What is an Arbitrage

Taking advantage of the price difference between identical assets but in two different markets is what we call arbitrage. Cryptocurrency arbitrage is fundamentally no different than another asset.

In the trading world, there is no waiting, as they say, time is money —the possibility of arbitrage opportunities come for a very short span of time. Sometimes selling and buying must even occur simultaneously.

Basic Example of Arbitrage, in Real World

You are walking on the road in a place where you notice in a shop that they have a good sale on Apple which is 75% cheaper than the other market that you visit most often. If you are a buy for the business purpose then you will buy those Apple from that market and will go to the market where they sell at high price to sell them and you will get a profit from it or if you want to buy those Apple for your own self as you often like to eat them, then still you saved a lot of money as if you would have bought it from another shop you would have lost extra more money that you saved from buying it here.

So, let say you bought those Apple to trade it with a good price. You bought at a low price from one market which was located at other parts of the city or country and then sells it at a high price in another market.

Supply and Demand

- Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as well.

- Taking (exporting, shipping)the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price.

- Doing this repeatedly will cause the prices in both markets to converge to roughly the same. Or at least eliminate the profit taking opportunities.

The prices may not precisely converge because the risks and/or cost of moving the asset from one market to the other might outweigh the profit that can be made on average. And so the market enters a state called the arbitrage-free or no-arbitrage condition. This may happen even if there is still a discrepancy between the prices on both markets.

To take advantage of the arbitrage always keep the supply and demand on top of the list.

Methods of Arbitrage

There are 3 main methods to execute an arbitrage trade.

1. Betting on Convergence

- Buy asset1(BTCUSD) on exchange A and simultaneously short asset1(BTCUSD) on exchange B.

Note: We assume that the price of asset1 on exchange A and B will converge eventually.

However, there is a risk that the price does not converge if there are external market constraints – such as an exchange halting fund withdrawals, or certain countries limit currency inflow/outflow.

This requires you to pay an interest cost to short asset1 on exchange B.

2. Moving Assets

- Buy asset1 on exchange A, transfer asset1 to exchange B, sell it for a higher price.

Note: The risk here relates to the time. If the price difference disappears during the time it takes for the asset1 to transfer from exchange A to exchange B in a time after which the price difference between the two markets is gone.

This requires you to pay a cost to transfer assets between exchanges.

3. Moving Assets with Insurance

This is a hybrid of the above 2 methods.

Buy asset1 on exchange A and simultaneously short asset1 on exchange B.

Next, transfer asset1 to exchange B, close your short trade with the transferred asset.

In this trade, you need to pay both the cost of shorting the trade and asset transfer.

Risk-Free vs Low Risk

Ideally, an arbitrage trade is risk-free. But in practice, the risks might be low but is not completely risk-free.

Here are some of the common risks:

- Time risk

- Exchange risk

- Counterparty risk

- Regulation risk

- Country-related risk

- Execution risk

- Liquidity risk

- Default risk

Is Arbitrage worth to try?

Yes, it is and there are many tools and sites now that offer this service with a cost of the fee. If you have no programming skill and still want to earn from this system it is possible. All you need is a good website to do the job for you.

It is a kind of passive income if you want to earn some.

l7 trade

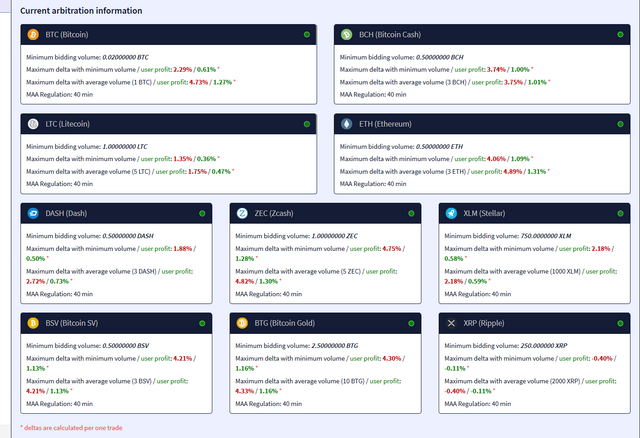

For a non-programmer this is perfect and they have many coins in their website

The only drawback that it seems to me is that every coin we can trade on there platform have a min amount of trading bet. Of course, they have different fee structure due to which the profit at the end is not too high but it is worth it.

.png)

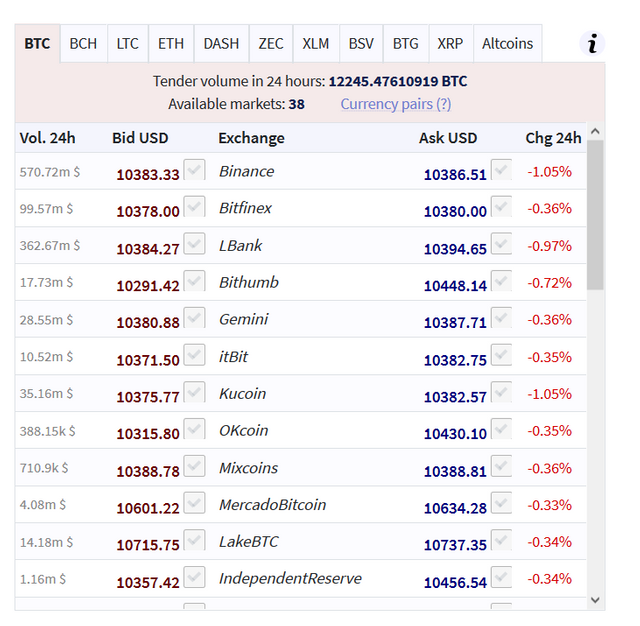

Their site is very user-friendly and they have 38 exchanges on which there agent working on.

If you like the post and want to support me then you can do any one of the following:

- Register on l7.trade using my referral link.

- Upvote this post.

- Bitcoin donation: 18sdGvvBe5R9zRcX8FcXDCQjJsN5NuGH7M

- Eth donation : 0x615FEF37eAA29c8642BAaA8336ceeE4683fD272E

Thanks and Happy reading.