Bitcoin continues short-term growth with a target of $ 12,473. During the last week, the situation has not fundamentally changed.

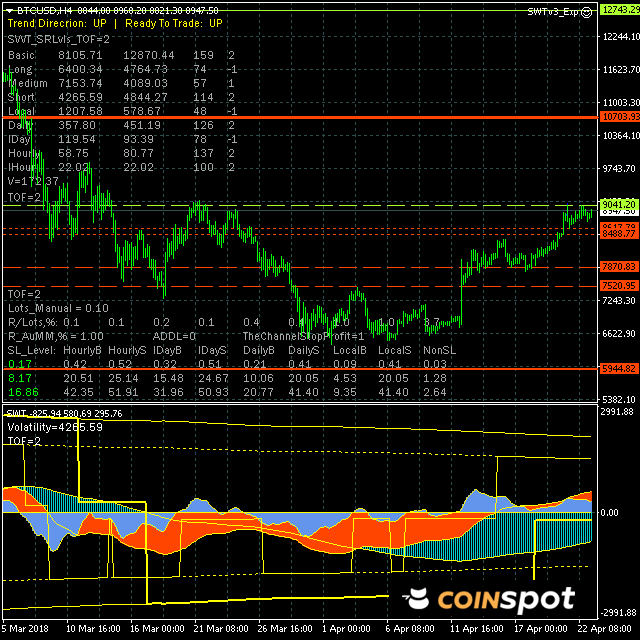

The long-term trend remains in the correction phase to the downside. In the medium term, there is an upward correction in the channel of $ 5944- $ 12 743, within which the short-term growth of the market continues with the objective in the upper edge of the channel.

The market growth during the week was determined by a local trend (the red histogram of the H4 chart) with setbacks in the daily cycle trend.

In the growth process, the market formed a local resistance at the 9041 level, from which it began a lateral correction in the key channel of the daily trend $ 9617- $ 9041.

Advance key upper limit of the channel will continue to apply the short-term growth scenario for the purpose at the level of $ 12 743, a break of which will continue to have quotation growth in the medium-term trend for the purpose at the level of $ 14 065. This scenario remains a priority.

Breaking the lower limit of the key channel will extend the correctional rank to the local support level $ 7870, but this option is unlikely at the time of programming.

The commercial tactics remain the same. We maintain long positions with a short-term objective at $ 12,743, adding backward purchasing volumes to increase intraday trend trends and partially set the gains at intermediate market highs.

Deferred orders can be purchased in the support range $ 8488- $ 8616 and in the rest of local resistance 9041.

Levels of resistance: 9041, 12743, 14065, 19421.

Support levels: 8617, 8488, 7870, 7520, 5944.

@cooperdoran thanks for you vote bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit