Those who read from this blog already are aware of this blog's view of most social media trading analysis. Those who follow them mostly lose money compared to just buying and holding based on fundamental value analysis. An informal survey of cryptocurrency holders who follow trading analysts shows that many are losing to a simple strategy of simply HODLing bitcoins. What this means is that if you've been a crypto-investor for about a year and bought bitcoins in March 2017, then your investment should be worth about 10x in USD today. If they are not, then you are actually falling behind a HODL strategy. You are also likely doing worse than those that HODL other promising and/or useful assets in that span.

Much of the time the best strategy is to hold. Those who held through the 80% drop in 2014 are ahead today by about 10 to 12x. But then you got late into cryptos and you see those who did early and held back in 2011, 2012, or even 2016 and they are whales today. And you want to catch up some. So you follow trading analysts, day trade, margin trade, and fall further behind.

It might be wise to find assets of fundamentally strong value, analyze and understand them well and what gives them value, and then invest and hold (such as Steem, Dash, or ETH). This blog will be looking at some of those. Those solid picks will provide opportunities to potentially beat gains in simply holding bitcoins. And bitcoins itself still likely has much room to grow in the medium term.

But You Still Want to Beat Simply Hodling

Maybe there are some things you can also still do to accelerate your portfolio gains. This series will also be looking at some of those. The first one in this series will be burn tokens based on a real product and actual value. Burning of valuable tokens on a schedule reduces the supply. And this is an act of fundamental value that increases price (see prior articles for how this has been shown with data in the past.)

The Binance Token - Potentially Nearly Triple Your Holding Within About Two Weeks

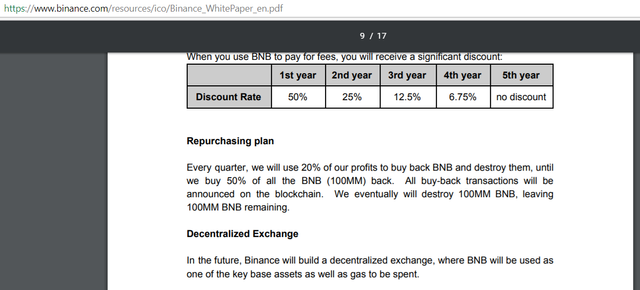

This is a token with actual utility. Its use reduces fees on the Binance exchange significantly. So no serious investor on Binance would be buying or selling any asset without using that token to pay the fees. And Binance is the largest cryptocurrency exchange in the world. So yes this token is not like some ICO promising some product. This token has utility, and significant demand.

Source: Binance White Paper.

End of October 2017

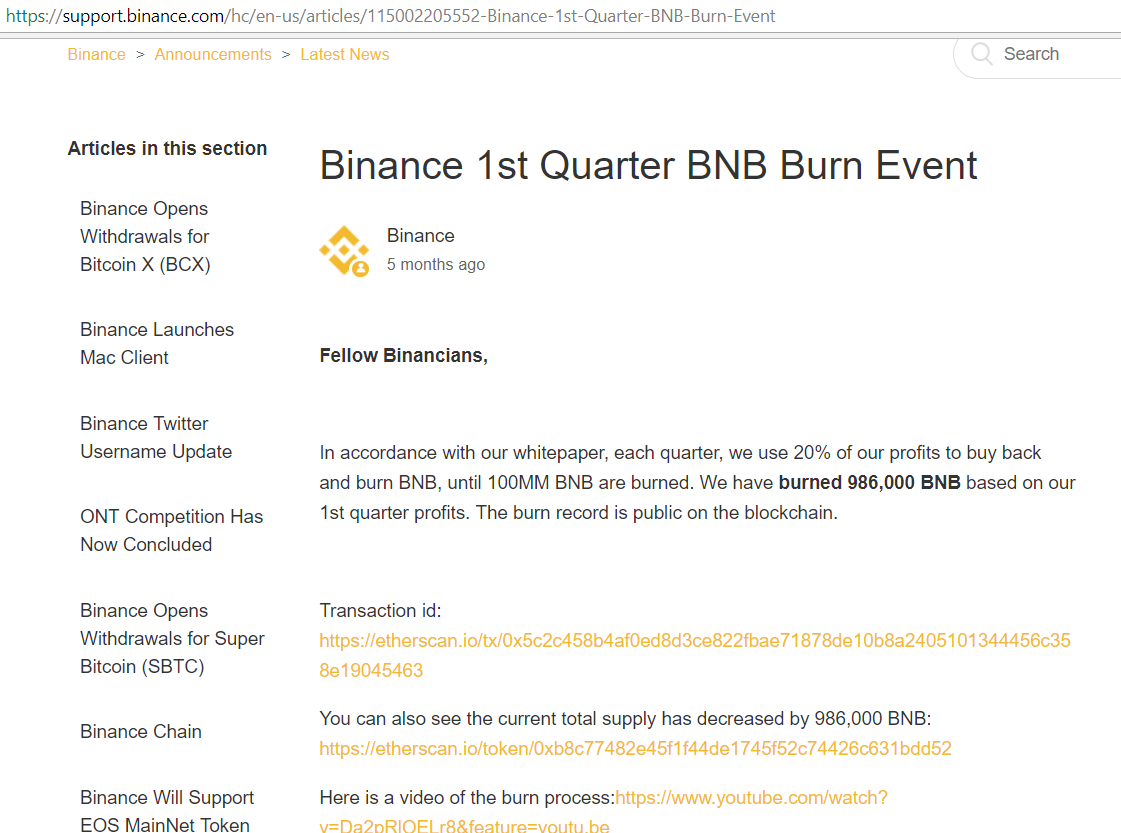

Now based on Binance operating white paper, every quarter they burn a good portion of the token. In the first burn event at the end of the 3rd quarter 2017, 986k tokens were burnt:

Source: https://support.binance.com/hc/en-us/articles/115002205552-Binance-1st-Quarter-BNB-Burn-Event

And here was the price reaction through that event:

Source: Binance charts

There was about a near 3-fold increase from shortly after the middle of the last month of the quarter to about 3 days after the end of the month, where the price progressed from about 0.0025 to about 0.0065 per ETH.

End of December 2017

The next burn was at the end of December 2017 when 1,821,586 BNB were burnt:

https://support.binance.com/hc/en-us/articles/360000012892-Binance-Coin-Burn-in-2018-Winter

And here was the price reaction through that event:

The price progressed from about 0.0065 around Dec 15th to about 0.023 by Jan 3rd 2018; a nearly 4-fold increase. Granted everything was also going up through that period, which should be factored into correlating the burn.

End of March 2018

The next burn is slated for the end of this quarter. It is likely already in progress as we see the usual rise that begins to occur as the token buy back begins to occur. And this is in defiance of the mostly downward swing of bitcoins the past few days! (In addition, Binance did also announce that they will be creating their own blockchain which could also have played a role in driving the price during this period.)

Warning: Past performance is no guarantee of future performance. A complete crash of crypto prices for instance, or any other event or even a none event could depress demand and cause the supply burn to not have as effective an increase in price as in the past.

Bottom line is this is a worthy potential to look forward to while trying to boost a portfolio without following analysis that are not based on fundamentals and actually are mostly wrong these days. As usual, be careful and don't go all in on any one strategy or asset if you can help it.

This post will not be promoted much. This is a reward for those who follow this blog. To incentivize such content simply upvote it 100% and resteem it. And engage in comments below - that is the reward to this author. Let me know of any strategy that you are employing that is currently beating a passive bitcoin hodl strategy, if any. All related comments are upvoted - you will see the same in all my other articles. Let's have an exchange and some intellectual fun.

Oh and if you resteem this article you get 100% upvote as well.

References

Binance White Paper: https://www.binance.com/resources/ico/Binance_WhitePaper_en.pdf

(For more due diligence)

Other Articles by the Author

Mar 17 2018: Lightning Was Released This Week – What Will be the Impact for the Bitcoin Network and the Cryptocurrency Market?

https://steemit.com/bitcoin/@kenraphael/lightning-was-released-today-what-will-be-the-impact-for-the-bitcoin-network-and-the-cryptocurrency-market

Mar 16 2018: Social Media Trading Analysts Are Likely Mostly Doing a Disservice to the Blockchain Community

https://steemit.com/bitcoin/@kenraphael/social-media-trading-analysts-are-likely-mostly-doing-a-disservice-to-the-blockchain-community

Mar 09 2018: Blockchain Technology Potential (Series 1) – A Review of a Recent PAYPAL CryptoCurrency Patent Filing and What It Means for the Future of the Technology

https://steemit.com/bitcoin/@kenraphael/blockchain-technology-potential-series-1-a-review-of-a-recent-paypal-cryptocurrency-patent-filing-and-what-it-means-for-the

Mar 07 2018: Audit the Teths – A Macro Case for Why Tethers Need to be Audited for Confidence to Return to the Market

https://steemit.com/bitcoin/@kenraphael/audit-the-teths-a-macro-case-for-why-tethers-need-to-be-audited-for-confidence-to-return-to-the-market

Feb 24 2018: A Review of a Few Fundamental Metrices that Drive Bitcoin Value and What They Currently Indicate

https://steemit.com/bitcoin/@kenraphael/a-review-of-a-few-fundamental-metrices-that-drive-bitcoin-value-and-what-they-currently-indicate

Feb 17 2018: Bitcoin Has Not Yet Fundamentally Recovered At This Time – A Mathematical Case

https://steemit.com/bitcoin/@kenraphael/bitcoins-have-not-yet-fundamentally-recovered-at-this-time-a-mathematical-case

Feb 12 2018: There is Little Chance Bitcoins can Sustain any Real Recovery Until This Fundamental Metric Begins to Turn Upwards Again

https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again

Feb 09 2018: This Single Metric Seems to Correlate More with CryptoAsset Values The Past Two Weeks Than Most Predictive Methods

https://steemit.com/cryptocurrencies/@kenraphael/this-single-metric-seems-to-correlate-more-with-cryptoasset-values-the-past-two-weeks-than-most-predictive-methods

About the Author

Ken has a doctorate in Engineering, and a master’s in Computer Aided Engineering, An IT professional, programmer and published researcher with over thirty publications in various fields of technology, including several peer reviewed journals and publications.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Upvote/Resteem/Comment. All comments are upvoted. Everyone that resteems gets a 100% upvote on comment here or their own blog. Let's start a conversation and discuss strategies in these series.

Resteemed and upvoted.

Good catch. Not much of a BNB investor, but for traders it is a must have, and if there is an investment opportunity, it may be worth it.

However, I do think it is important to note that BNB got pumped the last few weeks, after binance advises that would be doing an ICO... could be over bought by now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed although what they announced was that they would be creating Binance chain. Not an ICO (https://support.binance.com/hc/en-us/articles/360001668872). I'd wait for next quarter at this point based on its current levels as it has seen a near 3-fold increase the past few days already. But this is a good time to observe and plan a strategy for the next burn event.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TBH, I just started looking closer at the Binance coin this week - I do most of my trading on GDAX/CoinBase as of now.

I have a ton of time on my hands, as I am not currently employed. So, I can sit and watch the BTC impulses on the 1-minute chart. I've made about 30% profits over the last month - while BTC has been in a pretty major downtrend. Of course, trading costs are higher - but it's really not all that hard to do, if you take the time to devise your own trading strategy. Of course, not everybody has the ability to do that - and I'm not about to try and start "giving out advice" to people when I'm poor as $#!t, myself. But, that circumstance is about to change, I think.

I am seriously considering buying into the Binance token and using their exchange because I want to get my hands on some EOS tokens as well.

Upvoted and Resteemed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Be careful with Binance - their withdrawal fees are eyewatering. That's fine for those who trust exchanges and are happy to keep their coins there

But for those who like to withdraw to their own wallets, the exit fees are painful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 100%. Thanks for the comments, and service! And good that you are able to eke out 30% gains in this market. If anything I publish even helps more in that regards it would be worth the time spent on these articles. And you might find that your strategy is sound even though you might not have that much capital to commit to it yourself so do share if you can. Followed back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanx for info, but BNB is already almost on ATH...let's see what will happen

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed. This is a good time to observe and plan for the next burn event. It probably only has so much more room to run on this round.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm trying to learn as a beginner. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Check out our profile the @accra community has many things that a beginner would benifit from!

🖖

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Had no idea burning was behind the jumps in BNB price. Looks like its time to grab some bnb before the brun happens!

This is a great idea for a company! Are there any others with simular activities that you would recommend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is already likely happening and is price has appreciated much since March 15th. Much of its rise may have taken place so probably a good idea to observe this burn and position for the next. There are other strategies that are still upcoming in this series.

And by the way, its not totally new and also practiced in stocks where companies do buy backs to increase the values of their stocks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah thanks for the advice. I will do some research to be in positio. For the next one

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wonderful

Bitcoin very nice

100%upvot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What do think about BTC price next week @kenraphael ??? I want to invest but I will wait exactly time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do not predict prices. Nor offer financial advice so do not take anything here as such. That would be doing the same as chart readers do - which is a practice I frown upon. For fundamental value, I'm using the indicator introduced here as a guide:

https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again

The demand side still looks weak and I doubt without the additional 3m tethers recently minted it would even be at this level. I'm waiting to see after tax refund season (middle April) if true demand returns to tell how many more months the sideways and lower prices would continue. But it would definitely end.

A good idea might be to simply get in at one of the lows at good value. I don't think there is not that much difference from a risk-reward viewpoint between getting in at 6K or at 4K by the time it gets to 20K or even 50K if you believe that's where its going. And then maybe use some of the more sure accelerating strategies along the way such as the one discussed here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a very informative post. I didn't realize the utility associated with the Binance coin. Thank you for providing this information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice tips, understand the cryptocoins you are in and master how it behaves!

Thanks, will do it then.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks mate, I have heard it said that coin burns create a surge in price action, but didn't think to study the correlation between burn events and the charts. Will definitely set up a Coinigy chart for BNB to monitor price performance in the upcoming burn!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're very welcome. I like what they did on Coinigy. Particularly using the github contribution rate as a fundamental metric that could tell to some extent how a project is progressing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am happy to see, read and enjoy your post amazingly innovative. Thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

lets burn somethings

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

:) pls don't burn anything you or anyone else would need.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

excellent post about bitcoin and crypto. thanks for sharing your valuable post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is Binance's own pumper coin :)

You can guess the price on BNB tomorrow at @dolphincontest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have valuable piece of information.You can follow me too to get detail review of new ico in the market like Forty Seven.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted but sorry I will not be following for such info though. Over 96% of ICOs are junk in my estimation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello dear . i am happy to your advise for bitcoin . i will wait for next advise .@ pakhi

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post is resteemed and upvoted by @bestboom

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have you looked at iconomi? they do something interesting. every one who buys ICNs (their own cryptocurrency) from them become shareholders. iconomi pays you dividends in a different way and that is by increasing the value of the ICN you hold everytime a buyback happens. so whenever profits occur, they buyback and burn ICNs thus upgrading the value of all ICNS that are still owned at that time

In terms of circulation i believe they have around 100 million coins. What is your take? this seems to be a strategy that is gaining ground

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I Like It 😊🎵🎧

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post is resteemed and upvoted by

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @kenraphael! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for heads up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks your informations

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post!

i hope bitcoin will go rise!! :D

https://goo.gl/43ikcJ

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People who liked this post also liked:

Ezira Hangout #1 | Ezira: State of the Network | 2018-4-1 | 1PM UTC | EZIRA prizes by @dahaz159

The Current Facebook Problems With Selling Our Personal Information Is Resonating - Good Opportunity to Push Steem Platform by @migosia

Bitcoin's dirty secret: Disgusting images found on the blockchain? by @cryptonomics1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We are a Personal Financing Lending Platform that’s currently in Pre-ICO stage!! If you think this will help you then please hit that follow @twq-ip2pglobal or at least an upvote🙆♂️🙆♂️🙆♂️!! Thanks and happy steeming

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Resteemed and upvoted, because like usual it’s a well written piece.

Day trading is like constant gambling, the graph analysis cannot predict the news.

Some gamblers do however get lucky, by for instance going short in the 20k to 10k dollars crash of bitcoin.

But for most people I would agree that HODL is the best tactic for long term growth.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @kenraphael!

Your post was mentioned in the Steemit Hit Parade in the following category:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post @kenraphael

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wonderful information, thanks for your post @kenraphael

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So you guys don't like transparency, I guess? Wow decentralized blockchain, but actually it's quite censored and centralized around here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Take a look @spaminator, she puts out extensive lists, too.

If you make the bot, i will autovote it something because i want access to the data.

Make a list of the top >20 votes to auto comment, make the post comprehensive, maybe updating through the day like @abusereports does, and maybe you wont get flagged into the negative where it wont matter what you do, nobody will see it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, they dont like competition that is for sure.

Do you have any links to what you did to get on the list?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah sure, I could include links to the original transactions to bid bots and vote selling services. And maybe publishing a daily top list of bid bot abuser might be a good idea instead of commenting. Anyway, I just saw @transparencybot and got a bit motivated to resume my operations. I'll think about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good deal, the more light shined on the abuse of the insiders the better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit