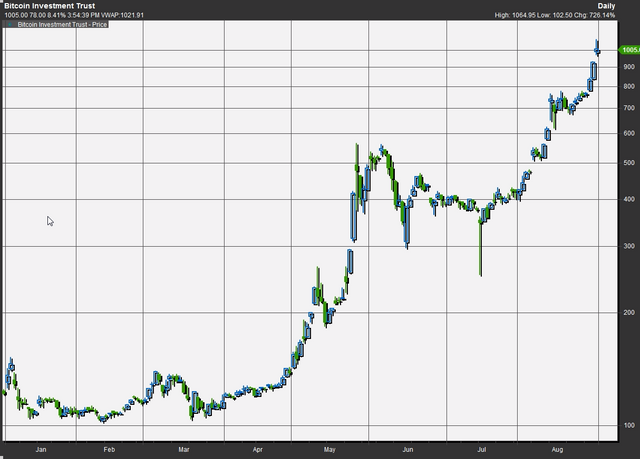

Bitcoin is up 400% this year but the Grayscale fund is up an eye-popping 726% so far this year, according to FactSet data:

Even though the Grayscale fund is more risky than Bitcoin!

The Grayscale has not even finished the process for registering with Wall Street regulators to trade on the New York Stock Exchange, and they don’t even have insurance for the Bitcoin that they are custodians of!

Bitcoin Investment Trust, which made its debut on the over-the-counter market in 2015, is a so-called open-ended trust and the first publicly traded bitcoin-related investment vehicle. Open-ended trusts can be bought just once a day at the market’s close, compared with exchange-traded funds that trade like stocks.

Grayscale’s fund has benefited from being one of the few investment funds that offers an opportunity to buy bitcoin without owning it directly from sites like Coinbase.com - but it is expected that other funds will enter the scene, which could put significant pressure on BIT’s price.

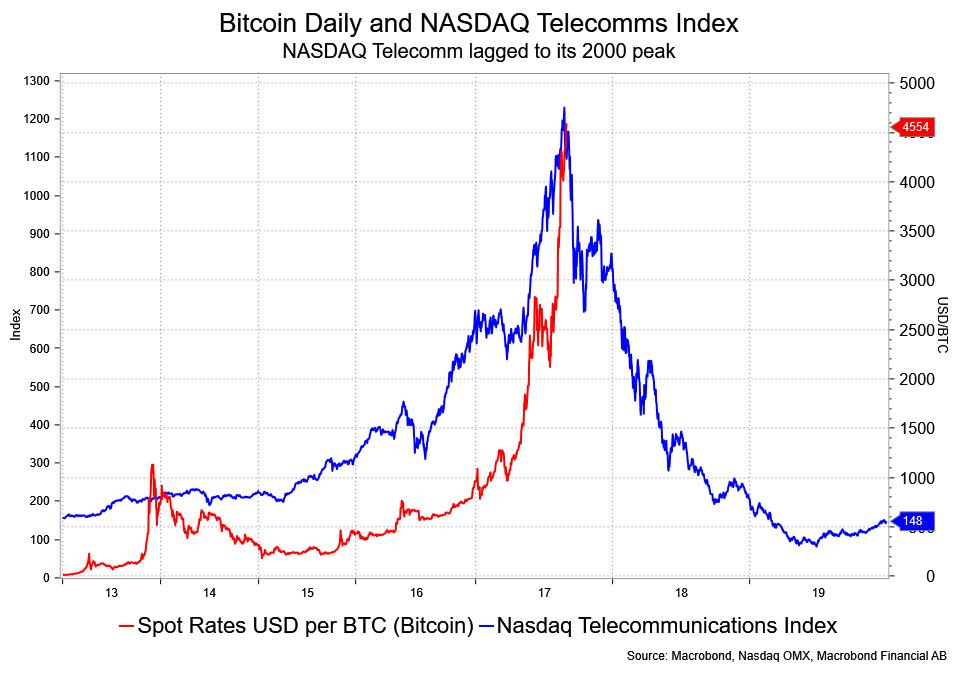

Many analysts say that Bitcoin follows the so called Elliott Wave model:

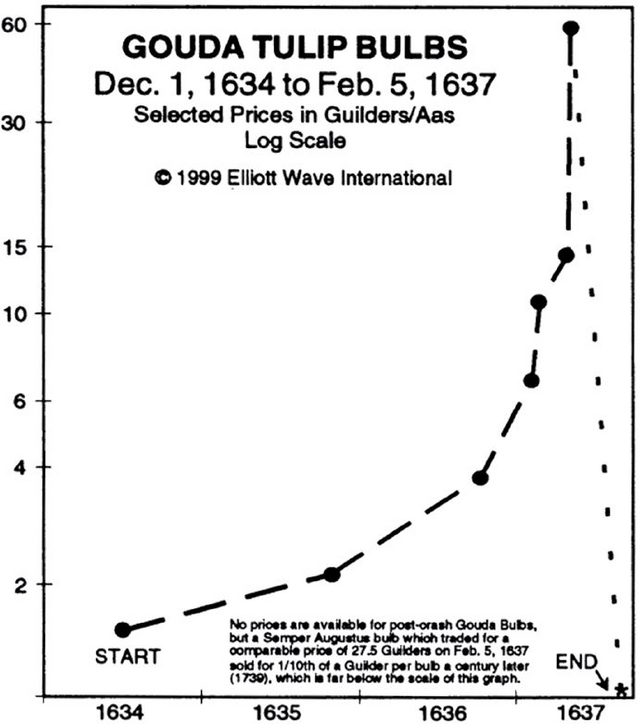

Bitcoin bubble already dwarfs tulip mania from 400 years ago, and look how sharp the decline of the tulip's bubble was:

As Investopedia tells it, tulip bulbs became such a prized commodity that by 1636 they were being traded on many Dutch stock exchanges and "many people traded or sold possessions to participate in the tulip market mania."

Also, bear in mind that just recently ethereum prices briefly plunged from above $300 to 10 cents on one exchange before recovering!

Bitcoins volatility also reminds me of the dot-com bubble, when one of the companies tripled the price of their shares overnight only because they... updated their website! And do you remember Boo.com who spent $188 million in just six months in an attempt to create a global online fashion store that went bankrupt in May 2000?

How often do you use Broadcast.com? Me neither - yet this is a website that was acquired by Yahoo! for $5.9 billion in stock, making Mark Cuban and Todd Wagner multi-billionaires: the site is now DEFUNCT. And if that wasn't stupid enough, CyberRebate promised customers a 100% rebate after purchasing products priced at as much as ten times the retail cost.

And what about Ethereum? Has it's rise not been impressive this year, with its market cap of €31.19bn?

Ehm... no, not really - Global Crossing's (a telecommunications company founded in 1997) market capitalization reached $47bn in February 2000 (almost twice the Ethereum's market cap in today's money) before going to ZERO in January 2002. And Geeknet went up by 698% not in one year, but in one day - and then it's price fell from $239.25/share to $8 - which is still not as bad as Tiscali - Italian telecommunications company whose share price rose from €46 upon its IPO in November 1999 to €1,197 in four months, and then fell to €40 in less than two months and eventually fell to €0.20.

So... nihil novi sub sole: