Hello friends steemians, in this installment we will continue with the explanation of how to make a basic trading that leads us to get the maximum possible profit to our investments, if you have not read the first two installments, here you can find them:

Once you have chosen the market and knowing the strategy to use, it is time to choose a point of entry, or if you already have your investment (STEEM, STEEM DOLLAR that you spent on steemit) and only want to get the most benefit knowing when to leave

To do this we must learn to identify the market trend, seeking to enter the exact point and time and get a trend that leads to the goal, or leave a previous trend at the most profitable time. our task will be simply to buy cheap, hold and sell at a better price.

It can be compared to riding a surfboard and running the waves.

"The bull markets are born of pessimism, grow with skepticism, mature with optimism and die with euphoria" - Sir John Templeton.

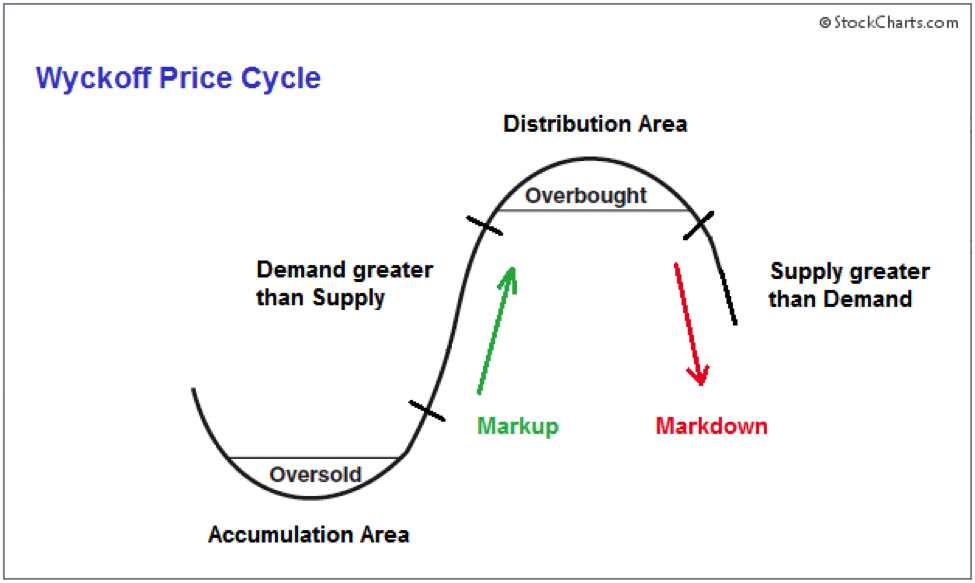

We will start from the premise that financial markets move in cycles. These cycles will be divided into 4 phases:

Accumulation, Bullish Phase, Distribution and Bearish Phase. We will explain each one, without extending much and in a rough way to keep the operation very basic:

Accumulation phase: begins after a bearish trend and is the point at which the most risky investors, begin to buy. Normally for having detected in the market a depletion of the bearish phase. At the beginning it is difficult to detect without having knowledge of technical analysis, but with time you will begin to be able to see the signals and identify them.

Bullish phase: In this phase the upward movement has already begun, and investors enter it who do not want to stay out of the market. We will leave it simple without more mysteries since we will operate in medium or long terms.

Distribution phase: This phase is characterized by the withdrawal of benefits from those who operated from the accumulation phase and those who entered the upward phase and determined the point of exit. It is a rather unstable phase in which any news can make the market fall, which, for the moment is already over sold. In this phase you must be careful, carefully check the market to avoid entering the purchase in it, which is the main mistake of unsuspecting investors.

Bearish phase: A market is bearish when new falls are reached in each fall and bullish corrections fail to reach the last levels of the previous correction. It usually forms in less time than it takes to generate the bullish phase, in it investors become pessimistic and doubt the strength of the market.

Until, as if by magic, the cycle begins to repeat, getting the market a minimum support and changing the accumulation phase in which it stabilizes to repeat the whole process.

If you are one of the few who arrived here, in the next installment we will see "Japanese candles" and put examples of entry and exit in real operations. Already quite close to you can operate in demo accounts we will see how to create one and how to start with it to do exercises without risking a penny. thanks for reading me

Congratulations @jfprodigy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jfprodigy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit