Coinfloor has announced that among the encryption options belonging to their group is now Coinfloorex, Bitco's futures exchange. "Providing institutional risk management and management", traders, hedge funds and miners get Bitcoin futures on a "scale" through "specifically designed cipher exchange agreements and operational controls".

Coinfloor launches physical Bitcoin futures

"Our goal is to build a bridge between the Fiat currency and the critical currency," Coinfloor's Managing Director Obi Nwosu stressed, "pushing the critical currency into stability and sustainability, and many market players require existing cryptographic exchanges that offer futures contracts to move from cash to physical settlement. We have understood this requirement from the beginning and have been working for more than two years to launch this activity, and now institutional investors and investors can leverage market dynamics in line with their own risk parameters and individual trading strategies. "

As such, Coinfloor claims to have launched the "first physically delivered cryptocurrency futures agreement" through its newly created cryptochange, Coinfloorex. Contracts "were created to protect investors and traders from price dissolution at clearing positions and market manipulation concerns."

The company is well known in the ecosystem since it has been in the first half of 2013 using a peer-to-peer network. Bitcoin-certified brokers are tied to bitcoin investors. With a local bank, buyers can send money directly to sellers. They were also an early adapter for the normal two-step conversion fiat and bitcoin. Coinfloor was one of the first to try the non-payment trading model, but later reimbursed the fees at the end of last year. It will also continue to play an active role in regulating the authorities to take the crypto seriously.

This time, innovation seems to be the physical delivery of Bitcoin futures. "The settlement solution is based on physical delivery and no other index-based price index that offers maximum pricing transparency. Coinfloor's spot exchange allows investors to easily convert Bitcoin to physical physical delivery, to create longer-term exchange rates or to meet Bitcoin obligations," the company explained .

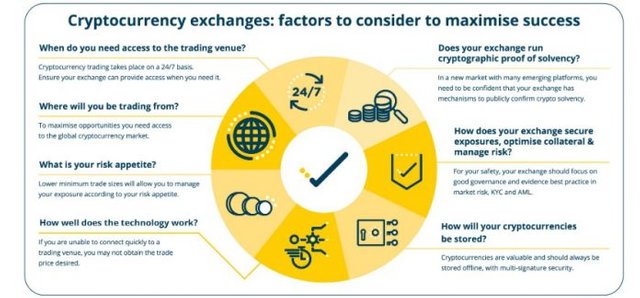

Any encryption, hacking is a problem. Anticipating such concerns "Securing security is emphasized by the 100% multi-segment cryptographic encryption currency

storage, customer portfolios stealing from theft, loss or other security issues that are partially related to the storage of online or online assets. Coinfloor also provides monthly capital adequacy reviews of Bitcoin balances, which gives institutional investors the assurance that Coinfloorx has sufficient Bitcoin liquidity to control market fluctuations, "explained the announcement.

Ultimately, the product is aimed at better "sophisticated investors". In April this year, a physical delivery of the Bitcoin futures agreement (XBT) will be published.

What are your hopes if you have British Bitcoin futures? Tell us your comments!

Followed and Upvoted, Keep up the good work and looking forward to more from you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit