulations... no matter. Chart shows everything.

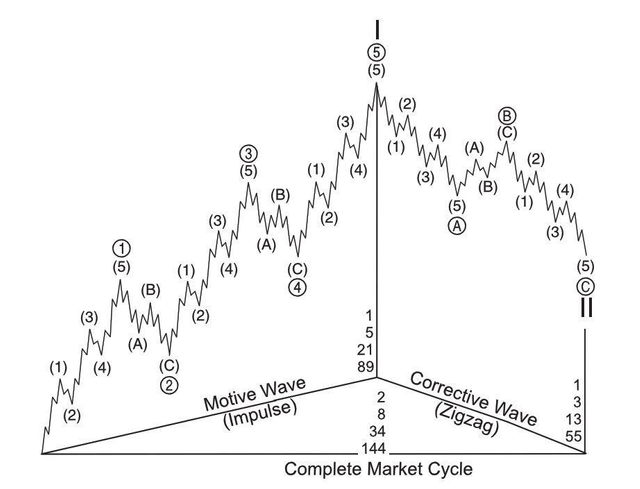

Here is the image of the Elliott Wave structure:

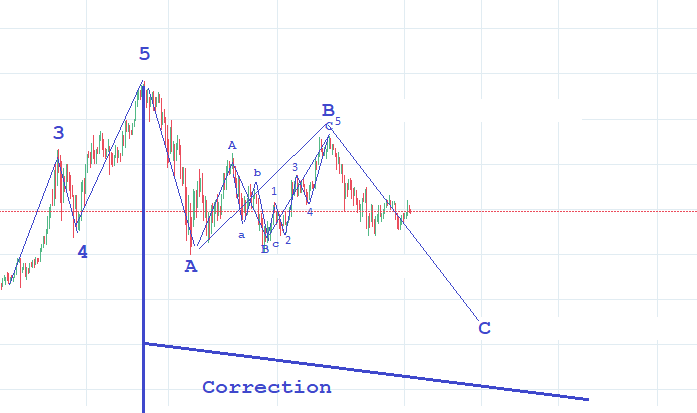

Here is the corrective phase (after the peak of $20 000)

And here is the wave C from the A-B-C correciton (I have posted it few hour ago):

What I want to say is that x10 growth per yearis something extraordinary for the markets, but same rules apply to correct the growth and something "extraordinary" is required to balance. I feel calm.

Thank you for the great content, @cryptovestor! Always waiting for your videos!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agree, I always land at 7600 with my calculations... that may no happen but there must be a reason for that level, last not least that many big investors (institutions) also analyze like this and place their bets there... they follow exactly these market rules, which is why they are so reliable. I just posted earlier years' winter corrections somewhere above or below here. No reason to get excited.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So:

Bitcoin just fell to 7600 where a pocket of buy orders awaited it, and bounced in three perfect Elliott Waves, which are ow correcting.

How hard can it be ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great! Glad to see some detailed Elliott wave work. You just need to put some Fib retracements from the beginning of the rise last year or before to the top. That C wave will end somewhere between 61.8% and 78.4% of that entire move up. We need to see an exhaustion sell off, where just about everyone in Bitcoin now hates it and wants out. That’s your buying time. I guess it’s around $4,000 but I don’t have the charting package and tools to check it any longer. I don’t trade full time now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Could you suggest a good source to learn how to apply Elliott wave?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"Elliott Wave Principle: Key to Market Behavior" by Robert R Prechter is the good one.

Here I give an example of the correction pattern on the Bitcoin chart: click here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

It is really fantastic that you still calm and waiting so long to achieve your 8300 target level.

I think that the best react in the CryproMarket is keeping calm as most of the investors were guided by there feeling rather than their rational!

Thank you for the good lesson, however, I think that we will see new critical levels within the next week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What I learned in my crypto journey is - NEVER ACT ON EMOTIONS ❗❗

It's one of the biggest traits of an investor or trader to be logical even when it might be impossible. Emotions can get you in some nasty places in crypto. Although, at the end of the day we are all human and there's a drop of subjectivity and emotion everytime!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Previously locking in some profits has made this time much less stressful for me . It was the hardest thing to do, yet the most rewarding. Even with the 'Fomo' that followed. For anyone stressed about the current state of crypto, set a withdraw as a goal in the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You mentioned diversification outside of crypto: All i know is crypto. If you would post a video explaining some of the ways you are diversified, that would be a big help. As a low budget investor with no banking relationships, I dont know where to begin, dont know what services and platforms to use, when it comes to acquiring positions in stocks, commodities, etc. But I do have a decent cache of crypto profits I could shunt into these other areas. All i need is some experienced counsel, and I assume I speak for most of your listeners.

(FYI: This is a copy of a comment I posted on the same video on YouTube).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The winter bear market of 2014 turned into a two year long less exciting period, there were ups and downs that weren't so parabolic, till early 2017. Does this mean we're doomed, or is it just another problem with the dopamine levels ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not sure if its comparable for the one fact that Wall St has entered this game...and will be moreso slowly .

BTC is in a different area now...so the result might (i emphasize) might be different.

Now the alt coins....with all those fantasy evaluations of certain coins...this might create a more"honest' market in that sense.

How many coins that you have seen that are just concepts...that's it?

I've seen too many to my liking.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In Early December, it was "We'll be at 30k soon because Wall Street may enter the game" - then the end of year decline happened and everybody goes "this is special because Wall Street entered the game" - but it hasn't really, there's just the futures so far and futures are a parallel market (which may influence the psychos who desire to be influenced by it psychologically) only.

Most investors are just gamblers, rationality is not their forte.

Institutions haven't really bought into Bitcoin so far, but they will.

If the mere hint of that already sends the chickens flying, there will be lush grazings for the ones who play along with Wall Street rather than the chickens.

Bullshit.

So far, there's absolutely nothing special in this early year bear market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And old saying says: "The best time to plant a tree was 20 years ago. The second best time is today!".

That been said my view for bitcoin is "The best time to buy bitcoin was a year ago. The second best time is now!".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In the video, you stated (paraphrasing here) "if anyone tells you they know what will happen, don't listen to them cause they have no clue." With that logic, why should we listen to your opinion that it is a bubble given that you just admitted you don't know what's going to happen?

Additionally, I watched your video about bitcoin being a bubble and the final conclusion seemed to be: if bitcoin is a bubble, then everything is a bubble. So if everything is a bubble, then what is the point of "being diversified across stocks, fixed income, crypto, etc." if it all is going to burst in the long run?

I'm not trying to paint you into a corner, I'm just curious if you could explain yourself better because some of these statements seem contradictory.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a far worse bubble than anything else by magnitude. And in almost any other asset class, there are many individual securities that are undervalued even if the broader asset class is overvalued. Hardly can say the same about cryptocurrencies given where they are currently from a development standpoint.

I listen to other people's opinions just to help build my own. I throw out the ones I don't see as valuable and put more weight in the ones that I do see as valuable. I suspect most people do the same. If I happen to have an opinion you want to throw out, that's fine - doesn't bother me. It's natural. So really there is no reason you SHOULD listen to me, it's just whether or not you want to based on what I present forth.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The way USD is losing purchase power and it's status as reserve currency, deflationary crypto doesn't seem like a bad way to diversify, even if the bubble is about to burst. The stock and debt bubble is about to go any moment anyways.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If inflation explodes like in the 1960's, crypto will replace gold as a good hedge this round.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've often claimed that humanity is itself a bubble (in evolution and the ecosphere) but people have a hard time understanding what I mean, human awareness has more limits than its hubris.

So let's say that human economy is a bubble without intrinsic value. It's a process that turns natural resources (everything from crude oil to life forms including humans) into assets they haggle about and sell each other to gain higher status and property inside the human societal hierarchy.

There is NO intrinsic value in ANY of this, as you can easily prove while watching how rich societies always decline and the biosphere suffers very badly and is now actually facing extinction.

Still we are delusional enough to focus on detail questions about which asset is more real or valuable by making comparisons like "can we touch it or eat it?" to determine its intrinsic value. THERE IS NONE in things we cannot eat, and water beats that anytime. If"world economy" which is not world but only human economy, broke down I would not buy gold but stock our basement with vodka which would likely be a sought after trading item in breakdown times...

Why am I saying all this ? Because only petty human psychology determines the value of any asset, and as long as many agree crypto is a valuable alternative, and it is as long as the technology is working, it will be exactly that.

Pundits on this network as well as youtube, ae motivated by three things, a) money (they will not be the most successful elsewhere) b) influencing. Why people would want to influence others may have personal and other reasons,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice video. My bet is that this bubble is likely to continue.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In one of your previous videos you talked about your distrust of tether. Do you think using an exchange like vualtoro (gold/btc exchange) would be a better alternative to using tether as a way to hedge?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have you looked into the BitShares Decentralized Exchange and the MPA's/smartcoins offered on there? Opposed to tether which is backed by nothing (most likely), the bitAssets are backed by twice the value in BTS.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Does this exchange function the same way ether delta does?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I haven't tried EtherDelta so I'm not sure how it functions in comparison. As far as I know ED is only for Ether and Ethereum-based tokens and does not offer smartcoins like bitUSD so I'd say BitShares has more to offer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never heard of that but it is an intersting idea. Why isn't it on coinmarketcap though? 🤔

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not sure. Maybe its because gold is not an actual crypto, but valutoro seems to be a legitimate exchange.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

usd euro is not a crypto either

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was inspiring. I know that most people that bought before November are still in the positive. But it still feels a bit scary to see market correct. I do agree with people screaming FUD all the time won't do any good to anyone. Now is the time to think before reacting and just give yourself a moment to decide what your next step is. Thank you for all of your videos. Keep up the great work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Being in the crypto space for only three months I find this quite interesting. Seeing the value of my altcoin portfolio diminish isn’t fun but having opportunities to purchase more altcoins and even bitcoin at these prices is nice as I’m in this for the long term and have no inclination to sell any of my positions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How low can Bitcoin go? Well, when it was 2500 USD, it was still very profitable to mine with electricity costing 0.12 USD. There are plenty of hashing power who operate using electricity at 0.06USD. Include those who dont pay taxes and can afford electricity at 40% higher cost and there you have it - Bitcoin can go down until it is still profitable to mine with 0.084 USD (that is lower than 2500 USD).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think this is a healthy correction for a market that's currently accumulating a lot of scars, with this USDT exuberance in particular. Bitcoin for me is still an overpriced asset because it's main use at the moment, outside of speculation, is to trade against alt-coins in the hope of making more Bitcoin. What I see before me is that the space is becoming more and more of a sideshow with money flooding in to coins which are worthless. Many people in this space have grandiose visions of how they will be hailed in 2025 as one of the early adopters but I think I'll look back with some embarrassment about what is going on in front of our eyes.

There's a lot of hope/attention being pinned on the lightning network but with the inertia in getting wallets and exchanges to implement SegWit I don't see that turning around soon. Implementing changes like that on such a dynamic system which has to be live all the time is a bit like trying to tie your shoe laces while running at speed.

I think self-regulating decentralised exchanges will go some way to treating the problems in this sideshow that the space currently has but whether that will tackle adoption issues is hard to tell.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i dont think it has popped either, there will be consolidation around the $9k IMO, but we will see!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WHALES!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just want to say I love your stuff despite that you keep promising more and doing less each time :D.

Gotta say I'm not in lock step with some points in this one, but it is thought provoking as usual.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It definitely hasn't popped. There's a lot of FOMO that's keeping the price high. The pop will drop the BTC below 3k. The interesting part is the waves happening in the ETH/BTC trading pair. Seems like ETH is the haven now (hopefully due to ppl using USDT less)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm feeling $2000~$5000. I don't think we're finished with bad news before the market can jump on good news. When we see credible and practical usage in commerce maybe people will want to take some risk supporting this again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What you said in the beggining it's really really stupid imo , there are facts , and there are missinterpretations , and there is the media that's trying to manipulate the people's opinnions with idiotic title's like " India is banning crypto " THAT"S FUD . If you read the article itself , it's not FUD , it's FACT. When other news catch onto it and re-write it so it fits theyr agenda, it's FUD. get it right next time , because you have a decent amount of viewers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saying that another man's thoughts are stupid is a best way to engage in conversation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That FUD will soon come to end. Once facebook will announce it's official tie up with ltc. Probably all crypto currency will climd 10000%. Therefore, today is a great day to but and stay calm.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great video. I see bitcoin as a long term investment. I got in with a substantial amount of money. I'm very low on cash now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you think the ticking time bomb that is Tether has any effect on what is happening? Meaning, do you think what we are seeing now is just priced-in? And do you think this analysis holds water:

http://www.tetherreport.com/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i think price will go to 6000 and bounce back mid of this year.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the video again. The market is quite uncertain now.

What do you think about the ETH-BTC chart?

It is really starting to get close to that time around june 2017 when the flippening was close to occur. Do you think its going to occur?

https://www.tradingview.com/symbols/ETHBTC/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What's your opinion of the price with the 50-day moving average sitting high above the 200-day and starting to turn down?

I know the MA is a lagging indicator, but do you see the mid to long-term price direction not turning around until the 50 MA gets within a more reasonable level of the 200 MA or touches it/crosses it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nothing to be worried about in my opinion, this gets too emotional for a lot of people who invest irrationally, buy high in fomo and sell low in fud. We have seen this kind of movements many times, don’t forget we are still up 10 times from January 2017, just hodl and place buy limits on key points when everyone else is panic selling, cryptos are here to stay, this won’t change.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope they don't regulate it any time soon. If that happens we won't be profiting much from any coin really. I have pretty much most my money on crypto, you're right it's best to expand to other asset classes cause it isn't looking to well now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Come on.

They regulated the entire stock market long ago - that must be why nobody's getting rich there or what ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, I would generally be a little more cautious about suddenly reallocating your portfolio once the market goes down (that's the worst possible time), but in general it's good advice given the volatility in cryptocurrencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Off topic, you mentioned that adoption is the biggest hurdle for crypto. I'd love to see a analysis of say top 3 coins that you see are the ones leading the charge. I see Steemit as one personally.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Binance is now listing Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With bitcoin futures in the market, it totally make sense to crash it to 7000-8000 close shorts in futures then drive prices up to 14000 and up area in order to short it again. One thing is for sure, bitcoin will not disappear in the coming years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The end of 2017 was the first time random people that I know began to know the word "bitcoin". There's too much road ahead for cryptocurrencies to become mainstream and that's why I still feel confident, despite all the times I bought it over 10k USD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great stuff. Thanks for another awesome video/post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You weren’t kidding when you said steemit has better comments! I love reading all with such detail, wish I was here from the start. Thank you @cryptovestor.

As always great video, seldom do I disagree with your miserable point of view😉. I’m looking at an 8k level in btc if we go below that we will see a hard fall with no volume in exchanges between 7-5k it’s looking scary.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your daily insights. We also believe stricter regulations are coming, essential to set some order in an otherwise chaotic environment. I am not talking about fully regulated crypto markets, but rather the 1st layer of a directive framework to minimize scams, etc. Btw, we are putting together a daily recap in case it helps to complement your videos. https://medium.com/@coinlive.contact/daily-crypto-recap-indias-stance-on-cryptos-dramatized-sea-of-red-as-a-result-d1b250b36fac

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There were too many bad news in quick succession while the market was deciding where to go. I think the next piece of news on tether might be what tells us if it will go further down.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great video. I love how you look at what is going on from both bullish and bearish perspectives. Totally agree that it is important to be diversified. Also, I am with you, I hate when everyone in this industry disregard all negative news as "FUD".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Eeeeessh. What a beating all coins took today. Except Nubits. Ha!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greed in the extreme has too be matched by fear at an equally heightened sense. Too many traders are comfortable at the moment. The market has turned and it has much further to go before anyone should worry about buying it. The corrective phase to last year’s buying need to have proportion over time and price.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great video again. All in the red, double digits here this morning. We are at $8,418 at this moment. Very excited about what's going to happen in the next few days.

I don't think the bubble has popped, but I agree that you never know what's going to happen, especially when it comes to regulation. I hope that it will come up slowly after this like we've seen before. Let's hold on to our seats. Rollercoaster style.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are talking about Bitcoin and cryptocurrencies being a bubble for so long, but I am not quite sure what you actually mean by that. What is your definition of a bubble?

For me a bubble means a rapid drop in price with no recovery after that. A good example would be Bitconnect or any other ponzi scheme.

Bitcoin had many major drops in price in the past. Were that all bubbles that popped? If so, we will see many more bitcoin bubbles in the years to come.

For me personally bitcoin being a bubble means the following: Bitcoin can never live up to the expectation of investors and speculators. There will be no mass adoption. There will be no one using bitcoin as a store of value. There will be no one using bitcoin as an alternative method of payment all over the world. If that happens, then it is a bubble.

Are you convinced that bitcoin wont succeed in the longrun? I think it has a decent chance and definitely a way bigger chance than any other coin today.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For now Bitcoin is only useful as a pool of liquidity. When it has no such use, it may not succeed at all. Its way worse as payment option compared to many other coins and it already lost more than 50% as a store of value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please do make a video about one of the "BitAsset" of the "BitShares" blockchain called "BitUSD", it seems to be a great alternative to "Tether",unlike Tether "BitUSD" is completely decentralize and backed by collateral of 300% of bitshares token.What do you think about this project?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There's an opportunity here to get involved in an extremely disruptive and scarce piece of technology but in reality most people are going to miss out.

The list of people who have missed out is growing:

(1) Early adopters that were put off after the FBI shut down the Silk Road

(2) Early adopters that were put off after losing money in the Mt Gox collapse

(3) Early adopters that are today being put off after losing money buying altcoins in their pursuit of the 'next bitcoin'

Bitcoin is here today and it's > 50% below it's all time high.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What if for current buyers it plummets to the level of (1) when you would pay thousands of Bitcoin for a pizza?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe this is not the year of cryptocurrencies after all... Nope, just joking :))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fantastic video and awesome interpretation of this volatile bear market we are experiencing. The term FUD is directly correlated to my systemic blood pressure ha ha. Negative feedback in matters that we are all trying to interpret on a macro scale is difficult enough as it is! If you want to be negative about cryptocurrency then stay out and enjoy the life of slavery in the Fiat corporate controlled world! Thank you CryptoInvestor; I appreciate your logical thinking and appreciate it! So keep on making the videos I am a big fan ✊🏽

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What you said in the beggining it's really really stupid imo , there are facts , and there are missinterpretations , and there is the media that's trying to manipulate the people's opinnions with idiotic title's like " India is banning crypto " THAT"S FUD . If you read the article itself , it's not FUD , it's FACT. When other news catch onto it and re-write it so it fits theyr agenda, it's FUD. get it right next time , because you have a decent amount of viewers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A truly common sense approach to this whole event.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit