Indian government is yet to consider Bitcoin as a legal tender. Under the current framework you can buy and sell virtual currencies but the government hasn't made any official statement saying that says it is legal to use it. Any news to this effect that you may have read anywhere is essentially incorrect. The most that has happened in the past few months is that the Indian government is considering a regulatory framework around Bitcoin and cryptocurrencies in general.

It's in a grey area currently and that's the truth.

Refer to this URL for more information on Bitcoin's legal status in India: https://cis-india.org/internet-governance/bitcoin-legal-regulation-india

It's no doubt that India has played a small role in driving up the BTC prices ever since demonetisation of Indian currency notes in Nov, 2016. Even today owing to devaluation of the rupee against BTC, the prices are generally on the higher side in India.

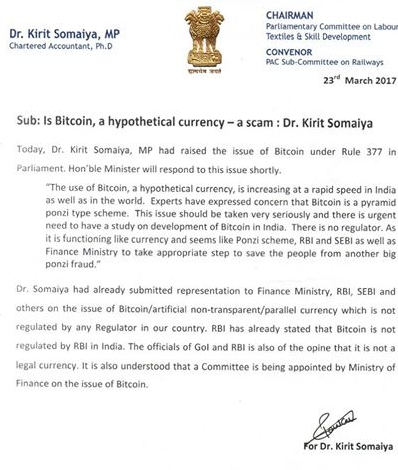

Many members of the Indian parliament are largely clueless about the nature of cryptocurrencies and their use. India is a financial risk-averse country with respect to it's current monetary policies, which makes it difficult to implement a pro-crypto policy in the short-term.

However, the Indian government recently invited public opinion on Bitcoin and other cryptocurrencies. Many Indians used this opportunity to express their desire to make BTC part of the everyday financial systems. But, reports such as 'Bitcoin from now on is considered fully legal' can cause confusion. It might build up hype amongst Indian users but unfortunately our market and regulatory framework is still at a nascent stage for mass adoption of Bitcoins.

We are far from seeing BTC as legal tender in India and it's highly unlikely that we'll see that happen in the near future. At best, we can expect to see a framework that allows the government to form reasonable laws for taxing the public on any capital gains, personal income or perhaps a corporate income tax for any BTC transactions or income generated through BTC/INR trades.

Currently there are no specific taxation laws that determines how to file your taxes when you are dealing in cryptocurrencies and every auditor is clueless about this aspect.

Framework might be built under the Indian Foreign Exchange Management Act to curb use of the cryptocurrencies as well. But, fortunately the government realizes that it cannot stop it's people from using Bitcoins. This might actually drive them to make a pro-crypto policy that can yield positive economic results in the long run.

The current official stance of the Indian government is that they have repeatedly cautioned everyone against use of cryptocurrencies such as Bitcoin and it is largely viewed with suspicion as it is beyond the 'control of the government's monetary policies.'

Let us not jump the gun on Indian government's monetary policies around Bitcoin. It would be wise to remember that Indian government monetary policies take years to form shape.

Even as a Indian business owner has begun accepting Bitcoins at his restaurant in India, we are far from seeing it as a legal tender which anyone can buy/sell groceries with!

Personally, I would like see the Indian government to rope in Indian Bitcoin exchanges or experts like Andreas M. Antonopoulos when forming their policies that should ideally have a positive impact on our economy in the long run.

But my expectations from my country's government aren't nearly as high!

1st Image: Pixabay

Thank you for your attention and support.

You may also continue reading my recent posts which might interest you:

- TheQuint Features My Story as an Early Adopter to Bitcoin, Steemit & More!

- Let's Talk—Importance of Being Charitable from a Young Age!

- Let's Talk—How To Deal Effectively with Steemit Skeptics on Facebook and Reddit!

So you could say that posts like these are really confusing and can get Indian users in trouble?

https://steemit.com/bitcoin/@kingscrown/bitcoin-officialy-legal-in-india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It could as we need users who understand the technology at basic level to use it in India instead of simply hopping on the hype train and potentially risk their finances.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is not legel yet. I think it will legel in near futur but gov. will need some tym..

U see indian btc exchange ZEBPAY has more customer then total nm of people using btc apps in korea.

And in the past few mnths there is regualr increase in demands of btc in india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's incredible when you think about it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Certainly Bitcoin and crypto's are still "too technical" for the average person. We really need to help it become more user friendly for mass adoption.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

absolutely!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No, I don't agree with that. As I am an Indian, there is no say from the Govt. side to make bitcoin legal. But it's not illegal also.

It's not in use for general trade and not accepted in shops etc. (unlike in Japan)

Indian Govt. is little slow and thoughtful regarding online trade, even some forex trading is illegal in India. Also online payment systems like Paypal are not fully and smoothly functional in India.

We hope GST and other new financial evolutions will pump the status of online trading and bitcoins in India in near future. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's true man!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People have the right to write whatever they want, but the Steem community should be wise to it and not upvote misinformation to a thousand dollars.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

¯_(ツ)_/¯

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hahah! Absolutely right dude! Well said! Steemit community needs to pay attention to who they vote and why!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The first country that ok's their banks to directly trade bitcoin will be the big winner. And it will bring bitcoin to the mainstream

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True that. I hope things change soon!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, correctly said.

In India it is yet to be decided whether Bitcoin and other crypto currencies will be a legal tender or not. The Govt. has not said anything about that, still cryptocurrency trading is being done in our country.

The new govt. of BJP is focussing on IT sector and technological advancement. Govt. may do something about it in near future if other big countries allow bitcoins legally.

It is to be noted that Japan has already made Bitcoins legal in his country.

BTW great article @firepower

Didn't know you are an Indian. :p :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Revised Tax in Effect From Today In Japan, Lifts the 8% Consumption Tax on Bitcoin making it more easier and cheaper to be traded. Hopefully India will soon legalize cryptocurrencies, but currently also it's not illegal to trade them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The last thing I need in this world is a Goods and Service Tax applied on Bitcoins 😓

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ha, ha. Just work the work my friend and get high with cryptocurrencies and it will not even bother you about paying taxes because you have these currencies bathing in like a dapper.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True that! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It will come most likely! Government will seize every opportunity to make money out of this and make our lives miserable!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well done post You deserve for getting Upvote from me. I appreciate on it and like it so much . Waiting for your latest post. Keep your good work and steeming on. Let's walk to my blog. I have a latest post. Your upvote is high motivation for me. Almost all Steemians do their best on this site. Keep steeming and earning.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much. Glad you liked it :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

U are welcome, @firepower plzz visit my blog and give me an Upvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 0.08 % upvote from @booster thanks to: @hamzaoui.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 0.04 % upvote from @booster thanks to: @hamzaoui.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope to expect good news, in india you never know :-D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yah! Hoping the same :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing.

Upvoted and following :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sooner or later they have to accept trade in terms of crypto currency's. Though they are trying to gain inputs from experts and understanding how to impose tax but due to GST I think they can't do that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You never know. Only time will tell.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

At first the Indian government was at war with Bitcoin! Now the government is slowly letting bitcoin become more adopted.... That is a good thing mates :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is good to hear. No country would want to be left behind in the wilderness. How will the make growth if they don't pick up a baton and run along with the other countries?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True! We are hoping to get there soon. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is good indeed! :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Discussion is going on and I believe that India will take a positive step however Indian Govt. fearing huge amount of money will go out of the country if people starts trading in BITCOIN or CRYPTOCURRENCY.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let's just wait and watch!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bitcoin already is the slowest and oldest crypto from the techside but it is the leading and the best known coin so it will stay i guess.

Do you think there is a chance that every country will create there own cryptocurrency in the future or will they just use whats in the market? cheers & thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just like the cellular phones. Very few people were using it when it was introduced. Some were not interested, but look at cell phones now even a 6 year old child has a cell phone whether it be a peanut or smart phone.

Every home has one in many parts of the world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it will happen eventually that a country might choose virtual currency but it might not happen in our lifetime.. Would be great though if it does, especially some global superpower.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cryptos will be free, you can't controll them

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, it will :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You know what? What they are doing, although it should be completely normal, is praiseworthy. Imagine what will happen in the United Sates or in the European Union when the imminent financial crisis arises. They will do everything to keep the fiat currencies alive. We're in the shit up to our neck yet governments won't admit it until evident. At that point, only people who know by means of alternative means will be ready to deal with the catastrophe. Making the issue public as an the're doing in India is different. This is what taking care of the people means wther or not all this will be implemented.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah I think so too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What was happening in India regarding the adoption of Btc as a legal tender is also happening in my country Nigeria. The authority here are still sceptical about the the technology behind the crypocurrency which is the blockchain

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope in time things will change for the good :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I Hope so mate, as it is Bitcoin is gaining ground in Nigeria very soon the authority won't have options than to legalize it . Period!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

These are very positive developments... Here's an article for a laugh if you get time. Followed. https://steemit.com/bitcoin/@ldauch/rollercoaster-of-emotion-dealing-in-bitcoin-and-cryptocurrency

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So I have sold bitcoins several times and have paid respective tax .... It is not illegal right now but it is not legal either .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True. Hope things change soon!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

From what i hear, the general consensus is.... its not...legal..but its also not illegal, and probably wont be either, this is just from a friend of mine living there right now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, I hope there is some good legality coming soon to it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article and thank you so much for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post !! Will follow for sure :) keep on the good work ! STEEM ON !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much. Glad you liked the post. Steem on! :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope Bitcoin and altcoins gets legalized soon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm hoping the same. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

☺️👍 I think they will put some sorts of tax also... Let's see ☺️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looks like the Indian Government is sleeping. They will wake up when lots of people start using bitcoin and other cryptos. That's when the central bank and its monetary policies will no longer control peoples lives.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, I really hope things change soon :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is more than what any one could expect, specially those living in India with this helpful information. I upvoted and resteem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much. Glad I could help.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You can't make it illegal really, it's just public addresses and private keys! India legalizing bitcoin would be mega huge for the crypto space. I'd love to see it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope India legalizes it soon. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Me too, I hope more and more countries do. Every one that does, more power to the people!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope Indian Government will legalize BTC, very nice article. Thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really hope the same. Thanks! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Had a lot of confusion regarding this , your information is definitely more valued than the clickbait media headlines and articles i have read so far.

keep posting :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much. Glad I could help :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is only a matter of time that the India Government will legalize cryptocurrency to be used in the country, India. Everything takes time my frends, only time.

They too would not want to be left behind while the world is moving forward.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very interesting!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. Glad you found it interesting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Woo good news

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yaaay!! :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They have to except crypto trading sooner or later. I can see that there is a problem with how the tax should be handled etc. I hope they will accept it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I really hope the same.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

according to the Latest Talks on Gov. sites it is likely to be a Legal Tender in India soon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really hope that happens so enough! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With all major changes coming to Indian economy like the historic implementation of GST. I really hope India soon legalises Crypto urgencies as our current government is all onto making India a country focusing on the digital age.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see my Indian friends here in China go to State Bank of India every month to send money to thier love ones. And some of them have home towns that are far away from the big cities

Would it not be easier just to send BTC from their smartphones ?

Of course , problem would be on the Indian end where BTC needs to be converted to Indian rupee. This should be an opportunity for Indian businesses

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wrote something related to this

https://steemit.com/bitcoin/@rjona1/impact-of-bitcoin-to-third-world-countries

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good Article but some information is missing @bitzoner

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What kind of information?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really appreciate creative posts and look forward to seeing more of your content in the future! I just followed you, and I hope you'll do the same so we can connect and continue to evolve and learn from each other! Remember, be yourself, because nobody does it better -- Full #Steem ahead :)

Follow me @fireangel

Much ❤!!!

Followed

Plzzz back

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

beware of this:

https://steemit.com/steemit/@svtechnik/bitcoin-is-near-end-of-lifetime-why-nobody-can-believe-it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this post. Upvoted.

This was similar to questions we had when seeing all the recent headline buzz and hype about "India accepting" bitcoin, but there was no concrete evidence of anything being ruled on or actually changing yet.

https://steemit.com/bitcoin/@thehutchreport/did-india-just-rule-to-regulate-bitcoin-or-not

We also find Aadhar quite interesting and we are following that topic quite closely.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the informative article @firepower. I was actually wondering why it's still not regulated in India, till I realized that it's not making that much noise as yet to attract the sharp ears of our policymakers. Till they see some benefit in it for them, they are highly unlikely to take any stand on the matter!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Earn bitcoin here https://btcclock.io?ref=200034

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit