Bitcoin cash price went on a tear heading into the weekend, buttressed by a surge in Korean exchange volume, mining profitability parity with bitcoin, and an impending difficulty adjustment.

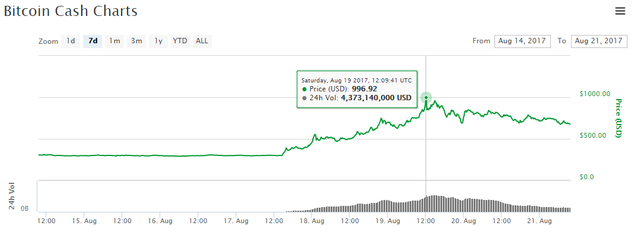

These factors converged to shoot the bitcoin cash price from $300 on August 17 to as high as $997 on August 19. This gave bitcoin cash a market cap of nearly $17 billion. For comparison, bitcoin’s market cap was $17 billion as recently as February

However, for reasons discussed below, the bitcoin cash price was unable to sustain its record advance and cross $1,000. Shortly after hitting $997, the bitcoin cash price began to slide, and it continued that downward movement on Sunday and Monday. In the past 24 hours, the bitcoin cash price has fallen by 18% to a present value of $665 and market cap of $11 billion. Nevertheless, this represents a 7-day climb of more than 115%.

Difficulty Adjustment Leads to Surge in Mining Profitability

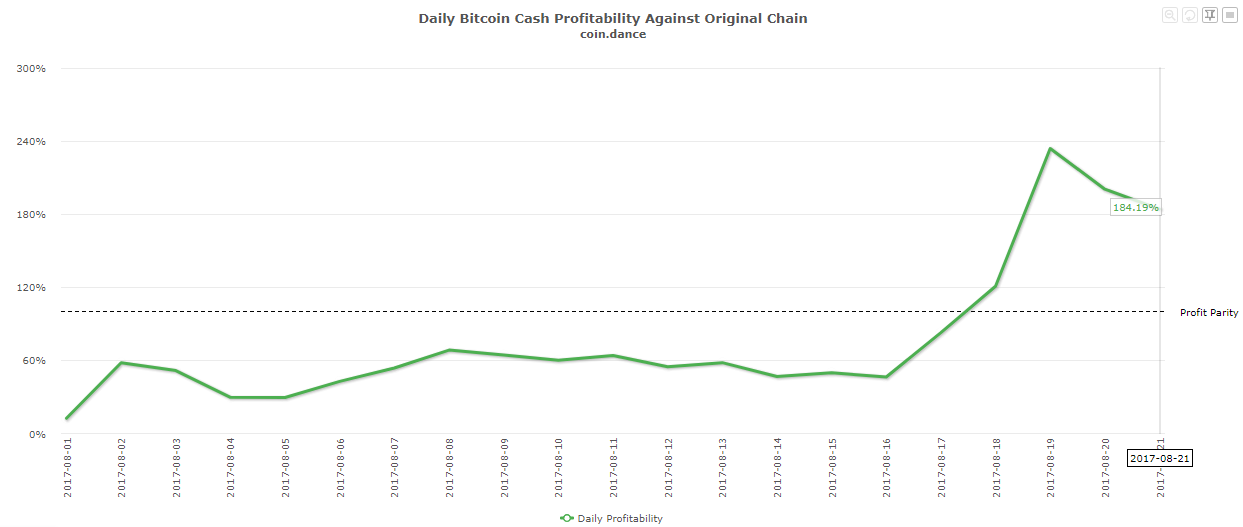

The bitcoin cash price rally made bitcoin cash more profitable to mine than bitcoin as early as Friday. That profitability increased on Saturday, when bitcoin cash’s network difficulty adjusted down to 7% of the main bitcoin blockchain. The difficulty adjustment caused BCH mining profitability to soar to even greater heights.

At one point, it was 234% as profitable to mine bitcoin cash as the main bitcoin blockchain. Even after today’s bitcoin cash price dip, BCH remains 84% more profitable to mine than BTC.

AntPool Begins Mining Bitcoin Cash

This surge in profitability convinced some miners to move a significant amount of hash power over to bitcoin cash. Within a matter of days, the hash rate increased from about 400 Petahash/s to 1.6 Exohash. This new group of miners includes AntPool, which has found more than 6% of the last 144 blocks.

Difficulty Set to Increase

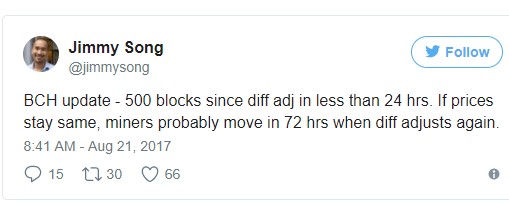

However, the increased bitcoin cash hash rate means blocks are now being found every few minutes. One recent block was only 0.19KB in size. Consequently, many people expect the difficulty to adjust again, making it harder to mine bitcoin cash:

This, in turn, should make bitcoin cash less profitable to mine and cause miners to switch back to the main blockchain (at least temporarily). Of course, if enough miners leave the network, it could trigger another difficulty adjustment. Anticipating this volatility, ViaBTC announced a mining service that will automatically put users on the most profitable chain.

The anticipated difficulty adjustment is likely putting downward pressure on the bitcoin cash price since many traders can currently sell their coins at a significant profit and avoid the uncertainty that will accompany a rapidly-swinging network hash rate.

DISCLAIMER'- Cryptocurrency trading Business risky business Loss and Profit both doing your own Responsibilty.

Sometime loss and sometime profit,

I'm not responsible for your any loss...

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=133995988

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @kashyap! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit