Days after the record-breaking sale of Leonardo da Vinci’s Salvator Mundi at Christie’s New York for $450 million, Bitcoin hit an all-time high of over $11,000. While Bitcoin remains somewhat obscure to the wider public, the virtual currency is having a more and more “real” impact. Despite its volatility, the solutions that Bitcoin could offer to the art market might be very attractive in the (near) future.

If the art market experienced a positive return between April 2016 and April 2017 — with Impressionist art and contemporary art accounting for the highest annual returns of 10.5% and 7.45% respectively — Bitcoin has known a much higher surge; by hitting a value of over $11,000, the cryptocurrency’s price has multiplied by 1000%. Only artworks whose value exceeds $10,000 can compete with Bitcoin, as the evolution of the price trajectory for Salvator Mundi tells us.

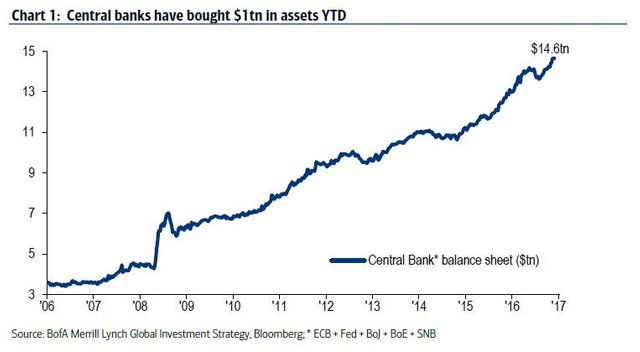

The high end of the art market and Bitcoin both soared in value at around the same time in 2010, but very different dynamics were behind their growth. Bitcoin is indissolubly linked with its political premise involving monetary freedom, the possibility of making transactions that aren’t controlled by the state or central banks and the creation of a decentralized payment system. On the other hand, the art world does not aspire to establish a new, global monetary system: it perfectly adjusts to the existing one. The growth of the art market stems from massive capital injections, which call for new assets with the prospect of positive returns.

As we approach the end of 2017, both the art market and Bitcoin have witnessed all-time records, but they are both responses to a global monetary system characterized by its programmed obsolescence.

Both fields are becoming more and more attractive to financial institutions worldwide. The Chicago Stock Exchange and the Nasdaq are preparing to launch forward contracts in 2018, whereas banking giants such as JP Morgan and Goldman Sachs have recently revealed that they are now holding cryptocurrencies as part of their offer, and they are both launching trading desks dedicated to them. Both also finance high-profile art world endeavours: art fairs for JP Morgan (Paris Photo) and Serpentine Galleries for Goldman Sachs.

However, different stances on power distribution and transparency continue the stark separation of the art market from the world of Bitcoin, although they are brought nearer and nearer together: increasingly, cryptocurrencies are calling for a system of semi-regularization, whilst new tools for greater transparency have begun to appear in the art world: Arthena or ARTIST PROFILES, to cite but two!

A fundamental element in the growth of Bitcoin was a soaring interest in ICOs — Initial Coin Offerings. The number of these crowdfunding campaigns, based on cryptocurrencies, soared to 2000 in 2017, as compared to some 60 in the previous year. This type of endeavour might soon lead to the creation of a cryptocurrency whose value is backed up by actual artworks, bringing the world of Bitcoin and the art market together.

With tangible underlying assets — both culturally relevant and ecological — art could, paradoxically, bring more confidence to a virtual, speculative universe. The fluctuations of a cryptocurrency of this kind would be regulated by the value of the artworks themselves through a smart contract. Thus, we’d have to be looking at typical art world issues, such as questions relating to the quality of artworks and their provenance...