I found 21 remarkable forecasts in total made for Bitcoin and Ether this year. Bitcoin and most other cryptocurrencies skyrocketed this year, but most experts predict much higher prices. If only part of it comes true, the bulls will gallop for a long time. And if you have them, how to sell them? When to sell?

The maximum amount of all Bitcoins will be 21 million, and I found 21 remarkable forecasts in total made for Bitcoin and Ether in 2021. The Bitcoin (BTC) price took a new orbit on the way to the moon, Ethereum (ETH) broke a new record last week. Most analysts predict BTC prices far over 100,000 and Ether over 2,500 USD, but seven-digit BTC and five-digit ETH prophecy are not uncommon.

But we live in exciting times also in other markets, like electric car stocks, vaccine makers, or other biotechnology companies. Some mining or other commodity producers also multiplied their stock value in the last 12 months. Brrr… The money printing in the US and other regions causes many assets to race. (Rescue programs of governments and inflation fears may also cause bull markets or bubbles.)

In my post recommendation, you find the details about the Bitcoin and Ethereum prophecies. And the essence of a new publication on my financial web page, Ageless Finance about selling tactics in a bullish environment. Detailed posts with many charts and lists. If you are interested in more details, click on the images.

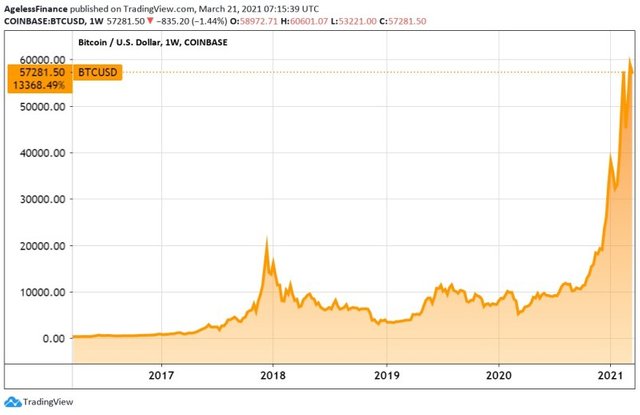

The 9+2 Boldest Bitcoin Price Predictions (in 2021)

The cryptocurrency market is booming again. This time, institutional demand is pushing Bitcoin prices higher. I found 11 interesting forecasts and calls made this year by famous professionals. If only a third of what they say is true, that could mean a further nice Bitcoin bull run.

- Bitcoin price predictions have seemed incredible in the past.

- Many predictions have become a reality today.

- New calls include hundreds of thousands of dollars, one million, or even more.

- But the boldest prophecy is not the highest.

Click the picture to view the full post:

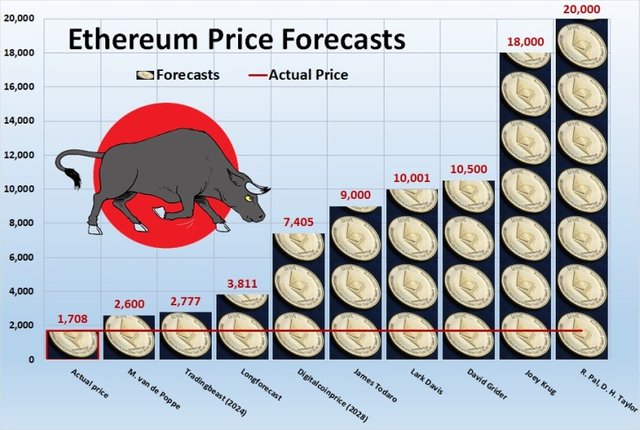

The 9+1 Highest Ethereum Price Forecasts (of This Year)

Many analysts are using the gold analogy, comparing Bitcoin’s capitalization to gold capitalization on the market. But that isn’t working by Ethereum. Smart contracts are something new, never seen before in human history. Which incomes will these solutions generate? And how much is ETH worth then? What are the arguments of the analysts?

- Ethereum price forecasting is more complicated than Bitcoin prediction.

- The second crypto is struggling with scalability issues, but they may solve them soon.

- Analysts expect Ethereum price to overperform as smart contracts and DeFi gain popularity.

- But estimates are widely spread. See the list.

Click the picture to view the full post:

Bitcoin, Tesla Went to the Moon, But When and How to Sell in a Bubble?

Do you have an asset that is skyrocketing in this bull cycle? Are you having grave doubts if you should sell, hold, or even buy more? Sell it in parts at primary price levels. This method’s three main goals are risk-reducing, psychological benefits, and more liquidity in your portfolio.

- Timing the market is almost impossible. You can never sell at the top.

- If you sell now, and prices surge, you will lose money and feel sad.

- If you don’t sell and the market crashes, it happens the same.

- One solution is selling in smaller parts, gradually.

- Also called “taking partial profit”.

Click the picture to view the full post:

Follow me!

You can follow me on:

My Previous Post and Chart Recommendations:

The Real Expenses of Being a Lazy Bitcoin Investor, the Secrets of Rhodium, and Japan Stocks for Foreigners

Is The GameStop Trade Illegal? Chances of a Dollar Total Crash, and a Strong 1-Trillion-Dollar Force Driving Markets Higher

Bright Era of Commodities? Interesting moves in European Stocks, Lumber Price, Turkish Lira, Zoom

The Big Tech Winter, Greedy on Energy Stocks at the Bottom, Real Highs of Platinum, Historical Lows of Crude

My Best Posts: Part-Time Jobs, the Real Price of Gold and Silver, the Longer-Term S&P 500 Sectors Performance

(Photos: Pixabay.com, Charts: Tradingview.com)

Disclaimer:

I’m not a certified financial advisor nor a certified financial analyst, accountant, nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, do your proper research or consult your advisors before making any investment or financial or legal decisions. I may have positions in the investment assets mentioned in this post.