A tumultuous period for Bitcoin in the last few days as our expectations of Bitcoin being labelled a "safe haven" asset has been re-asserted after a continued rise in price following the news of the Iran retaliation on US assets.

While a reversal scenario cannot be ruled out, it is important to understand that in the greater macro picture, the trend remains to the downside. And Bitcoin has to prove to us that the bulls are back in control and a reversal is on it's way.

Technicals would suggest that we have met a strong resistance in the 200 daily EMA marked by the dark purple line, and thus far serves as the resistance. In previous market cycles, we have had significant bounces of the order 5-25% following a 4 HR golden cross (50 EMA crossing over the 200 EMA).

As of right now, the 4hr golden cross from signal to the wick high is a tad over 9% which is well within the bounds of counter trend rallies during bearish markets.

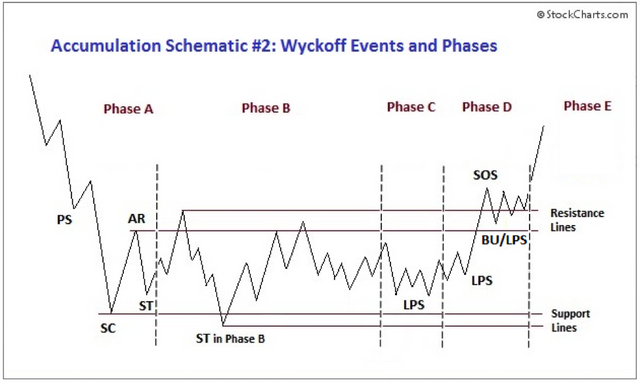

Some people have noted that we are in the "Sign of Strength (SOS)" point of a Wyckoff accumulation pattern, and as long as we hold above ~7650, the pattern is very much valid and in play.

A full on trend reversal still requires two things to happen.

- A weekly higher high (> 9550 on a closing basis)

- A weekly higher low (>6900 on a closing basis)

There remains a significant amount of work for Bitcoin to carve it's way out of this slump, particularly with about 5 months left before the halvening event. Whether or not the actual halvening will drive speculative front running of price remains to be seen, but we will be able to get ourselves into a trending market once the two conditions above are both satisfied. Patience is the key, and remember, STEEM is not a BUY until we're pushing 20k again on Bitcoin.

Another interesting asset to track is our time tested anti-fiat physical commodity bigger brother, GOLD.

Though there are no direct parallels between GOLD and Bitcoin, they are both typically anti-fiat assets which act as a long term hedge against inflation and depreciation of fiat currencies, in particular the US Dollar.

With surging equities, and gold making a decisive rip to the upside outside of the descending falling wedge/channel which it has been stuck in for around the same time Bitcoin has been stuck in it's own channel, we can start to see the two assets having a stronger and stronger relationship as the wider markets are back to risk on.

Counter to what a lot of people claim, a risk on market is vital to the health of Bitcoin, as large interests and institutional investors will not be as willing to commit capital in risk off scenarios to highly risky assets such as Bitcoin. If anything, they will go back to cash.

If Bitcoin was to follow GOLD in breaking out of the falling channel and making a higher high, especially the 11,500 USD level, then I would be confident in saying we will be testing the previous ATH in earnest shortly after.

Until then, the two conditions outlined above will provide us with the intermediate play.

Yeah, it's a good thing bitcoin isn't a safe haven because then we wouldn't see the price grow double digit percentages on daily or weekly timeframes.

Sure gold can 2x to 4x during a recession, but that's nothing compared to bitcoin doing 10x or an alt coin doing 100x to 1000x.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit