Despite the flurry of bad news hitting cryptocurrencies, the latest SharePost’s survey reveals that consumers and investors remain optimistic. Indeed, they are considering more digital currency purchases within the next 12 months. Moreover, according to the survey, implementation of projects involving blockchain technology continues to grow.

SURVEY SAYS: A GROWING DEMAND FOR CRYPTOCURRENCIES

A series of negative news stories continue to affect the crypto industry negatively. For example, the latest hit comes from a recent Goldman Sachs decision to reportedly drop its crypto trading plans due to an unclear regulatory environment. As a result, Bitcoin price $6540.61 +0.07% fell by over 5 percent on September 5.

Even so, retail investors are keeping their faith in the crypto industry, as shown by the results of a September 5th SharePost survey entitled Cryptocurrency and Blockchain Survey: Consumers Bullish, Investors Cautiously Optimistic.

One of the main findings of the survey states:

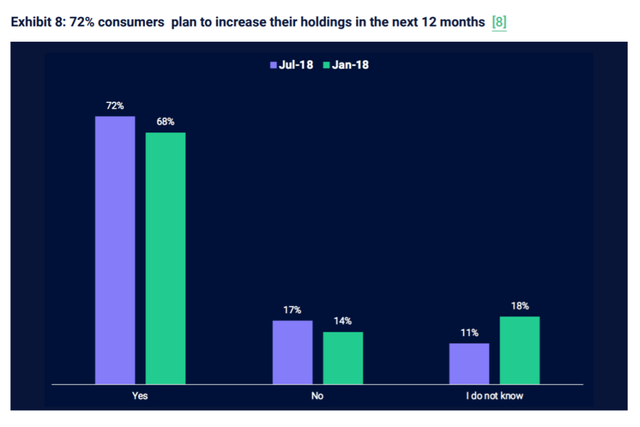

Cryptocurrency prices have seesawed over the past several months. Nevertheless, 59 percent of investors and 72 percent of consumers plan to increase their holdings over the next 12 months. Majority of respondents expect crypto valuations to increase over the next 12 months though investors were less bullish than in our previous survey. 57 percent of investors and 66 percent of consumers expect growth in crypto valuations over the next year.

The survey comprised the responses of 2,490 consumers and 528 institutional investors and accredited individuals.

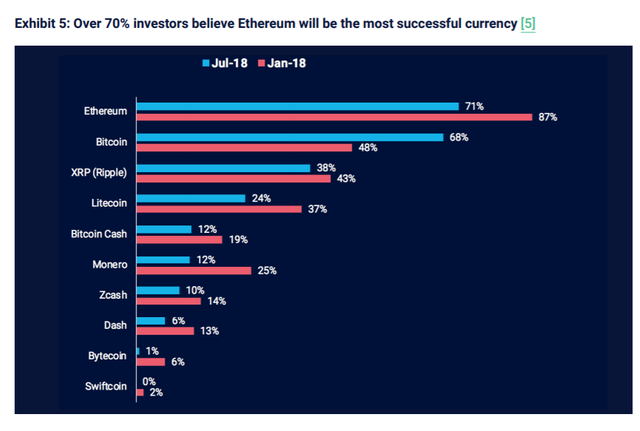

Bitcoin remains the king of cryptocurrencies. According to the survey, Bitcoin is owned by the greatest number of survey respondents, followed by Ethereum, Ripple, and Litecoin. As shown in the chart below, over 70 percent of investors believe Ethereum will be the most successful currency.

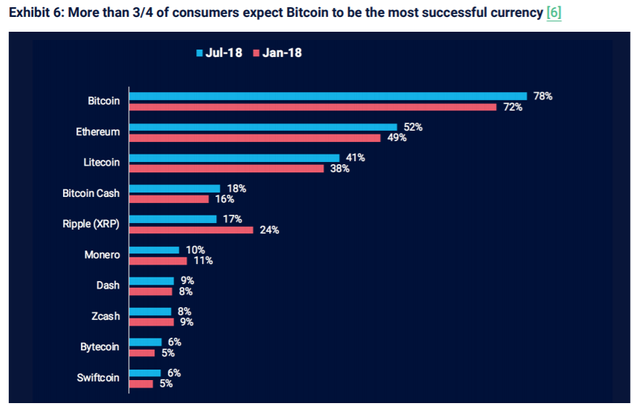

On the other hand, 78 percent of consumers think Bitcoin will be the most successful currency.

SURVEY: MONEY TRANSFER AND PAYMENTS ARE TOP CANDIDATES FOR BLOCKCHAIN DISRUPTION

The study also concludes that consumers and investors also retain a bullish outlook for blockchain technology. Specifically, “32 percent of investors and 49 percent of consumers say employers are planning to roll out Blockchain in the near future.”

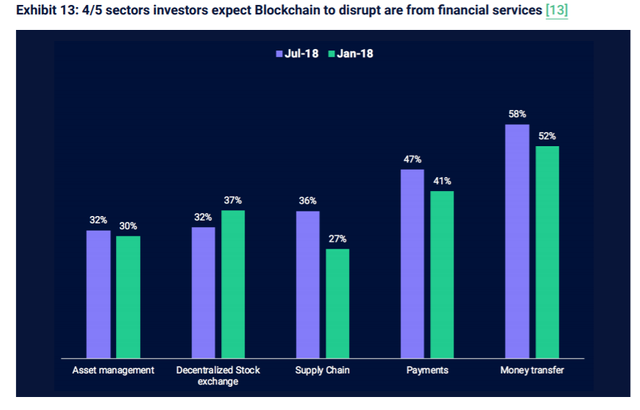

Most of the respondents believe blockchain disruption will most likely occur in financial services, mostly in transactions involving payments and money transfer:

Four out of the five sectors respondents picked that would be impacted by Blockchain hail from financial services. Both investors and consumers are bullish about Blockchain disrupting money transfer, payments, and asset management sectors. Over 58 percent of investors and 55 percent of consumers think Blockchain will first strike money transfer.

For respondents, price volatility and security remain the main concerns. Additionally, the survey highlights that a lack of education about blockchain technology, compounded by a lack of use cases are obstacles to a higher rate of adoption.

On the bright side, consumers and investors are now more cognizant of cryptocurrencies — The study states that “Over 95 percent of consumers and 100 percent of investors are aware of crypto assets.”

Moreover, the SharePost survey concludes that a majority of the respondents believe 2025 would be a realistic projection for when cryptocurrencies would become mainstream currencies.

Do you think Bitcoin will become a mainstream currency by 2025? Let me know in the comments below!

Images courtesy of SharePost, Shutterstock

Source: bitcoinist.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitcoinist.com/sharepost-newest-survey-consumers-and-investors-are-bullish-regarding-crypto-industry/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit