What is a 'Bubble'?

According to Investpoedia.com, a bubble is an economic cycle characterized by the rapid escalation of asset prices followed by a contraction, meaning the price of a particular asset increases very quickly and then subsequently decreases very quickly. The rapid rise in price is attributed to exuberant market behaviour also known as the fear of missing out (FOMO). People identify that the asset is quickly increasing in value and are scared of missing out on the potential financial gains of buying the asset. Eventually, the amount of people buying into the FOMO will run out, causing a massive sell-off to occur, and thus the bubble deflates.

Bitcoin as a bubble

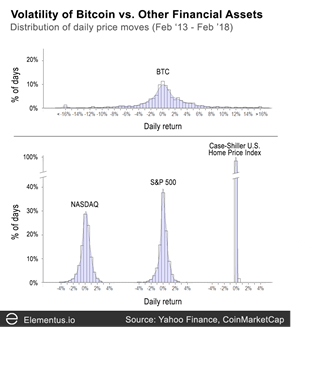

When talking about bubbles, you have to take into account a few extra variables aswell as the definition mentioned above. Bubbles are relative to the volatility of an asset, meaning that the more volatile an asset is, the bigger the explosion and crashing of the price must be. For example, as seen in figure 1, when comparing bitcoin to stocks and real estate, bitcoins price fluctuates 5x as much as NASDAQ, 6x as much as the S&P 500, and over 100x as much as the U.S. housing market. But why is this important? It is important as it helps you to gain some perspective on the volatility required in order to have a ‘Bubble’.

Taking a look at past asset bubbles, we can see that the DOTCOM bubble of the late 90s/early 2000s lost around 80% of its value, Tulip mania(Read about it if you haven’t heard of it) lost 99% of its value, and the US real estate market lost 25%. There is a great difference in the market value lost, however all these were considered bubbles as they lost a large amount relative to their volatility. That leaves the question of where Bitcoin and cryptocurrency sits if it were to be a bubble by definition. I could not put a percentage to it however I do think it would be somewhere between dotcom and tulip mania.

Figure 1: Volatility of BTC vs other Assets

Bitcoin vs NASDAQ

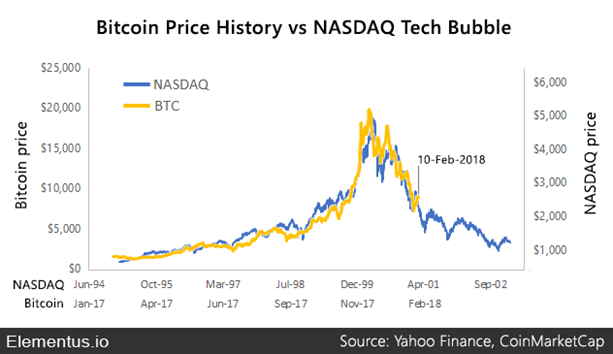

As you can see in figure 1, if you overlay the bitcoin price chart of 2017-2018 and the NASDAQ price chart from June 1994-September 2002, the shape of the charts are very similar to say the least. However, we do need to take into account a few variables. First of all the time periods are much different, with the BTC chart being over 1 year and the NASDAQ chart being over 8 years. The NASDAQ market cap was 10X larger than that of BTC when they were both at their peaks which is a massive difference, especially considering that Bitcoin and cryptocurrencies are a worldwide asset which are traded 24/7. Also BTC/Crypto is a much more dynamic and malleable asset that stocks, it is something which will change asset investing, currencies, stores of value as well as reforming and creating new industries for economies worldwide.

Figure 2: BTC price history vs NASDAQ tech bubble:

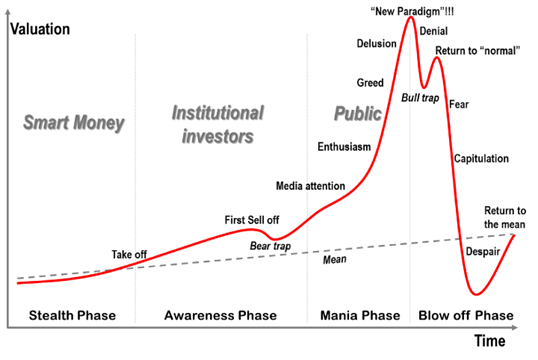

As seen in figure 3, the bitcoin chart does also look eerily similar to that of the classic bubble pattern, so that is another factor to take into account.

Figure 3: Traditional Market cycle chart

So was Bitcoin really a bubble and has it popped?

One could make arguments for whether bitcoin was/wasn’t a bubble which has/hasn’t popped. Personally I think it was in a bubble, but don’t click off now and sell all your bitcoin or have a rage quit at me in the comments before you read the rest of the article. I think bitcoin was in a bubble at the end of last year as it went up extremely fast driven by not much fundamental fuel, bitcoin wasn’t making any major moves and yet the price was soaring like nothing seen before. But the reality is, BUBBLES ARE GOOD. Yes I said it, bubbles are good, why? Well because they weed out the week. Bubbles for assets are like basic army training to try and score a place in a private division e.g. the SAS. A bunch of people go in, but only a select few make it out because they were worthy of being picked. The same goes for asset bubbles, to give an example, after the dotcom bubble, many companies did crash and burn completely, but the companies with real value such as Microsoft, Apple and amazon flourished and have seen great returns ever since.

So yes I think there was a bubble, but I also think that the perception of bubbles need to be changed a bit as well. Most people see bubbles as something of Armageddon, however this isn’t always the case, as for most assets, there are multiple bubbles that form over cycles. I believe that there is still much room for bitcoin to grow and that we will see many more bubbles, on a larger scale in the future. Times like this, when nobody is talking about bitcoin and cryptocurrency is when we need to be buying. Now I’m not a financial adviser and this is not financial advice, but in the famous words of Warren Buffet, “Be greedy when others are fearful”.

Another quick point to note is that when looking at the potential for blockchain/BTC/crypto, you have to understand that crypto is not only a financial, but legal and technological revolution as well.

Our responsibility

As Crypto evangelists, we must educate explain to people that bitcoin hasn’t burst its bubble forever and still will continue to grow long into the future. It is a hard task with the media trying to scare people away from it, saying that it’s a bubble when it’s going up, that they were right all along when it’s going down, and that if it stagnates, then nobody is interested in it anymore. However, by having the knowledge to explain to them some of the questions and misunderstandings which they have, they are much more likely to get on board.

Thank you for taking the time to read this blog post! If you haven’t already I would appreciate if you could upvote and Re-Steem this blog and subscribe to my YouTube channel for more cryptocurrency related content. Have a nice day :)

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @rw-cryptofit! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit