one of the most famous memes at the cryptocurrency subreddit r/bitcoin, arguably the biggest awareness of bitcoin fanatics at the net, depicts a cool animated film coin using a curler coaster with its palms waving wildly within the air. on days while bitcoin is skyrocketing in price, the meme suggests the rollercoaster launching directly upward, and on days when bitcoin is crashing, the funny facsimile is visible enduring a near-vertical drop. this twin-sided net funny story has observed almost each considerable movement in bitcoin’s charge in latest years and is telling in its frequency.

bitcoin is forever growing and falling in relative fiat price, and even early 2018’s 70% decline isn’t surprising, neither is it the worst ever witnessed. even amidst the maximum sickening of freefalls, experienced buyers continue to be unfazed, because they’ve been there before. conserving via a correction is almost a ceremony of passage for cryptocurrency investors, and the group’s most skilled veterans have persisted greater than their fair proportion over time.

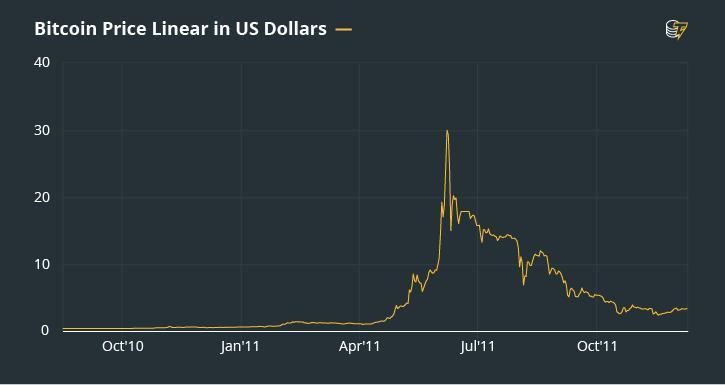

JUNE 2011

the early days of bitcoin were its ‘wild west’— a time whilst very few exchanges made buying and selling viable, and while best the bravest of the courageous dipped their ft in. such situations were all but starved of liquidity, and so whilst the rate started out rising from round $0.95, the incline and the following drop had been a number of the steepest ever recorded

in mid-june 2011, bitcoin’s fee reached as excessive as $32.00 in line with coin before tumbling all the way to $2.00 in november. at a ninety four% decline, this crash nevertheless continues its record and holds painful reminiscences for early investors, though people who held strong at the moment are counting their fortunate stars (and wads of bills). searching back, this double-digit all-time high seems low, but one must remember that there was a fraction of these days’s volume and hobby. bitcoin turned into still a largely unknown thought experiment, and nobody had any indication of its future. for that reason, $32 seemed like a great time to take income, especially after any such spike, and other investors started to capitulate.

JANURY 2012

the second massive crash occurred just months after bitcoin bottomed out at $2.00 consistent with coin. although the fee had greater than doubled from lows through the quit of 2011, the market became nonetheless apprehensive, as it had watched the cryptocurrency fall from $32.00 best lately.

beginning the yr at an optimistic $4.50, bitcoin increased in january to over $7.00. but, dip buyers nowadays ought to appearance to this time and take word, as it exemplifies an essential fact: bitcoin isn’t assured to reach its preceding all-time excessive before correcting another time. from round $7.forty, it took a frightening forty nine% decline to just $3.eighty in past due january, shaking out some buyers who had held via november’s debacle.

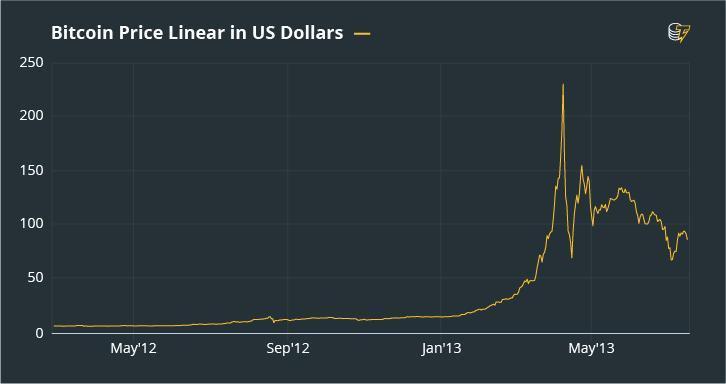

APRIL2013

the length among early 2012 and 2013 became uneventful. bitcoin received regularly and commenced 2013 at a charge of around $13.00, accomplishing as high as $17.00 in 2012. early 2013 became a bullish section for the cryptocurrency, as it driven past its all-time high of $32.00, achieving $forty nine.00 earlier than a one-day minor correction lower back to $33.00.

many new exchanges and investors, similarly to extended media coverage helped bitcoin recover fast, and it put on profits at a feverish pace till april, where bulls in the end capitulated at a rate of $260.00, breaking properly into the triple digits. an outage at the then maximum famous exchange, mt. gox, became also credited as impetus for the decline. profit-taking turned into a full-on freefall right down to $forty.00, for a complete loss of 83%.

NOVEMBER 2013

called the most important and maximum exemplary of bitcoin crashes, it’s no wonder that the notorious 87% decline happened in november 2013. as the today's buildup to $20,000.00 indicated, bitcoin bull runs tend to spin into a frenzy late in the yr. as many anticipated, november to january 2014 is a near mirror-picture of the ultimate four months, with a large inflow of recent investors and media interest helping bitcoin attain unthinkable highs.

in late 2013, the rate become nearing $1,2 hundred.00—a psychologically giant price that helped the following decay final for years. with a complete of 411 days in correction, helped in component with the aid of the epic implosion of mt. gox and erasure of just about $500 million, the put up-november low turned into most effective reached in january 2015 at approximately $one hundred fifty.00.

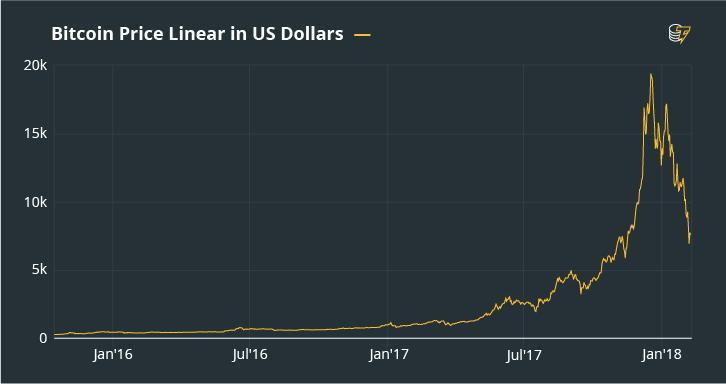

NOVEMBER 2017

5 years on the dot after bitcoin’s four-discern debut, the king cryptocurrency skyrocketed past the five-discern mark at $10,000.00 and driven all of the manner to $20,000.00 before dropping steam. the two years’ earlier would show to be a number of the quality possibilities to shop for, and even individuals who purchased bitcoin on the year’s beginning price of $750.00 received appreciably.

in december, a small correction down to $14,000.00 wasn’t enough to stop momentum, which fast took it again to $17,000.00 earlier than breaking down. concerns about bitcoin’s sustainability, particularly with a plethora of stunning opportunity answers being launched, most effective made the selloff extra severe. help emerged near $5,900.00—the mid-to-late 2017 degree while the cryptocurrency pricing started out showing a near exponential upward thrust. a complete decline of over 70% should pass decrease, if 2013 is anything to move with the aid of, however markets are positive for 2018.

searching in advance

if something, this lengthy records of repeated boom and bust is an positive sign. as soon as bitcoin entered the headlines, it never left, and it maintains to snowball in recognition with retail investors and media interest the longer it remains relevant. all through regulatory pressures, technical difficulties, and many greater corrections than those highlighted above, the cryptocurrency has remained at the forefront of the blockchain revolution.

bitcoin’s fate is tied to more than its believers, however, and the multi-yr war that occurred publish-2013 demonstrates that the course lower back upwards isn’t always directly. with its whales growing waves whenever they like, miners trying to find other ways to earnings, and a new futures marketplace, bitcoin’s outlook remains something but transparent.

Congratulations @farhanjutt! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit