Bitcoin’s price limbered up slightly from yesterday but still failed to break the $12,000 barrier. According to Coindesk’s index, a single bitcoin could set you back by $11,222.71, an increase of 3.53% from its price 24 hours ago, at 13:55 UTC.

The mostly sideways movement in bitcoin’s price occurred even after UBS Chairman Axel Weber told Bloomberg at the World Economic Forum that the bank will not offer bitcoin investing services to clients as government regulation of the cryptocurrency might result in a “massive correction” and an implosion in its price.

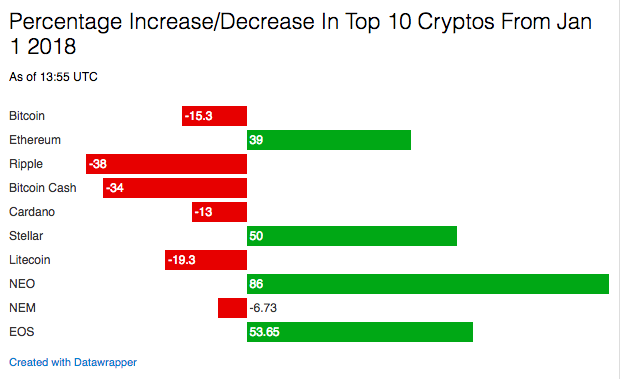

Gains for other cryptocurrencies outpaced that of bitcoin. Among the top 10 most-traded coins, Stellar’s Lumens was the biggest gainer, rising by 26.13% to trade at $0.57. The cryptocurrency, which shares technology with Ripple’s XRP, might soon be on payments processor Stripe's network.

At 14:09 UTC, the overall market capitalization for cryptocurrencies was $552.7 billion, up from a low of $515.5 billion earlier this morning.

( )

)

Ratings For Cryptocurrencies

The volatility of cryptocurrency markets has stumped even the best analysts. Now, there are efforts to bring some science and method to the madness.

Florida-based firm Weiss Ratings released a ratings assessment of cryptocurrencies, assigning letter grades to them, today. Bitcoin received a C+ grade and Ethereum, the second most valuable cryptocurrency, received a B. According to the firm, bitcoin has excellent security and "widespread adoption."

It did not make clear whether that adoption related to bitcoin's use as an investment vehicle or as a medium of exchange. Industry data indicates that bitcoin is struggling to gain traction as a medium of exchange. According to the company's press release, none of the cryptocurrencies listed in the markets obtained an A grade. That is understandable, given the market's nascent nature.

In an interview with Marketplace, Martin Weiss, the president of Weiss Ratings, said his firm had used “thousands of data points” and four factors to determine the ratings. The first two are risk and reward indices, which are based on price risk and profit potential.

Then, there is the technology index, presumably an assessment of a coin's underlying blockchain and its future potential. Finally, the firm also uses a “reality test” of the technology’s applications in the real world “to make sure that people are actually using it and it really works,” said Weiss.

Admittedly, that’s a pretty broad set of criteria, and most of it fails to provide clarity. This is especially important as the jury is still out on factors driving price movement in cryptocurrencies. Just yesterday, the Outline published an article detailing a pump-and-dump scheme on a messaging platform.

Also, the “reality test” of the technology’s applications will take a long time to assess, considering the industry’s nascent nature. And it is unclear how the firm will handle technology prospects for offshoots or forks, which essentially use the same blockchain as their parent currency.

Others in the industry also have questions. “It’s odd that Weiss is touting the fact that they don’t take compensation for their services,” says Jay Blaskey, digital currency specialist at BitIRA, adding that it may not be as applicable for cryptocurrencies as it is for credit rating agencies.

Still, it is a start. According to Blaskey, the ratings are a sign of continued maturation for cryptocurrency markets. “I expect this to be the first of many more systems to come, especially as more and more participants in the financial ecosystem integrate these assets into their business models,” he said.

Diverging Perspectives About Bitcoin's Utility

Is bitcoin an asset or a payment network?

That question has mystified analysts, investors, and users of the cryptocurrency. It also has an extremely important bearing on factors driving its price movement. Dan Ciotoli from Bespoke Investment Group has predicted a price target of between $20,000 and $30,000 by the end of 2018 for the cryptocurrency.

“The driver that I think is going to bring bitcoin up in 2018 is bitcoin-denominated commerce,” Ciotoli told CNBC, adding that the success of Lightning Network, a second layer to bitcoin’s blockchain to enable commercial transactions, has a big role to play in that assessment. If the network fails, Ciotoli’s price target falls to $5,000. Clearly, he has laid his money on bitcoin’s future as a payment network for daily transactions. (See also: What Is The Bitcoin "Lightning Network"?)

The team at Stripe, a payment processor, may not share Ciotoli's assessment. The San Francisco-based startup, which discontinued support for bitcoin yesterday, identified high transaction fees and price volatility as reasons for its decision.

“Over the past year or two, as block size limits have been reached, bitcoin has evolved to become better-suited to being an asset than being a means of exchange,” Tom Karlo, a product manager at Stripe, wrote in a post. Stripe processes “billions of dollars” in payment processing volume, so they know what they are talking about.

Finally, there’s Visa, the world’s largest payment processor. Its CEO Alfred Kelly told CNBC last week that bitcoin’s price volatility made it unfit as a payment mechanism. Instead, he said he viewed the cryptocurrency as a “speculative commodity.”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/news/bitcoin-price-inches-upwards-first-cryptocurrency-ratings-released/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit