Are you curious why the price of bitcoin dropped and then popped the last few days?

It really comes down to a couple things most likely:

Futures Expiration

High Short Interest.

Don't believe me?

Lets go to the charts...

Futures Expiration.

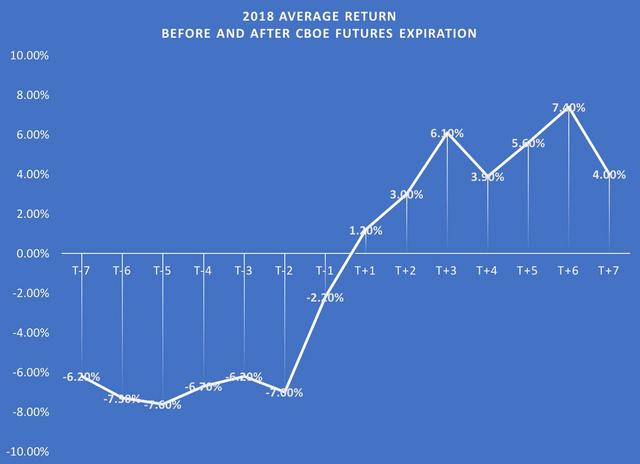

This is a chart of what happens to the price of bitcoin on average around the CBOE Futures Contracts Expiration:

(Source: https://cryptocoinreport.net/reasons-behind-the-crypto-bear-market/)

As you can see, prices tend to be quite weak on average during the 7 days leading into expiration.

Then, prices often rebound rather significantly during the 7 days after expiration.

Futures Expiration was yesterday, August 15th, by the way.

Now, this could all be coincidence, but thus far the numbers certainly point to a pattern taking place.

Another contributing factor is likely the high short interest.

Check out this chart from CNBC of the short interest listed on Bitfinex:

As you can see, the last time short interest was near these levels, the price of bitcoin reversed its downtrend and rallied roughly 50%.

Will history repeat?

I have no idea, but the setup is there for a nice move up over the next few days.

Based on the numbers and the charts listed above, the best move by traders would be to buy bitcoin about 5 days before futures expiration, and then sell it 6 days after expiration.

Stay informed my friends.

Follow me: @jrcornel

What we really need is a short squeeze followed by some really good news. I'm really surprised there hasn't been more of a fuss and price increase around the CXBTF ETN news.

I can go and buy into BTC through my E*Trade account right now, and the company behind the notes would then go buy more BTC, which is different than how GBTC works. That seems like a really big deal to me.

I would love to also understand how/why that is allowed without SEC approval where ETFs are not. It seems like this might help push ETF approval too, otherwise money will be flowing outside the US to invest in BTC through traditional brokerages. I could go on and on here!

One unrelated question - How often do the futures contracts expire? Is it always on the 15th of every month?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No. The next one is September 19th.

This looks like why it is not always on the 15th of every month:

"The final settlement date for "serial" and "quarterly" XBT futures is two business days prior to the third Friday of the month denoted by the ticker symbol. These final settlement dates apply regardless of whether one of the above-referenced Fridays is a CFE holiday."

http://cfe.cboe.com/cfe-products/xbt-cboe-bitcoin-futures

Regarding the ETN, I saw that news as well. Though are you sure you can actually purchase it through Etrade currently? Have you tried it yet?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I transferred most of my money out of E*Trade a while back into my crypto IRA, but i had about $70 left in there so I just bought 2 shares of CXBTF and can confirm that you can actually purchase it!

Regarding the futures expiration, I'm guessing they always do it on a Wednesday maybe? I'm guessing this pattern won't continue for too long once people start anticipating it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I edited my above response to include the reasoning. :)

I just picked up some CXBTF in my self directed IRA via Etrade. Thanks for the reminder!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

help me i am new in here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you not worried about price slippage from having so many currencies involved? Sounds like a nightmare for the ETN to convert between USD, Krone and BTC.

I will just stick to buying BTC directly, I am not scared to hold the private keys. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It makes sense to buy in an IRA. Outside of an IRA buy the bitcoin directly. There really are only two products to buy bitcoin in a US based IRA currently, GBTC and now CXBTF. The premium in GBTC is likely to start dropping out as more products become available.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@yabapmatt the money flow is indeed key. If brokers and institutions see money flowing away they will press SEC to let them open up show, i.e., ETF's or items similar to what you purchased.

I'm gonna go check my schwab account and see if they have something similiar to e*trade.

P.S. - great work on steemmonsters with aggy! I'm sure aggy tried to drag you on air enough but you are welcome to come on my music and money show sometime. :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would be happy to come on your show sometime! PM me on discord and we can work out the details!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow, I just looked into this CXBTF ETN, I was unaware of it before your post. This is fantastic news. I only hope that interested investors are financially literate enough to be aware of an exchange-traded note. With enough volume this could really bounce BTC's price back into the $8,000 or more within the next few weeks and perhaps days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's the market. It goes up and down. That's what it does.

This is normal and to be expected.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, but there are often catalysts for what drives this price action. Sometimes it is good to know what is causing it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes, but manystill ignorant about the cycles. the fluctuation is expected but people are whining much about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i'm sure the price will go up again soon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, if history repeats, it "should" go up over the next week or so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Purging is almost done. Big whales is ready their cash to swipe the whole market soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article. Thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope you are right @jcornel 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Am I ever not?! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Short sellers definitely still have a disproportionate hold on the market right now. With the lack of institutional investment large enough to counter the multipliers in favor of the shorts, the price will likely stay depressed. Although, increased OTC markets especially in Russia and other emerging markets - Turkey, China, Eurasia, etc, - may be a boon for Bitcoin in the near future with economic depression. Larger institutional investment coming from the developed markets, mainly the United States, will have the greatest impact on BTC and other large cap cryptos and their projects.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

While that may be true, keep in mind that if enough buying does come in to force short sellers to cover their positions, the resulting move up will be larger than it would have been had there been no short sellers to begin with. While they are annoying, they also provide some kindling to launch us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, the shorts could really take it hard if bitcoin swings the other way. Good for long-positions like mine. Not to speculate too much, but whats the outlook for the market if the shorts do have to buy in order to cover their wrong pays? Likely more than the 50% rally the market saw after the two spikes in shorts-volume - maybe 2-300% this time around with good institutional news from the SEC maybe?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Honestly I am not sure, it all depends. If there is news of a physically settled ETF being approved, I think bitcoin easily goes back to the highs. However, without that news it may be tough sledding in the short term. We need some sort of catalyst.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

CXBTF ETN just went live for traders in the US. It used to be bought only with Swedish krona, leaving it pretty much unavailable to the average US retail investor. But now it can be purchased as an exchange-traded NOTE, instead of a fund. What do you think this does for the market now?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is pretty bullish though it seems the market is not seeing its merits just yet.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting data. We will see

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jrcornel what is your prediction about other ALT coins

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jrcornel I think it's all because of Future Contractions. but It's quite tough time going in Crypto Market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The data shows they are possibly part of it for sure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had a lurking suspicion that this was in fact the case. The short-squeezing is becoming a little too obvious because we get INSANE volumes in very small time frames. I was watching the charts the last time we had a little pump from $6,100 to nearly $6,500 and it happened in about an hour total. The low liquidity and immaturity of these markets is very apparent still.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, there were even some rumors that tether was being manipulated again to cause a short squeeze. I am not sure what to believe regarding all the tether rumors to be honest. If it was as bad as some claimed I would have thought it would have collapsed by now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No one knows...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm still on the hook for a 10k price for btc this month. This is testing my nerves. It's more for curiosity now than money, as I feel I'll likely lose the bet at this rate. But hope keeps me glued to the price ticker.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well if bitcoin can follow the above futures expiration related trend, and best its average returns due to increased short sellers, you still have a shot :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I feel you are quite accurate @jrcornel

It's worth it trying this pattern and test it. You never know what awaits as a surprise

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really ! No one knows what will happens.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great stuff. It's bad that a whole bunch of cash settled futures can control an entire market which is rather small. It's really weird that these have been approved by SEC while ETFs haven't...

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree. It is also strange that they have this much of an affect on the markets considering they are cash settled. Though I guess one could buy the cash settled futures and then manipulate the spot markets to make their futures bets pay out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. And worse, you can buy an arbitrary number of cash settled futures (as long as there's somebody on the other side of the deal) as the amount of future positions doesn't have to be backed by actual Bitcoin - unlike physically settled futures.

I suppose the actual market for Bitcoin is much smaller than everyone thinks, I mean in terms of the number of participants in it and the percentage of Bitcoin used to keep the markets running.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep. It is ironic, not only are bitcoin futures derivatives, but since the current ones are cash settled and based on the price of bitcoin only (not the underlying bitcoin), it is almost like they are a derivative of a derivative... lol what could go wrong buying a derivative of a derivative?!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope so

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin is really expensive. But it is decreasing day by day

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Futures Expiration of contracts are a huge thing no one is giving attention to that its the main reason for all these up's and down's now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Es fascinante y intrigante la situación del mercado actual.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit