Technology

About 24-hours ago bitcoin cash (BCH) miners were processing a ton of large blocks between 2-8MB in size. Fees have remained considerably low, and the bitcoin cash daily transaction volume is nearing the same amount of transactions as the litecoin network.

Bitcoin Cash Miners Are Clearing 8MB Blocks In One Fell Swoop

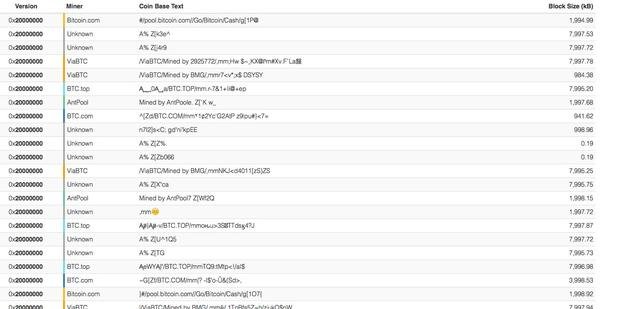

Bitcoin cash miners have been processing more larger blocks than usual over the past 24-hours, and many of them have been 8MB in size. There have been roughly 34,352 BCH blocks mined since August 1 and BCH is 8,714 blocks ahead of the bitcoin core chain. According to statistical data websites like Johoe’s mempool page, 2-8MB blocks have been clearing the BCH mempool (transaction queue) consistently. Over the past six months, the median BCH transaction (tx) size of 226-bytes costs $0.01-0.02 per tx. Average BCH fees have never exceeded more than 11 cents for median 226 sized transactions.

Skeptics Say No One Uses It But BCH Daily Transaction Volume Is Catching Up With the Litecoin Network

The bitcoin cash community has been excited about mining pools processing larger sized blocks over the past day. Mining pools processing 2-8MB blocks include Antpool, Viabtc, BTC.top, and four other BCH mining operations. Bitcoin cash block intervals have been taking place roughly every 10-20 minutes according to Coin Dance Cash statistics.

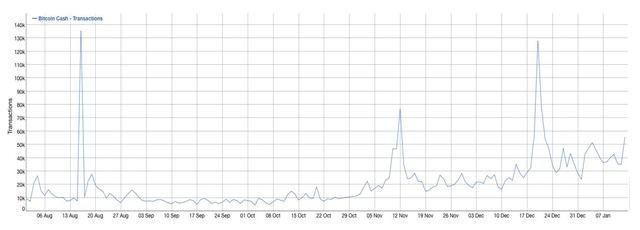

With fees so low, and the BCH mempool clearing so quickly many skeptics say the BCH network isn’t used much. However, the bitcoin cash 24-hour transaction rate has been climbing exponentially, and after six months of use, the network is close to being on par with the litecoin network’s daily transaction rate. In fact, the BCH daily transaction rate eclipses nearly 90 percent of the 1,300 other digital assets listed on Coinmarketcap.

Bitcoin Core: $15-50 Transactions at Any Given Time and Over 100,000 Unconfirmed Transactions Never Clear

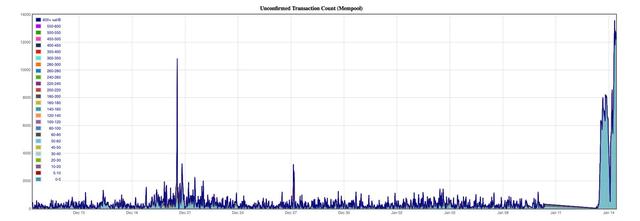

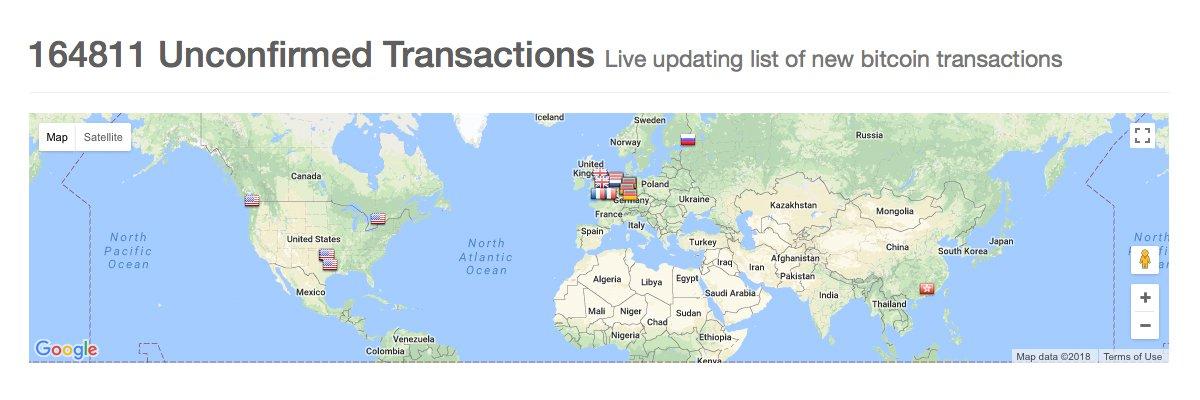

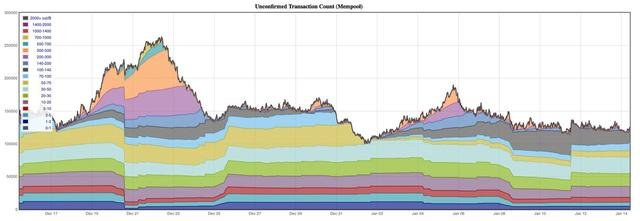

At the time of writing the BCH transaction queue has only 10,000 unconfirmed transactions in the mempool. Meanwhile, the bitcoin core blockchain’s mempool is full and has been for weeks on end. This weekend’s bitcoin core unconfirmed transaction count is considered low but still has over 157,000 unconfirmed transactions waiting to be processed.

Just 2-3 weeks prior, when the price of BTC was closer to $19K, those numbers were upwards of 250,000 to a 300,000 all-time high. At the time users were paying over 1,000 satoshis per byte, whereas at the moment most BTC users are spending an average of 500 satoshis/byte. This means using the bitcoin core network the median transaction size of 226 bytes results in a fee of 113,000 satoshis or $16 per transaction.

Multiple Inputs Make BTC Transactions Even More Costly

Over the past few weeks, the bitcoin core mempool has not dropped lower than 100,000 backed up transactions which has kept the fee market above $15 and upwards of $50 in some cases. Further, the $16 applies to only 226-byte transactions which typically have very little inputs. Bitcoin core transactions with multiple inputs (a feed of data) will charge a lot more for the fee, and some businesses are paying thousands of dollars to send funds. BCH transactions with multiple inputs and more than 226-bytes cost only a few pennies more to process.

According to Earn’s Fee statistics, the average fee for the bitcoin core network is $16 per transaction. Transactions bigger than 226 bytes and multiple inputs will cost more in fees.

A Great Example of Big Blocks in the Wild

The past 24-hours of big block mining has been a great example of seeing the chain operate this way. People can see how it affects the fee market, block intervals, and the processing of unconfirmed transactions in an on-chain environment. In addition to the bigger blocks since the hard fork, last November the BCH chain has kept an almost perfect profit parity with the BTC chain. This means the wild fluctuations between block intervals are gone, and miners are not bouncing back and forth between chains these days keeping things more consistent.

What do you think about bitcoin cash miners processing 2-8MB blocks over the past 24-hours? Let us know what you think about this subject in the comments below.

Images via Pixabay, Johoe’s Mempool, Bitinfocharts.com, Blockchain.info, and Coin Dance Cash statistics.

Have you seen our new widget service? It allows anyone to embed informative Bitcoin.com widgets on their website.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.youtube.com/watch?v=tRQFg4kTO3QDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit