As we all know, oil was the most important economical factor for governments and countries in the past century. Well, the game is about to change now!

V.S.

V.S.

At the beginning of 2010, you could buy more than a thousand bitcoins with a barrel of oil.

Today, one bitcoin is worth more than 55 barrels of oil!

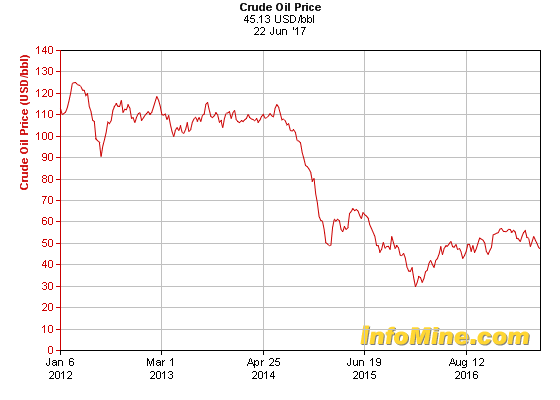

The price of one barrel of crude oil have decreased since 2010

However, the price of bitcoin keeps rising

THE QUESTION IS: WHICH ONE HOLDS THE KEY TO THE FUTURE?

According to some research, the world will run out of oil in the next 50 years. But mining bitcoins can last until the next century. So we will actually run out of oil before we run out of bitcoins to mine.

-Will the governments switch to mining cryptocurrencies in the future?

-Do we know for sure which one will lead the market in the future?

-What happens when we run out of oil or mining?

Tell me what you think in the comments!

US Congress Introduces Money Laundering Act Criminalizing Digital Currencies; Requiring the Reporting of all Digital Currencies and Cash to Local Banks, e.g. Steem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Experts are saying that oil prices will never get back to 100 USD/bbl so in my opinion its better to invest in bitcoins

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with you 100%, more renewable energy are been discovered day by day, so demand for oil will decline which will affect the price

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bitcoin good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit