Following on from my first post in my new Cryptfolio segment, I’d like to introduce you to the framework I’ve created to aid my investment decisions; The Cryptfolio Matrix. It is largely based on the BCG matrix, which is designed to allow companies to accurately analyse and manage their portfolio of brands or business units. The BCG matrix contains two measurements; relative market share, which can be considered as cash generation ability, and market growth rate, which can be considered as potential for future cash generation.

The use of this matrix was really drilled into me at university, because at a quick glance it shows whether a company is focused too much on the present and too little on the future, or vice-versa. Whilst it’s perfect for representing a business-unit portfolio, one of the main problems is that an awful lot of research has to be done to accurately decide which stage a brand is in. For an in-depth explanation of the BCG matrix click here.

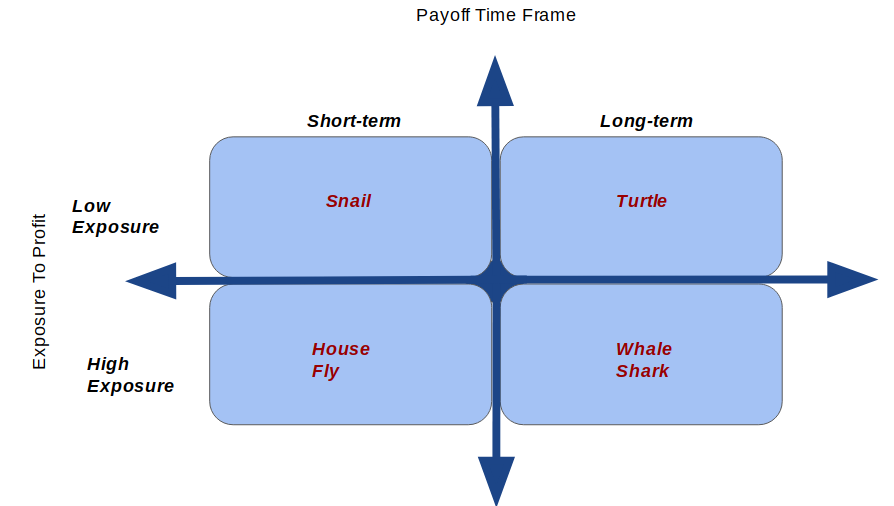

Right now that you know your stuff I’m gonna talk about my matrix, or the Cryptfolio matrix, as I like to call it. As I previously mentioned, it’s largely modelled on the BCG. However, the dynamics of the crypto industry are quite different from the stable, rational world of business. Consequently, I’ve altered the two measurements to reflect this, so that the measurements have now become payoff time frame, how long I’m expecting to hold the coin, and exposure to profits, whether it has potential for a huge profit return, this could also be considered as risk, especially in the short-term.

Here it is:

For those of you familiar with the BCG matrix you’ll see that, for simplicity, I’ve followed a similar structure in naming my categories. The main difference between the two frameworks is that whereas the BCG analyses brands or business units, the Cryptfolio matrix analyses investment moves, not necessarily the coin itself. I think this will be clearer after I’ve explained the categories so I’ll touch on this again later! I’ll quickly run you through the categories now:

- Snail: Snails are moves that I anticipate holding for a relatively short time and do not expect to see huge price swings from. Just a quick point here, short-term and long-term is hard to quantify in crypto where coins can see huge changes in price in a very short period (see PIVX in the last few months for proof!). So I really class anything less than 30 days as short-term, however, I advocate holding a few coins, such as Ethereum, for years, so in that sense short-term moves can also be considered as a few months. Snails are largely held to add stability to your portfolio whilst drip-feeding some value.

PIVX Price Chart courtesy of Coinmarketcap.com

- Turtle: Turtles are moves that I am aiming to hold for a few years and do not expect to see anything over a 3 figure ROI during this time (because turtles move slowly but live for a long time, get it?). A great example here would be some Ethereum or Bitcoin. Both have grown rapidly to date, but realistically, if you buy some now you are unlikely to see huge gains within a few years. Of course, people expect this coins to grow in value as crypto becomes more popular, but their current prices mean huge dollar movements can be relatively low % swings in relation to other crypto movements.

- House Fly: House Flys are investment decisions that I am doing for a short-term huge gain. Named due to a house fly’s quick erratic flight path, but their relatively short life-span. For example, I recently bought some additional Golem to add to my stack. With the upcoming release of Brass I anticipate a large price increase, but as soon as I hit a satisfactory ROI I will close this long and return to my usual position in Golem.

- Whale Shark: These are the really killer moves. The moves which I aim to hold for a long time but that I also expect to see huge returns from. Whale sharks can live for around 100 years, so these really are the moves that I want to make and almost forget about. For example, holding Bitcoin, Ethereum or Neo (formerly Antshares) as a pension plan, this differentiates from a turtle in that I would plan to liquidate a turtle within 10 years.

Going back to the point about the Cryptfolio matrix analysing investment decisions rather than coins, you can see that I have classified Ethereum and Bitcoin as both potential Turtles and Whale Sharks. Largely, I feel this is an important distinction to make because I feel that most cryptos will see a huge price increase over the next few years so analysis at the coin-level would see most placed as Turtles or Whale Sharks. Additionally, I feel that the big coins may not move by huge percentages (4 figure ROI for example) until we truly hit the mainstream, which for me could still a decade or so away. Importantly, I feel analysing at the coin-level would also limit your profit potential to long-term hodling value (nothing wrong with this). However, I don’t want to wait for crypto to hit the mainstream consciousness before I can realise my profits, consequently I thought the Cryptfolio matrix should focus conduct analysis at the investment-decision-level.

Everyone’s investment portfolio should be different, everyone has different needs and wants from their portfolio and investment decisions should reflect this. So some people may want to heavily skew their portfolio towards Whale Sharks, whereas others may prefer House Flys. I believe in stability and profit-protection, and so I have a bias towards the longer-term investments, however I hold a number of smaller positions in the Snails and House Flys to keep my monthly profit figures at a reasonable level.

How does your portfolio look using the Cryptfolio matrix?

This is part of a super regular segment I'll be doing, to make sure you don't miss out click through to my profile and follow me! Let me know in the comments below if you do, I'd appreciate it! Also, got any comments, questions or suggestions fire those at me too!

---

Disclaimer: For legal reasons, this is not intended as advice, I'm happy playing with fire with my own money, I do not by any means suggest you do the same moves I do. I will, however, be posting them, and the reasons here, and if you choose to follow me, then sweet!

Hi! I am a robot. I just upvoted you! Readers might be interested in similar content by the same author:

https://steemit.com/cryptocurrency/@jhcooper7/the-cryptfolio-matrix-a-matrix-for-analysing-crypto-investment-decisions

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit