It's time for some Bitcoin realism: revisiting the Bitcoin hype and looking forward.

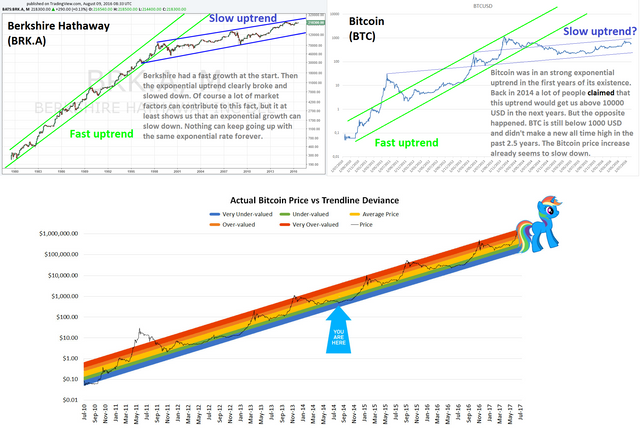

Many of the bitcoiners who were around in 2013 and 2014 thought that their precious bitcoins would continue to go up. Even after the crash from the all time high above 1000 USD to a price below 400 USD in early 2014, people still believed that the exponential uptrend would eventually pick up again.

But alas, more than 2 years later it's time to revisit this sentiment. I think we'll need to live with a much slower uptrend for Bitcoin in the next years. Your Bitcoin wealth won't just continue to multiply by 10 every year. The fast uptrend clearly broke, and Bitcoin is already pretty well known by the general population.

So what are the reasons for it not being adopted? There are multiple reasons, but in my opinion most people just don't NEED bitcoin. They are fine with what they have. I know, if their bank collapses, they will lose their money. But after the debacles in Cyprus and Greece, people still seem to trust most of their money in banks. Most people are sheeple, and it's very difficult to change that.

[Greek prime minister a week before the banks collapsed]

So who uses bitcoin? Where does it gets its value? The simple answer to this question is the undeserved: people who don't have access to the bank system, like illegal immigrants, whistle-blowers and oppressed political opposition. Oh, and of course also the people who want to do stuff with their money that should not be done with the traditional banking system if they don't want to end up in jail (sex workers, drug users, contraband sellers, ... to name a few). And yes, the libertarians.

Bitcoin will become more and more regulated over time. Governments try to strip the pseudonymous nature from Bitcoin. They want to be able to monitor the Bitcoin network. The EU dropped the ball with their proposed regulation to track all Bitcoin users. This looks very compatible with the leaked ChainAnchor system by MIT.

Regulation is inevitable. It will make bitcoin eventually less useful for the people who are currently using it. So this evolution is a tremendous opportunity for anonymous currencies (such as Monero) to flourish.

Bitcoin Realism also leads me to believe that, at least for a while, apptokens can gain some traction. Especially if it's very user friendly, has good marketing and tries to gain a foothold in a market that was not yet taken by Bitcoin.

Steem seems to be a good example of that, at least for now. I don't know if it will continue to thrive, but the fact that so much content is being posted on steemit is very telling.

So in short:

We need to become more realistic on our expectations for Bitcoin, anonymous currencies can take some of the Bitcoin market in the coming years and apptokens can try to explore a broader market.

PS: check back in a few hours for the second part of my "Bitcoin realism" series.

You've missed the biggest selling points of Bitcoin:

On mass market adoption... well, few people want to be their own banks, and we don't have secure computers yet. We will soon...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit