Recently I've seen a number of people in the Bitcoin ecosystem commenting that they think that Bitcoin blocks should always be completely full. This is analogous to thinking that Starbucks should always be completely sold out of coffee.

Block space is like coffee in that it is a consumer good. When consumers buy coffee, they are expressing their desire for this consumer good. When Bitcoin users pay transaction fees for inclusion in a block, they are expressing their desire for the consumer good of block space as well.

In the coffee market, there are numerous suppliers of coffee. We have Starbucks, Tully's, Costa, and numerous others. We also have competitors to drinking coffee, such as Coke, Pepsi, water, caffeine pills, and a myriad of other options. Consumers will look at the price of coffee from the various suppliers, and coffee alternatives. They will then decide the amount they wish to purchase based on their individual preferences.

Some will be willing to pay almost any price for coffee, but others will simply choose to do without. If the price offered on the market for coffee is high enough, additional suppliers will be attracted to enter the market and fill this demand. If the price of coffee is low, the coffee producers who are the least efficient will be forced to leave the market.

Many Options

The exact same situation applies to Bitcoin block space as well. We the consumers, have lots of options. They include Bitcoin, Litecoin, Ripple, Ethereum, Dogecoin, and many many others. We also have non-blockchain based options as well. These include banks, credit cards, PayPal, cash, or simply forgoing a specific economic transaction.

Potential Bitcoin users will look at the costs involved in using all of these systems. These costs include network fees, ease of use of the wallet software, the number of accepting merchants, payment confirmation speed, safety, difficulty of opening an account, legal risks, and numerous other aspects. Consumers will choose the one that most closely matches their desires, and it certainly won't be Bitcoin if Bitcoin doesn't do the best job of meeting their desires.

Just as it would be a mistake for Starbucks to intentionally not have enough coffee to meet the demands of their customers, it would also be a mistake for Bitcoin miners to not supply enough block space to meet the demands of their users.

Any time a Bitcoin user is willing to pay a fee that is larger than the marginal cost of including the transaction in a block, it makes economic sense for a miner to include it. Whether it is for the sale of coffee, or block space, only someone who lacks an understanding of economics or business would want to turn away paying customers.

Externalities

This brings us to the topic of externalities. An economic externality is a cost or benefit not born directly by the parties involved in a transaction. In an ideal world,we would find a way to internalize all externalities so the costs are born solely by the participants. When Starbucks sells coffee, there are likely some externalities that should be taken into consideration.

Perhaps people on caffeine drive more aggressively, causing more traffic accidents. Or perhaps they are more alert, and therefore more productive at their jobs. It's hard to know exactly, but these externalities need to be taken into consideration when it comes to both coffee sales, and the Bitcoin block size.

The only negative externalities I can think of regarding mining an extra bitcoin transaction in a block are:

- The additional bandwidth required to relay that transaction across the network.

- The extra CPU time required to validate the transaction.

- The extra storage space that will be required to store the transaction.

- The potential for fewer nodes in the network because of some combination of the three issues above.

Let's consider these one at a time:

1. Additional bandwidth.

It's hard to know just how big of a problem this is, but with connectivity becoming faster and faster, year by year, more and more places around the world will have the ability to relay more and more transactions each year. If a block takes too long to relay the chances of it being orphaned increases. This chance puts a downward pressure on the maximum block size that miners will be willing to create.

The right size today is certainly different than the right size next year. In the end, I see the best option to be letting the individual miners and nodes decide how much bandwidth they are willing to allocate to the relaying of individual transactions, and bitcoin blocks. The least efficient miners and nodes will drop off the network, just as the least efficient producers in any industry would.

2. Extra CPU Time.

Every transaction included in a block requires some additional time to be validated by a full node, or for a miner to create a block that includes it. Only the parties involved in the transaction directly benefit from it, but every full node across the network has to pay the price of validating it.

The time it takes to add additional transactions to a block increases the likelihood of a block being orphaned, and therefore puts a downward pressure on the block size that miners are willing to create, or relay. Even without a maximum block size hard coded into the protocol, there would still likely be a practical maximum block size because of this, as well as point #1.

3. Extra Storage Space.

For me, this seems to be one of the most troubling externalities. All of these additional transactions need to be stored in the block chain that is held by everyone running a full node. If the block chain becomes too large, not enough people will be willing to run a full node. If there are too few nodes on the network, Bitcoin becomes more susceptible to outside influences, and loses some of its censorship resistance.

The good news is that like bandwidth, storage is getting cheaper and cheaper every single year. Even today, storage in a relatively modest computer could keep up with 100 MB blocks, or about 5TB worth of data per year. In the not so distant future 1GB, or even 1TB blocks wont be an issue from a storage perspective either.

4. Fewer Nodes

If the above three issues become serious enough, fewer and fewer people will be willing to run full nodes, and bitcoin will lose some of its censorship resistance. I think this is one of the biggest risks we have regarding Bitcoin, but as the great Frederic Bastiat reminded us, a good economist always considers what is seen, and what is not seen.

Today we have around 5,000 full nodes around the world, with a user base of just a few million people. If Bitcoin is allowed to scale to have hundreds of millions of users, or even a billion users, there will be a much larger pool of people to draw from to run full nodes. This means that there will likely be a much larger absolute number of full nodes, even if it's a smaller percentage of bitcoin users that are running these full nodes. When it comes to censorship resistance the absolute number a full nodes is the most important characteristic, not the percentage of users running a full node.

It's also important to keep in mind that there are dozens of positive externalities from wide Bitcoin use.

- Governments will no longer be able to inflate the money supply.

- Capital controls will come to an end.

- Wars will no longer be able to be financed by inflation.

- It will be made much harder for governments to hide financial waste or corruption.

- People around the world can interact financially with each other much more freely than they can today.

- The value of bitcoin will go up, meaning the value of the block reward has gone up, meaning more resources will be devoted to mining, meaning Bitcoin is more secure, meaning more people will use Bitcoin. It's a self reinforcing feedback loop.

This list goes on and on, but it is important to remember than most of these positive externalities only become a reality if the vast majority of the world starts to use Bitcoin. That will never happen if Bitcoin is artificially restrained from growing to meet the demands of people who want to use it.

Increase the Block Size

Numerous people from Bitcoin Core have directly told me, there is no technical reason why the block size can't be increased today. They are simply not allowing it for “economic” and social reasons.

A point made by the great economist Murray Rothbard is entirely relevant to this situation: It is no crime to be ignorant of distributed cryptographic consensus networks, which are, after all, a specialized discipline, but it is totally irresponsible to have a loud and vociferous opinion on this subject while remaining in this state of ignorance.

I would never dream of telling the current Bitcoin Core team the correct way to build a cryptographic consensus network, but the small block proponents are having loud and vociferous opinions on economic subjects while remaining in a state of ignorance.

There is nothing advantageous to artificially limiting the block size. It will simply cause potential Bitcoin users to use something else. It's time to let the cryptographers do cryptography, while the economists consider the economics.

As someone who spent most of my educational career studying economics, I'm sure this was the reason I became the first person in the world to start investing in Bitcoin companies, including many of the most prominent companies in the ecosystem today.

As someone who is still hodling the vast majority of own my net worth in bitcoin, I want to do everything I can to make sure that Bitcoin is a world wide success. Artificially restricting the amount of block space we produce is just as insane as Starbucks artificially restricting the amount of coffee they produce.

It's time to end the block size blockade.

Originally published by Roger Ver on Bitcoin.com

Verification:

https://www.facebook.com/rogerkver/posts/10153803301075737

https://twitter.com/rogerkver/status/766506616212422656

Welcome to steemit Roger! I'm sure you'll like it in here :)

All the best!

Adil.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"He who controls the spice, controls the universe" From Dune Frank Herbert

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How familiar you are with Graphene, the codebase that powers Bitshares and Steem? I'm not a developer/coder, just a blockchain enthusiast and a big fan of @dan, so I might have little bit biased opinion... but I think Graphene is the best solution so far for the scalability problem.

Here is some information about it from Bitshares website:

@dan is great developer and blockchain designer, but there is one thing which he sucks: marketing. Graphene is amazing piece of technology but it's kind of a hidden gem. Nobody else is interested in it or understands it besides a few Bitshares/Steem core developers.

I would love to see a chat between you and @dan discussing about scalability of blockchains. Maybe some cryptoshow could host that?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

+1 for the chat/interview/whatever.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Graphene is a permissioned blockchain (only specific and known parties, here called witnesses, are allowed to write), while Bitcoin is an open blockchain, where you don't need to have any clue to know who the miners are. Satoshi's innovation was all about trustless consensus. Graphene is a variant of the Paxos algorithm and could have existed for around 20 years already.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Roger, I put this together, I was wondering if you could comment on it. https://steemit.com/bitcoin/@gank/the-truth-about-roger-ver-and-bch-and-why-you-and-your-usd-should-stay-away

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Edit: VERIFIED

https://www.facebook.com/rogerkver/posts/10153803301075737

Welcome to Steemit! We need you to verify that it is actually you who is posting this. You can do so by posting about Steemit on one of your social media accounts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure!

https://www.facebook.com/rogerkver/posts/10153803301075737

https://twitter.com/rogerkver/status/766506616212422656

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Rogerkver we've talked plenty of times about Bitcoin! welcome :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Been inviting you fo about 2 months now, anyway it's great to finally see you here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry it took me so long. I'm here now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem with your kind of profile, you will overtake many of us here in no time. At least here, we can talk, argue, debate or prod each other ALL THE TIME, and make something while doing them, unlike FB!

Welcome once again to your new hide-out! I mean addiction...Or maybe an INVESTMENT??? :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Roger, WE DON'T NEED BIGGER BLOCKS!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

so cool

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Roger! So glad to have you on steemit! Can't wait to hear more. Oh and I agree 100%

-Greg Moon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So awesome! looking forward to you nest post so I can resteem them bad boys lol. I'm going to tweet this for sure though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is STUPID

you dont need bitcoin for coffee and VERified doesnt understand the tech of bitcoin, but he can VERifiy GOX

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The difference is that Starbucks is selling the coffee. The blockchain would be offering tx capacity (or storage capacity) for free.

Right now even with what you would consider the "constricted" 1mb size, 47.000 txs went through in the last 24hrs at fees from 0-20 satoshi/byte. If there was a real congestion this wouldn't be happening.

Now if we go to 4mb, you'll have something like 3.2 mb extra capacity to spam at near zero cost. And since it is at near zero cost it would be spammed for the lolz by malicious entities.

If I were the big banks and bitcoin was my enemy, I'd like bitcoin to have as big blocks as it gets. Then I'd spam the hell out of it to bloat it on purpose (and doing it cheap too!) rendering it unusable for the average PC, making it more centralized in terms of nodes that can afford it and also making it more vulnerable to attacks. It's a good attack vector.

Core devs know what they are doing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm with you Roger. We need BIGGER blocks NOW!!! The 1MB block size limit cannot hold out much longer. The hard-fork to 2MB is inevitable and unavoidable. Ultimately, I think the core developers will be left behind working on SegWit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Roger! Fantastic to have you! I thought of you today and thought, "Wait a minute, where is Roger Ver? Does he not know?.."

And here you be. Here you be! :)

I think you're going to like it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rogerkver, I take it that users of Bitcoin can benefit the continuing functionality of the blockchain by running a full node with devices like the BitSeed: http://bitseed.org/

Do you think that mining bitcoin has become cost effective enough for more of the average users do do it?

I'm posting this video as reference:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please be more active on Steemit, Roger

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this is all very well and good,

but

for bitcoin,the main advantage except for it's network effet,is it's stability and avoidance of any substantial change unless it is ABSOLUTELY necessary or there is an absolute consensus in it's desirability.

I think every other path of increasing scalability should be explored and exhausted before a change in the protocol is even considered...

to use the coffee analogy, I know of many chains(Iboth in food and in retail) that had over-extended,and, by branching out too quickly brought about their own financial ruin..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting bit era

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @rogerkver. If the core team doesn't increase the block size do you think it would be more economical to switch to an alt-coin or simply hard-fork off of Bitcoin?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

excellent post! we need to know more about this stuff.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I responded to this in my own blog; https://steemit.com/bitcoin/@tomz/pondering-about-bitcoin-scaling-response-to-roger-vir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to steemit, too. お待ちしていました!!!!! Im so exited to see your post here more!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! I look forward to participating more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanx for the new name attribution of ignorant. Though still, increasing the block size to serve an industry's appetite is wrong. Downgrading the importance of economics behind #BTC, the same principles that have driven its success up to now it is twice wrong.

I am used to this rhetoric but I am not backing down. Now on the Core team members expertise, I should just remind them their reaction when I told them that such a system as BTC was possible and within reach on an extremely short schedule in 2008...

I have my own reasons to insist on that issue and I will not change my mind. If you still want larger blocks, as you already said, there are plenty of options out there. So please move your assets to a "better" one than BTC...

Thanx to duplicate & modify policy you can choose your BTC flavor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thats so true: ¨It's time to let the cryptographers do cryptography, while the economists consider the economics.¨

thx @rogerkver and welcome to steem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

God bless your work Roger. I am so new to all this and see you in many of the videos and documentaries like some others doing your thing for humanity. I appreciate you. I have been targeted also for being a truth speaker. God bless ya man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi welcome onboard Roger! Thanks for all that you've done. Hope you enjoy your stay here in this (honestly) awesome community!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

5000 validating full nodes is already not enough. For bitcoin to reach the potential people like you and I believe it has, it needs to be 10-100x that.

The block size, if changed, should be reduced. Global consensus is extremely expensive when multiplied across that many cpus and disks.

Your calling for the block-size debate to end is insincere - this post is your demonstrable commitment to wishing to continue the debate. It's just a sneaky technique to try to get the last word. Don't do that. Don't insinuate that your arguments are the be-all, end-all, but instead speak your piece and let people decide for themselves. That's what cryptocurrencies (and voluntary interactions) are about. :)

Perhaps Bitcoin isn't the one we end up using. It's terribly suited for retail use, or for high-volume, low-value transactions. Allowing a bunch of noisy, US-centric organizations that aren't hurt by excessive centralization to push their objectives over everyone elses' isn't really in the spirit of voluntaryism.

If people wanted bigger blocks, they would run one of the hardforks, or they would use (or launch) an altcoin that serves them better. People aren't doing that - they're using bitcoin-as-it-is-today (and the fad chasers are going to Ethereum, with spectacularly poor outcomes for them).

Diversify, and stop trying to convince people that your worldview is the One True Answer or insinuating that discussion and learning for all interested parties isn't valid or useful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Then why do a supermajority of the participants in the bitcoin block-validating network choose to run software that does precisely that? They can run any software they want, including forks that change these rules. For the most part, they don't.

That's their choice to make, is it not? Several people tried and failed to convince them otherwise.

This "sky is falling" style of post is just the latest subset of "bitcoin doomed to fail" shouting. Bitcoin-the-currency is pretty much done, complete, finished - not in the "over" sense, but in the "no more brush strokes necessary" sense. There is very little left to add or change. Bitcoin Core the software implementation of Bitcoin-the-currency is under active development, but the vast majority of changes are related to the implementation, not the idea of Bitcoin-the-currency.

Voluntaryism means accepting the choices of others. The majority of bitcoiners have chosen the status quo of the current blocksize limit. You can argue against it, but they're not wrong for having different opinions.

I don't think the difference of opinion is "what should the bitcoin block size be?" I think the difference of opinion is "are the devs in the business of making hard-fork decisions for all users of the currency?" The answer that most have come to is "no - the status quo is what we signed up for, and the core devs are the core devs because they understand that we have not delegated them authority for rule-changing". Contentious hardforks will NEVER HAPPEN under the current leadership, which is why Bitcoin is still Bitcoin and not the clusterfuck that Ethereum has become. Learn from Vitalik's tremendous mistake!

Forking bitcoin is your right as any other open source project. If you believe the devs are wrong, you are encouraged to try, and join the list of people who have failed to appoint themselves Bitcoin BDFL. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing your entirely valid opinions here, Roger. Hopefully Bitcoin won't lose all of its economic advantages by the time action finally happens.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Can you verify with a tweet?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Verified on Facebook

https://www.facebook.com/rogerkver?fref=ts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think. I may be paranoid here. that there is a plan to turn bitcoin into another "stock" and to transform it into a form of stock trading and limit its potential to do anything else.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great to see you here! I am really looking forward to Bitcoin's success as well. Hoping this block size debate can be resolved soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I posted this last week, but didn't get much of a response. I'd really like your opinion - the TL;DR version is - Why not use a few thousand dollars worth of Bitcoin and fill every block with small transactions to essentially launch a DDoS on the Bitcoin network for a few hours to prove a point that block sizes have to increase?

Here's my earlier post where I asked this question:

https://steemit.com/ddos/@fintech-jesus/ddos-attack-on-bitcoin-a-question-for-bitcoin-developers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

: ) happy to see you @steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wonderful to see you on Steemit @rogerkver. Followed and I look forward to reading your posts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

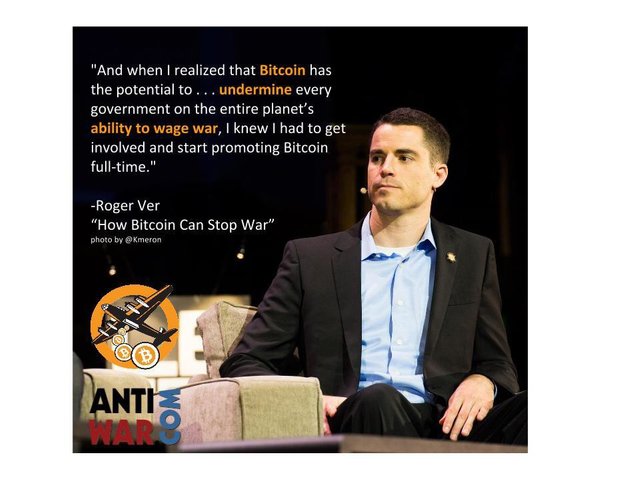

Glad to see you here at Steemit. Your "How Bitcoin Can Stop War" quote sums up the value and importance of crypto-currencies, especially Bitcoin. You voice is a welcome addition to this site, particularly as it relates to the Blocksize debate, and the future of Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been into BTC about just as long as you and I have diversified almost all my BTC to Dash. I like the way Dash self funds its own advertising and development and the way things are voted on. Even if BTC does fork or the blocksize is raised by core, this kind of drama will continue forever in bitcoin IMO. The market has already learned from BTC mistakes and created alternatives. Look into DASH more roger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rogerkver, if a fork happens in the direction you're discussing, I'll be switching my full nodes to it at once. I'm always in favour of careful consideration when it comes to major changes in large ecosystems, but the community has had plenty of time for discussion. Action is now called for...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rogerkver -- welcome to the party! Do yourself a solid and add the

introduceyourselftag. This post will explode :)Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the tip! I just did that for my other post: https://steemit.com/bitcoin/@rogerkver/roger-ver-the-world-s-first-bitcoin-investor-is-now-on-steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read.

Your content is right up my alley, just subscribed.

Looking forward to read more from you..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now more than ever @rogerver the community needs you. There are some that are claiming that the Blockchain mess is too much to handle and a failed project. Blockchain a Bust!

www.bloomberg.com/news/articles/2016-08-18/man-who-introduced-millions-to-bitcoin-says-blockchain-is-a-bust

We need to bust up the misunderstandings and build better consensus. Do you think we can get agreement in the end or there will be chains everywhere?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Anti WAR Dot COM!

#Competative-Collective-Intelligence-Co-Operative

#nothing-makes-sense-because-psychopaths-are-in-charge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Roger...this is just sad. I wanna run through some basic math with you here. I'm going to start with a few figures. First, it takes 5-10 milliseconds to verify the signature of a transaction. I'm going to be super optimistic and assume every transaction takes 5 milliseconds. An average, IDEAL, transaction is say 250 bytes. These figures I believe do not take into account gains from secp256k1, but even with those savings it will only give you so much head room.

So, breaking that down, it pretty much means you validate 200 transactions in a second, 12,000 in a minute, and 120,000 every ten minutes. Now this is a dangerous limit, this last number. If you push significantly beyond that, then statistically you will not be able to validate blocks as fast as they are being made, bitcoin will be a perpetually run away train that you can never validate to make sure the claimed current state is valid.

Now remember that figure about 250 byte transactions? An insanely overly optimistic figure by the way. That means that pushing up against that runaway train limit...is at 29 megabytes.

Yeah. 29 MEGABYTES. And you really only get a few orders of magnitude gains from secp256k1. Validation is the bottleneck Roger. Validation is also what gives it value, because I am validating and securing the integrity of my own money myself.

Stop attempting to use "a lack of understanding of economics" on the part of the devs as a BS excuse to scream for bigger blocks, proclaiming that will make bitcoin's fiat value increase.

It is more than just the technicals, though those alone make your proclaiming of GB and TB blocks out right insane, it is about maintaining the incentives. A big part of with is, I validate my money MYSELF. And that I can afford to do so, MYSELF. Paying hundreds or thousands of dollars a year on special purpose computers to validate my money is not cost effective, and not a sound and motivating incentive structure Roger.

I'm sorry, but you are the one who has a lack of understanding of how this all works, not any of the developers Roger.

EDIT for spelling

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So by your own math, with today's hardware, Bitcoin can scale to 29 times the transactional capacity we have today. Thanks for making my case for me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wrong Roger, using layered approaches like Lightning Network and sidechains, it can scale thousands of times past todays transactional capacity while still maintaining the incentive balance by keeping validation costs low.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, after mulling it over I think I found the source of your misunderstanding. It is by no means safe to just push up against that limit Roger. Keep in mind 10 minutes is the statistical average a block is found. The more you move towards that limit, the more of a potential problem this can cause. The bigger you make blocks, the more periods of high luck will cause problems because you are being sent a new block before validating the old one.

You cannot just push up to that limit, even more TOWARDS that limit starts to cause performance issues. Just fucking accept it Roger, you're a good guy at heart, but stop pretending you understand any of this when you clearly don't. Instead of being a sound public figure to advocate for the ideology beyond Bitcoin, and the social movements it will create, you are making yourself look like an idiot by speaking on matters you do not understand. Just stop it Roger. This is a 100% technical matter. The economics get involved when looking at how the system is FUNCTIONING. Economics will ALWAYS have to take a backseat to technical realities, and adapt to what is possible. Otherwise what you are suggesting is lets turn Bitcoin into a centralized service like Paypal, where nodes can refuse to relay your transactions for not using ID, being from somewhere they don't like, without paying a "membership fee" to use a nodes services. I do not think you want that, I don't want that, and I'm pretty sure most users don't want that.

Just be a man, step back a second, and realize you are WRONG here Roger. It does NOT make you a stupid person. It does NOT make you a bad person. It just makes you WRONG. And the sooner you realize that, the sooner we can all get back to being a productive community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And also what is this comment supposed to mean? Your way of doing things only works so far until it hits problems, so just full speed at that brick wall anyway? You are just going to ignore technical reality and how the changes you propose weaken the quality of bitcoin that makes it valuable in the first place?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Umm ever heard of multi tasking? If verification is expensive why can't we just multi task it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is more than just the technicals, though those alone make your proclaiming of GB and TB blocks out right insane, it is about maintaining the incentives. A big part of with is, I validate my money MYSELF. And that I can afford to do so, MYSELF. Paying hundreds or thousands of dollars a year on special purpose computers to validate my money is not cost effective, and not a sound and motivating incentive structure Roger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And why is 1mb correct? The point is the blocksize should be found as an equilibrium via market forces , not by design of some King. Even if he is satoshi or max or whoever controls core.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is set by market forces. By the software people run to secure their coins. And right now it is voting 1 MB, and we'll see with the rollout of 0.13 if the market will support and prepare for Segwit rolling out to increase to a blocksize of 2-4 MB. Which is right up to the edge of what the network can handle in terms of latency increases right now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nope that is called hard coded. Market forces would mean no blocksize limit and miners deciding how much to put into blocks for what price.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

He wrote " In the not so distant future" - perhaps you need to go back to school and retake the basic English reading comprehension class with the other 5th graders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no, he thinks everything in this world runs on a giant CPU with 1 core and a single thread. lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your assumptions are off by quite a lot actually. sha256 chews through about 100MB/s. On 5 year old hardware. And single-threading.

So I'm wondering where that 5ms comes from.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's not the only operation in tx verification in a block; the signatures have to be verified (the expensive bit), the inputs have to be checked against the utxo set, and the scripts need to be executed.

It's not that simple.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bitcoind is slow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Would have nice for you to bring a solution to the table and not just criticise. I'm all up for finding a solution to this this long standing problem so what's your idea if Rogers don't fit the bill???

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Core's roadmap. We get a blocksize increase(bigger than the one Roger is pushing for), fix malleability, add compatibility for LN, and through raising the blocksize to a maximum of 4 MB increase the possible transaction throughput of the network to hundreds of thousands of transactions per second, not just doubling it to 14 tx/s.

Oh, and maybe you should ask Roger why he is intentionally disrupting testing on testnet? If he is soo enlightened and behind raising the transaction throughput, WHY IS HE ACTIVELY SABOTAGING TESTS ON THAT BY MINING ON TESTNET?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sweet to see you here. It goes to show how more and more big names are flocking in.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rogerkver I love the post but I will not engage in blockchain debates as I am not qualified. I would however like to comment on what you call externalities.

It is my belief that there really needs to be more added to the list of "Positive externalities" that encourage or entices the layman as well as the shopkeepers or business owners to use bitcoin. Basically, what are the economic benefits to using Bitcoin? Who/where is this "advocate", where is this "Public " information ?

Most people in America don't even understand how a grocery store actually works, although they use it everyday, because the store owner has turned it into a pick & pay system that people do understand. What is the benefit to a store owner to accept Bitcoin ? What is the benefit to the consumer by paying in Bitcoin? This is an issue every store owner and consumer in the world needs to understand. Again, where is the Bitcoin advocate helping them to understand?

Imho, It is of NO VALUE for a store owner to post a sign "Bitcoin Accepted Here" if only .0001% of people have Bitcoin, and by the same token (lol) It is of NO VALUE if everyone has Bitcoin but no store owners are knowledgeable enough to accept payment in Bitcoin.

So where are the Bitcoin Seminars in cities to show the layman and the store owners ? Where/Who are the people going door to door to businesses explaining the benefits of using Bitcoin ?

BECAUSE UNTIL THIS HAPPENS there will be NO

Just my .02 BTC

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post @rogerkver Interesting to see how this pans out in the future, cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Until there is a save function, I'm commenting here so that I can revisit this article at a later time. Otherwise I'll have to find it manually, if I even remember where to look.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rogerkver thank you because you are the reason i got into BTC and eventually steem in the first place.!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

To me this is a compelling argument. Well put.

(Great to see you here Roger!)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes! <3

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been linked to from another place on Steem.

Learn more about linkback bot v0.3

Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise. Built by @ontofractal

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rogerkver, what about Dash? It seems Dash has transformed into the evil brother to a coin that Bitcoin aimed to be. Is it not time to move over Dash?

Dash is currently checking all the boxes with regards to empowering economic freedom. Nodes are rewarded, miners rewarded, there's even a budget for the dev community, instant payments, full anonymous wallets, not pseudo like bitcoin.

To my understanding, dash also uses methods from its big brother bitcoin, but it seems to be a lot more wiser. It's strategy has been retail focused, and that is exactly what you are suggesting Bitcoin should be and become again.

What are your thoughts on Dash vs Bitcoin? And when answering, try remove the heavily biased perspective you could have due to the fact that you are currently heavily invested in bitcoin. Your portfolio is broad, and I don't think you're an idiot, the only reason I mention this is because you have many critics, clearly, because you have been censored on other platforms, who frankly don't have nice things to say about you. Your investment could be a reason for your side on the scaling issue. Well here, you cannot be censored.

Personally, I say Dash for the win.. It's a real no brainier at this moment. All those points make perfect sense to me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The current Bitcoin Core dev team's refusal to scale bitcoin in a timely manner is the best PR material DASH and other competing currencies could ever hope for. The block size blockade is the main reason that I've diversified into some competing currencies including Dash. If it wasn't for the total disregard by the current Bitcoin Core dev team for people actually trying to conduct business with bitcoin, I would have likely never owned a single alt coin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i just created a super long steemit post and it says:

'''

fc::raw::pack_size(trx) <= (get_dynamic_global_properties().maximum_block_size - 256):

'''

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Join us at www.reddit.com/r/btcfork to solve not only the bitcoin scaling problem but also the governance problem as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You need to put an http:// on the front of that link to make it work right on steemit.com.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My response:

https://steemit.com/bitcoin/@sneak/bitcoin-contentious-hardforks-do-not-entail-death-contentious-hardforks-are-death

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit