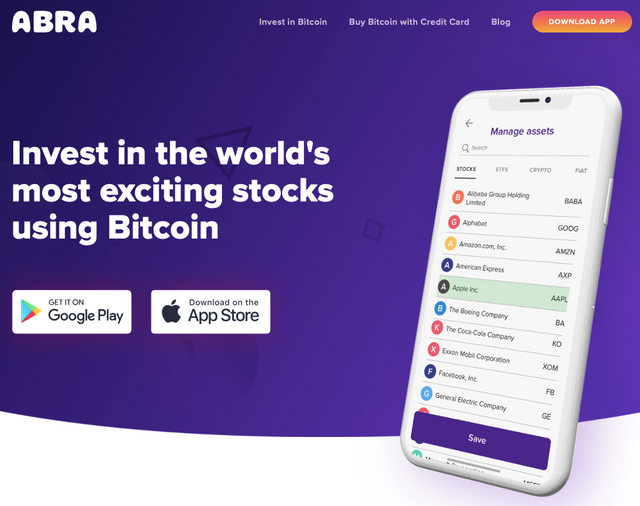

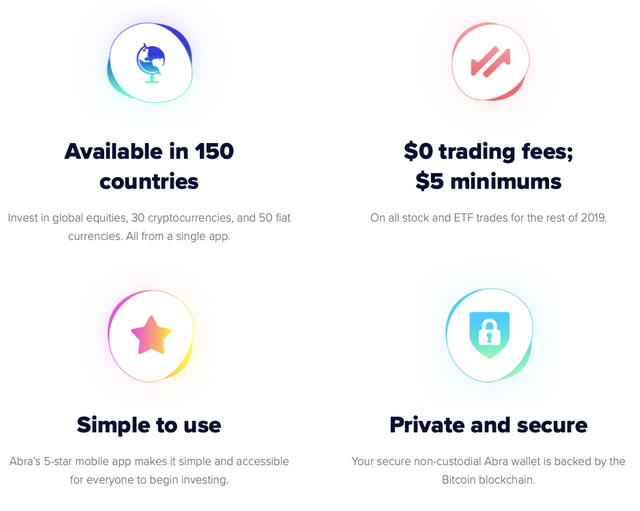

Abra is one of the most exciting projects in the Bitcoin industry. They have figured out a way to create synthetic assets using Bitcoin. This means that Abra is able to create a synthetic version of EVERY LIQUID ASSET IN THE WORLD. Synthetic cryptocurrencies, fiat currencies, stocks and ETF’s are already available in the app. Because the assets are made out of Bitcoin, you hold the private keys yourself, thus you are not subjected to KYC and AML and free of counterparty risk!

These synthetic assets are driving demand for the real assets on the legacy market. Thus they are not created out of thin air. Also, demand for synthetic assets will drive demand for Bitcoin and potentially launch the bitcoin price to the moon. Succes of Abra or the technology used by them will not only give bitcoin the potential to become a reserve currency, but even to become the base currency for all liquid assets on earth!

This will increase the potential market capitalisation from tens of trillions to hundreds of trillions! The app is not only extremely useful by making financial services available to everyone, but also very bullish for the Bitcoin price!

How does the Abra App work?

Synthetic assets in the app are actually smart contracts on the Bitcoin blockchain. When you buy one Tesla stock, you lock up an amount of Satoshi’s in the smart contract that exactly reflects the value of the stock at that moment. The smart contract will ensure that more Satoshi’s are added when the Tesla price goes up and Satoshi’s are subtracted when the price goes down. This means that you get exactly the amount of Satoshi’s the stock is worth at that moment you sell it again. Even dividends are being paid out.

To make up for te difference in price, Abra takes the opposite trade. In other words: When you buy Tesla with Bitcoin, Abra will take a short position in the same smart contract. When the price goes up you will get Satoshi’s from Abra and when the price goes down Abra will get Satoshi’s from you. This means that the smart contract is always able to pay out when it get closed, without having to add or subtract Sats from an external source.

Of course this is not perfect for Abra, they risk to lose on the majority of trades and lose money. This risk they eliminate by hedging their trades on the legacy market. In the example above, Abra would take a short position on the TSLA/BTC pair in the App and at the same time a TSLA/BTC long on the legacy market. This means that the Tesla stock is really bought on the market and Abra will certainly play even.

Max Keiser and the CEO of ABRA

Financial products are now available for everyone

This construction enables the users of the app to hold financial products literally in their phone and not with a 3rd party. You hold the private key yourself, so Abra doesn’t hold any of your funds. This is the reason that they don’t have to comply with KYC and AML, with only your phone number and email you can now open an international broker account (‘FREE’ Americans need more).

This opens up the ability for billions to get involved in global finance. An email address and a phone number is available for everyone, so anyone who can’t comply to the KYC / AML regulations can have acces to the Abra app. On top of that: You can buy a part of a stock, thus 5 USD is enough to start investing. This means that there are no barriers on regulatory grounds and no barriers for the poor as wel. This will bring the opportunity for a huge group of people to at least easier escape poverty.

This technology can become totally immune for regulation

At the moment the app is not subjected to regulation, but regulators can change the law whenever they wish and they could get nervous when it gets bigger. However, Abra can be further decentralised and eventually become totally immune to regulation. The CEO already said that decentralising the app is a goal for the future. Even when they don’t, it can be done with a fork or a replica of the app.

Only the trading desk to carry out the hedge trades is centralised, this is the central point of failure where regulators could clamp down on. However, the longs and shorts within the app can be set against each other and only the remaining will need a hedge trade. The app could create a market place where people can earn fees by taking opposite trades and they can hedge themselves on a regular broker if they wish. This way no single entity is involved in the app anymore and regulators can’t do anything!

Last but not least: MOON!

Imagine that this way of holding assets and doing finance becomes popular and a big part of the financial markets move to Abra and Abra like platforms. For every stock, bond, ETF or fiat unit held, there must be an amount of Satoshi’s of the same value locked up in the smart contracts! This means that the total value of in total held assets will be added to the market capitalisation of Bitcoin. This will greatly increase the price!

Bitcoin will moon because people are buying stocks, how cool is that!

Also westerners who have acces to proper banking services can benefit from synthetic assets. The absence op KYC will greatly enhance privacy and counterparty risk can be eliminated by holding your own keys. For perfect privacy you should also buy the bitcoins to be send to the Abra app on a KYC-less exchange. Localcoinswap, Hodlhold and Bisq are peer to peer marketplaces where you can buy bitcoin anonymously for cash. Also some Bitcoin ATM’s don’t require KYC (yet).

Did you like this post? UPVOTE and RESTEEM!

Something to add? LEAVE A COMMENT!

even dividends are paid out? do you have a link for it?

this would allow you to basically run one of those "early retirement via dividends" strategies... sounds exciting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, you will receive dividends on the stocks you own in the app. Abra receives them in the hedge trade and will pass them on. Here is a link to the app: Download Abra App and here is a link to the answer whether they pay dividends as in the image below: Abra FAQ

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow, that's awesome. will check it out :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is amazing if it works. Saying there is no counterparty risk isn't correct though. Abra is the counterparty, and you are relying on them to make good with their hedges.

#steemleo

Hopefully tagging this comment will get your post included in the tribe posts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Once the smart contract is open Abra put it's BTC already in. When they fail to hedge properly they will lose money and not you. The biggest risk I think is the oracle. When the oracle fails to input properly you could get a wrong payout.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you should have tagged this on steemleo . It's very informative and useful for people looking to invest in stocks and ETFs

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @michiel! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hold stocks, directly from companies and on the exchanges. And etf and cef as well. As well as Bitcoin and altcoin. Precious metals and their mining and royalty stocks. The object, as I see it is to diversify your asset base to hedge the market volatility.

This is taking that concept a step further and is very exciting.

Thanks for the post!

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it is very exciting! Especially between stocks and Bitcoin there is a lot of friction. With Abra you can trade between them instantly without sending money between different platforms.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 93.71 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit