AssetStream is a peer-to-peer lending platform, hopping-on to solve an existing problem in Thailand created by lending middlemen. The mission of the company is democratizing the microfinance business and creating a trustworthy environment for both lenders and borrowers.

It has already established a working partnership with a key partner — Pico Finance. A company backed by the Thai government in the battle against informal loans in the country. This is a great start and gets the attention of the finance world in the region. There are other partners listed, as well.

The benefits for lenders are numerous. SMEs from different industries can be found on the platform, so a proper diversification is possible. The payments are monthly, so the lender can exchange the profits and withdraw it.

The benefits for borrowers are mainly the easier process of acquiring capital, without heavy bureaucracy and friction. AssetStream is even developing an automated matching engine, which will make the borrowing process almost instant.

When you are lending money, you expect passive income, i.e. your money to work for you. And not you being on the computer all day long browsing through different borrowers to choose the best ones. This is why the automatic matching engine, which will be provided by AssetStream is such a luxury.

As a lender, you will be able to configure the engine, giving it certain parameters — minimum credit rating of the borrower, for example. If there is a match in all the criteria specified, the loan gets executed. This way, you don’t need to be present and active on the platform, unless you want to cash out your profits. This is the way a lending platform should work.

In case you are more picky, the platform will allow you the manual option of choosing a borrower, as well.

What I like the most about AssetStream is how well every aspect of the project is explained. Having three different tokens is not an easy system to present to the mass user, but I needed just one read of the FAQ and everything became clear. The punctuality of the team with the ICO dates and crowdfunding rounds is also for applause. No delays, no changes in the tokenomics. Neat and professional work.

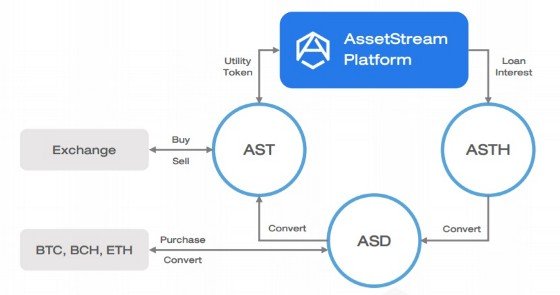

The platform is powered by 3 different tokens — AST, ASD and ASTH. Each of them has a different function, as shown below:

AssetStream's vision is to create a sustainable microfinance platform based on blockchain technology. Inspired by the "Year of International Microcredit" - dedicated by the United Nations in 2005 - and Muhammad Yunus, a Bangladeshi social entrepreneur who was awarded the Nobel Peace Prize along with Grameen Bankin 2006 "for their efforts through microcredit to create economic and social development from below "

The AssetStream Initiative was established to create a sustainable microfinance platform to enable growth and advocate for population poverty reduction that does not have a bank account while providing alternative, high-yield, peer-to-peer microfinance platforms for everyone.

Peer to Peer lending brings "the bank" to your doorstep.

AssetStream aims to reduce poverty and bring financial inclusion by providing people who do not have bank accounts with access to financial services. AssetStream will expand to a full P2P network that will include local communities who can take private loans. AssetStream aims to create a broad microfinance ecosystem that will be able to bring people who are excluded financially to the blockchain through a new global economy.

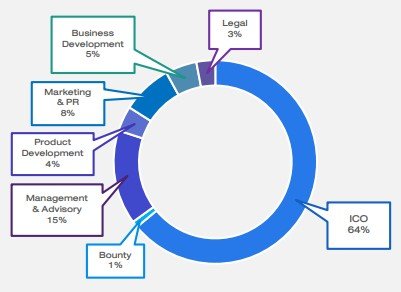

TOKEN DISTRIBUTION

ICO (64%)– All proceedsfrom the ICO sale will be kept as a backup in AssetStream platform and will be incorporated as a lubricant for the lending pool for Thailand market.

The total budget raised from ICO will set the maximum lending capacity of the platform to ensure that all tokens can be lent out at the same time.

At the same time the ICO proceeds will preserve the AssetStream Token (AST)value to be 0.01 * USD and doubles as a guarantee to the lender to reimburse the lender in case the platform doesn’t provide any feature that has been committed to by the AssetStream Team.

Management and Advisory (15%) – Tokens will be committed to hiring, maintaining and training staff to compete with the global market. These tokens will also be used to promote long term alignment with advisors and to support other operational expenses. These Tokens will be locked up for 1 year.

Marketing and PR (8%) – These tokens will be used to increase adoption and attract lenders and borrowersin new and existing markets.

Business Development (5%) – Tokens have been set aside for potential partnershipsto bring in participation from local governments and NGOs.

Product Development (4%)– External expensesincurred for the development and improvement of the micro-financing platform, mobile application, infrastructure and security.

Legal (3%) – Legal support in the creation of a legal entity and for the documentation of potential changes in legislation related to cryptocurrencies used in operational, marketing and business development activities.

Bounty (1%) – A portion of the tokens will be used to accelerate the growth of the community and assist in building awarenessfor AST.

TEAM

The core team is comprised of 7 members. All of them with solid previous business experience and connections. Highly professional squad, leading the project. All of them are verifiable on LinkedIn. The project has 4 advisors announced. The team balance is more towards the business part rather than development, but for a fintech project, this is understandable. The team seems to be fully engaged and occupied with the developing of the platform and the business operations, and they are not getting distracted with unnecessary marketing activities and hyping the project. The best projects like AssetStream don’t need artificial hype.

AssetStream is a platform that provides loans to individuals, businesses and organizations that do not have access to bank financial tools, which effectively reaches populations that do not have bank accounts. The AssetStream initiative is designed to combat poverty among people who do not have bank accounts by creating a peer-to-peer microfinance platform that will make lending easy and convenient to do.

To achieve this, blockchain technology has been relied on to create a transparent and easy platform that will make it easier for lenders and borrowers, effectively eliminate third party institutions, generate borrower-friendly interest rates and faster loan processing.

SUMMARY

Most of the time, when we look at an ICO start-up, we try to assess the idea and predict what the team will deliver. In AssetStream’s case, we already have the working product, the users, the lenders and the borrowers. We don’t need to predict anything, because everything is already here. And the project only gets better from now on.

FOR MORE INFORMATION:

https://www.assetstream.co/AssetStream-Whitepaper.pdf

https://www.assetstream.co/AssetStream-OnePager.pdf

https://t.me/AssetStreamBlockchain

https://medium.com/@assetstream

Author: han emily

My profile: https://bitcointalk.org/index.php?action=profile;u=979957

XLM address: GDJKLNZRPG3BZN3VANRDDX6AZXHCEZV46YKSDZ34TRA56GPRPFQXZKYS